Sava Insurance Group has announced its business plan for 2022, outlining its strategy and expectations for the end of 2021 and the plan for 2022.

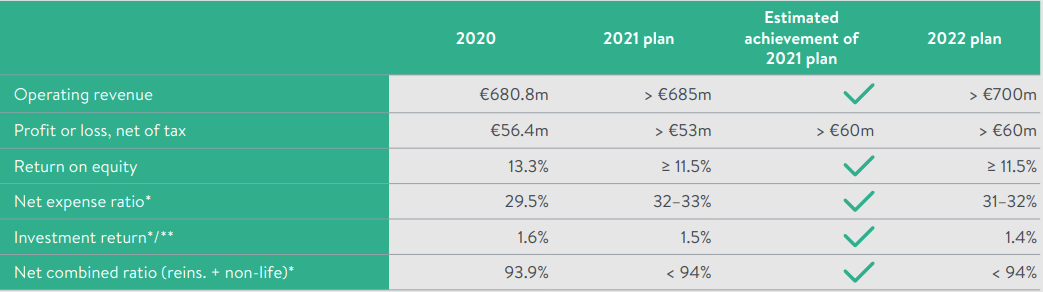

Based on is 2020-2022 strategy, Sava Insurance Group has prepared its business plan for 2022. The Company is planning to surpass EUR 700m in operating revenue, as well as to generate profit after tax of EUR 60m, which would translate into a ROE of more than 11.5% in 2022.

Key Performance Metrics

Source: Sava Re

The Company believes that despite the impacts of the COVID-19 pandemic on the macroeconomic situation, and the expected volatility of financial markets that the plan can deliver sustainable long-term development, risk management and profit generation. The Company will put the emphasis on the customers and introduce new core IT systems, all in order to improve enterprise efficiency and service.

Regarding the planned revenue of EUR 700m for 2022, the Company says this forecast is based on several assumptions; autumn forecasts for GDP growth where the Company is present, no major fluctuations in the financial markets, no major lockdowns or restrictions of movement in 2022 similar to those imposed in 2020 and 2021.

Consolidate Operating Revenues by segment (2022 plan):

- Reinssurance: -16%

- Non-life Slovenia: -2%

- Life, Slovenia: +2%

- Non life, international: + 6%

- Life, international: +17%

- Pension and asset management: + 4%

- Other: +4%

The Group expects Slovenian non-life insurance revenue to decline slightly. The projected decline reflects lower premium income from Freedom of Service (FOS) business, largely discontinued in 2021. In the Slovenian insurance market, the Group is targeting 2% growth in revenue against the backdrop of expected lower growth in car sales and potential lower insurance sales due to inflation. For international non-life insurance, the Group is targeting 6% organic growth in operating revenue.

The life insurance business in Slovenia is forecast to grow by 2%. While new annual premiums are planned to be slightly higher, revenue is projected to grow at a slightly lower rate due to the impact of the maturing of large parts of the life portfolio. These effects on revenue trends will largely fade away by the end of 2022. This operating segment has seen a significant boost in revenue since the takeover of Vita in 2020. In international markets, revenue growth of 17% is planned in this segment.

Reinsurance is expected to see a 16% drop in revenue in 2022. This decline is due to the expected one-off effects on growth in 2021 (positive development of income from the 2020 underwriting year) and unwavering underwriting discipline with a strong focus on profitability, risk and portfolio diversification by both region and partner.

Revenue from the pensions and asset management operating segment is expected to increase by 13%.