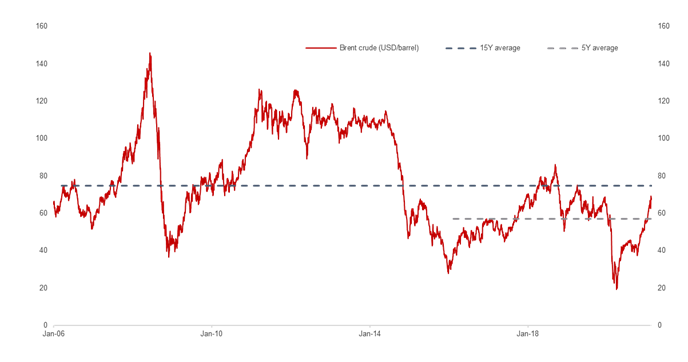

As of 9 March, Brent crude is traded as USD 67.52 per barrel. At the current price, Brent crude is traded quite above its 5Y average of USD 57.16.

Brent crude showed a very strong performance since the begining of 2021, with expectations of a recovery in the global economy amid the approval of a USD 1.9 trillion stimulus by the US Senate. The markets seem to expect that the mentioned will lead to a reduction in crude oil inventory in the US.

The beginning of this week was particularly interesting as, on Monday, as Saudi Arabia’s oil facilities were targeted by missiles and drones on Sunday. A Houthi (Yemen) military spokesman claimed responsibility for the attacks. As a result, on Monday, Brent crude futures noted a sharp increase above USD 70 for the first time in more than a year, however those gains were turned around, settling the session in the red. According to media, it seems that the assault on the Saudi terminal has not had an impact on shipments.

Oil prices were also supported in March by OPEC and its oil-producing allies announced the group would keep production largely steady through April. Saudi Arabia also stated that it would extend its 1m barrels per day voluntary production cut into April. The group approved the continuation of current production levels for April, except that Russia and Kazakhstan will be allowed to increase production by 130,000 and 20,000 barrels per day, respectively.

As of 9 March, Brent crude is traded as USD 67.52 per barrel noting a very sharp increase of as much as 32.2% YTD. At the current price, Brent crude is traded quite above its 5 Year average of USD 57.16.

Source: Bloomberg, InterCapital Research