As of end May, total financial institution’s loans amounted to HRK 274.3bn, which represents a 0.7% increase YoY.

According to the monthly statistical report as of end May published monthly by Croatian National Bank (HNB), total financial institution’s loans amounted to HRK 274.3bn, which represents a 0.7% increase YoY and remain flat on MoM. Such figures do indicate that credit activity, especially certain segments, showed very solid resilience during the pandemic.

Its biggest categories household loans and corporate loans evidenced growth rates of 2.7% YoY and -0.7% YoY. Note that corporate loans have been observing negative trend for the third consecutive month, both on YoY and MoM (-0.7 YoY and -0.46% MoM). It is worth mentioning that in May Government still provided pandemic support measures, while moratorium on many loans were still active. When looking on a YTD basis, corporate loans decreased by 0.4%, while household loans are up by 1.3%.

Corporate and Household Loans Growth Rates (YoY)

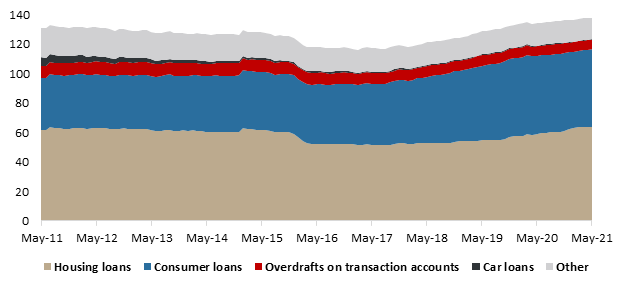

Total loans issued to households amounted to HRK 137.93bn, representing an increase of 2.7% YoY (or HRK 3.62bn). Such an increase was mainly driven by a rise in housing loans (+8.7% YoY or HRK 5.15bn). Housing loans growth was partially offset by a lower result of mostly credit card loans (-5.6% YoY) and consumer loans (-0.8% YoY). The mentioned segments account for more than 87% of total household loans.

We also note that car loans continue to observe a negative long-lasting trend (MoM decrease for each consecutive month), first time evidenced in March 2016, and are down by 9.7% YTD.

Loans to Households (HRK bn)