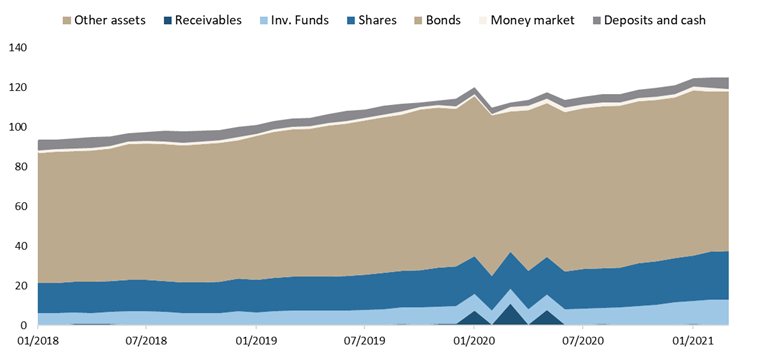

As of end April 2021, NAV of Croatian Mandatory Pension funds amounted to HRK 124.59bn.

As Pension funds could be seen as the key player on the Croatian capital market, it is worth seeing how they have performed since the beginning of 2021.

NAV of pension funds has witnessed a steady increase for 13th consecutive month, and as of end April stood at HRK 124.59bn (+12.3% YoY or HRK 13.64bn). To put things into a perspective, such NAV is converging very closely to the entire equity market cap of the Zagreb Stock Exchange (excluding PBZ – to be delisted). We note that on a YTD basis, NAV is up by 4.6%.

Looking at the MoM performance, NAV of Mandatory Pension funds is up by 0.7%, which represents the lowest increase so far this year.

Looking at the asset composition of pension funds, one can notice that bonds account for the vast majority of total assets (64.3%) which as of end April amounted to HRK 80.26bn. We note that bond holdings observed a MoM decrease of 0.5% (or HRK 4.3bn). Such a decrease followed already a high MoM decrease seen in March (-2.38%) which arguably came on the back of increased concerns regarding potentially high inflation and rising interest rates.

Shares come next, with 19.7% or HRK 24.62bn, representing an increase of as much as 2.4% MoM (or 578.2m). The majority of that mentioned increase came from foreign equity (+4.7% MoM or HRL 482.7m). Meanwhile, domestic equity witnessed a slight increase of 0.7%. Note that domestic equity accounts for 56.1% of total equity holdings.

Total Assets of Croatian Mandatory Pension Funds (2018 – April 2021) (HRK bn)