For today we decided to present you with the updated analysis of the interest coverage ratio of Croatian companies.

For this we used H1 2020 trailing 12m figures. Interest coverage ratio is used as a measure which gives us an insight on the company’s ability to meet its interest payments. The ratio is calculated by dividing the company’s operating profit by the interest expenses. Therefore, a higher ratio indicates that the company is less burdened by debt and the other way around. A ratio lower than 1 indicates that the company’s operating profit is not sufficient to cover for the interest payments.

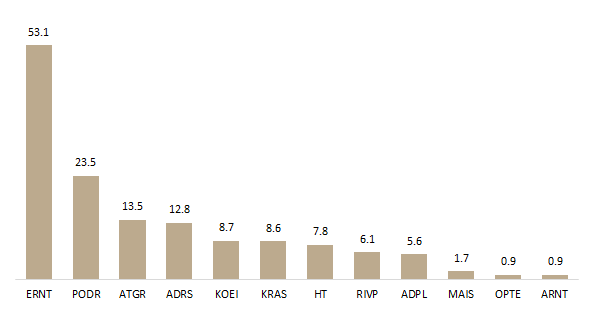

Interest Coverage Ratio of Selected Croatian Companies

As visible in the graph Ericsson NT operates with the highest interest coverage ratio of 53.1, which does not come as a surprise given that the company operates with low debt. Next come two Food companies, Podravka and Atlantic with an interest coverage ratio of 23.5 and 13.5, respectively. Both companies operate also with low debt, as net debt/EBITDA of these companies amounts to 1.24 and 1.06, respectively.

On the flip side, of the observed companies, the only two companies operating with an interest coverage ratio below 1 are Optima Telekom and Arena Hospitality Group.

To read our analysis of indebtedness of Croatian companies, click here.

To read about how much cash per share do Croatian blue chips have, click here.