As of April 2021, Slovenian mutual funds manage EUR 3.7bn, representing an increase of 2.1% MoM.

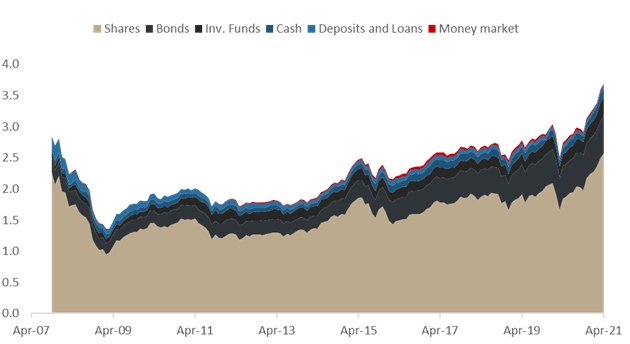

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their asset structure during COVID-19 crisis.

As of April 2021, Slovenian mutual funds manage EUR 3.7bn, recording an increase for the 6th consecutive month (+2.1% MoM). Meanwhile, total assets under management are up by as much as 14.5% YTD.

It is worth noting that net contributions to the funds amounted to EUR 47.3m, representing one of the highest inflows since December of 2007. As a reminder, the funds already observed a very solid inflow of EUR 72.9m in March.

It is also worth noting that mutual funds experienced a full recovery after a considerable loss in March 2020 due to the crisis caused by the Covid-19 pandemic. As a reminder, after witnessing a 12.4% MoM decrease in March of 2020, Slovenian Mutual funds have fully recovered and are currently up by 45% compared to March 2020 bottom. It is also important to add that we have not seen a net outflow from funds in the past 11 months.

Turning our attention to the asset structure, as of April 2021, shares account for 69.4% of the total assets (or EUR 2.57bn). Shares observed an increase of 2.6% MoM. We note that the vast majority (97.4%) of equity holdings of Slovenian mutual funds come from the foreign market. Domestic equity holdings, which amount to EUR 62.8m and is up by 8.7% YTD.

Total Assets of All Slovenian UCITS Funds (Apr 2007 – Apr 2021) (EUR bn)