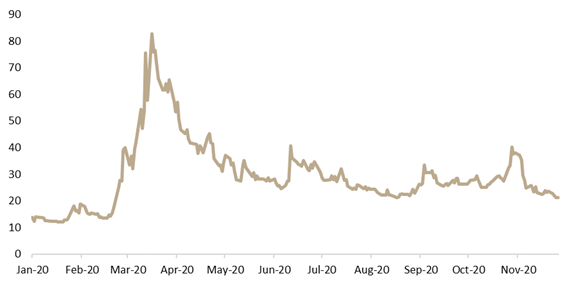

The VIX has witnessed a solid decrease this month as election uncertainty subsided while significant vaccine progress has been made.

The VIX has been in the spotlight this year, as the global markets have witnessed significant volatility as a result of the Covid-19 pandemic. VIX, also known as the fear index, is calculated based on the S&P 500 options and reflects market expectations on (implied) volatility in the coming 30 days.

Unlike classic indices, VIX’s growth represents negative sentiment or increased risk of market volatility. VIX levels over 30 could be considered risky as the market is expecting high volatility.

US indices Dow Jones and S&P 500 observed a break in almost uninterrupted rally from its March lows as a result of the negative sentiment on further possible restrictions regarding the Covid-19 pandemic. On a YTD basis, Dow Jones is up by 4.7%, while this week the index reached 30,000 points for the first time in its history. Meanwhile the S&P 500 is up by as much as 12.35%. Earlier this year, both indices observed a decrease higher than 20% in less than a month (compared to the 52-week peak) witnessing the fastest bear market in history.

YTD Performance of VIX

Source: Bloomberg, InterCapital Research

Since, the S&P and VIX are negatively related, this year’s market conditions earlier this year (the combination of Covid-19 outbreak and an oil price war between Russia and Saudi Arabia) have led to a surge in the VIX index. It is worth noting that VIX was last time seen at the levels observed this year during the financial crisis in 2008. In March, VIX observed two sharp daily increases this month. The first one was on 12 March, which coincided with President Trump introducing the European travel ban. Meanwhile, on 16 March the index reached 82.69, which is the highest value since the CBOE (Chicago Board Options Exchange) introduced the new methodology for the index in 2003.

Since the beginning of the year, VIX has more than increased by 54% and currently stands at 21.25. As visible from the graph below, less than a month ago VIX reached as high as 40.28, days before the US elections, and has since than been gradually declining. Since than Joe Biden has been elected as the 46th president of United States while Pfizer and Moderna have shown positive vaccine development. To read our blogs on US elections click here.