As of end Febuary 2021, NAV of Croatian Mandatory Pension funds amounted to HRK 121.38bn.

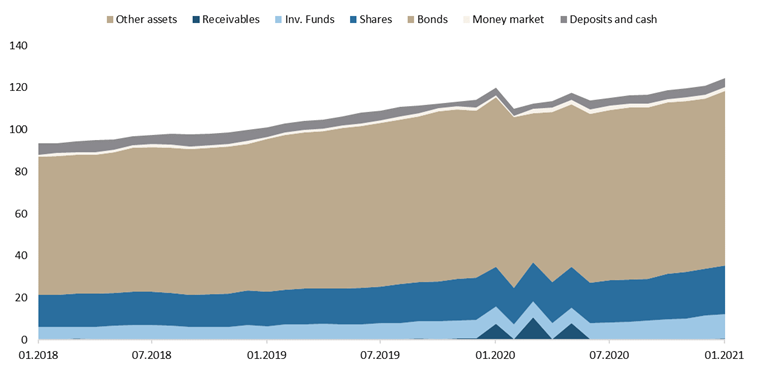

Pension funds could be seen as the key player on the Croatian capital market, as their current domestic equity holdings account for more than 40% of the free float market cap of ZSE. NAV of pension funds has witnessed a steady increase for each consecutive month since April 2020, and as of end February stood at HRK 121.38bn (+8% YoY or HRK 8.99bn).

Looking at the MoM performance, NAV of Mandatory Pension funds is up by 0.9%, showing an increase for the 11th consecutive month. It is also worth adding that in February net contribution payments amounted to HRK 593.03m (+6.7% MoM).

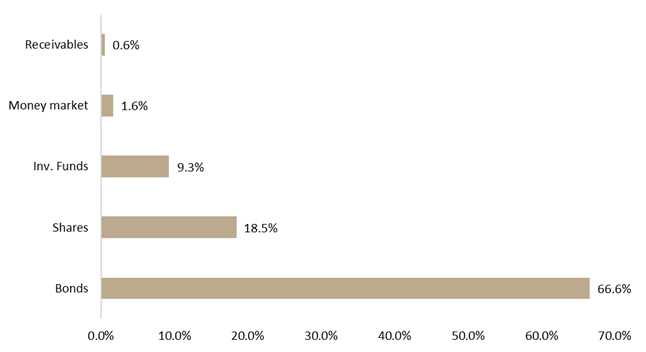

Asset Structure of Croatian Mandatory Pension Funds (Febuary 2021)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

Looking at the asset composition of pension funds, asset managers have not changed significantly their composition in the last three years, which can be seen in the graph above. Bonds account for the vast majority of total assets (66.6%) which as of end Feb 2021 amounted to HRK 82.96bn (increase of HRK 2.41bn YoY or 3%). Shares come next, with 18.5% or HRK 23bn, representing an increase of 2.8% MoM (or HRK 620.9m). Of that, domestic equity accounts for HRK 13.15bn, representing an increase for the 4th consecutive month (+1.6% MoM or HRK 206.3m).

Total Assets of Croatian Mandatory Pension Funds (2018 – Feb 2021) (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research