For today we decided to present you with a brief analysis of how correlated have been CROBEX and S&P500 since the beginning of the year.

If you have recently been following the Croatian and the US equity market, you might have seen certain similarities in the movement of CROBEX and S&P500. Like most major indices, both have witnessed a sharp double-digit decrease since the beginning of the year. In the graph below, you can see the YTD performance of CROBEX and S&P500, which does show a similarity in the movements of the indices.

YTD Performnace of CROBEX and S&P500

If we were to take a closer look at daily movements of the indices, one can observe an interesting correlation, which is visible in the graph below. Since the Covid-19 outbreak, one can notice that almost every time when S&P500 recorded a sharp daily increase or decrease, the same movement of CROBEX was observed. This can be also confirmed when calculating the coefficient of correlation of YTD daily returns of both indices, which amounts to 0.76, showing a solid correlation between the movement of the indices. This has not been historically the case (to such extent) as the coefficient of correlation for the same parameters since 2015 amounts to 0.42, while since 2007 amounts to only 0.37.

YTD Daily Change of CROBEX and S&P500 (%)

Such a correlation could imply that many investors in the Croatian equity market are not necessarily basing their investment decisions on fundamentals or the local news, but rather on the global sentiment. This would not surprise us as many fundamental parameters are still in a very unknown territory such as the end of the Covid crisis, relaxation of local measures regarding the virus or impact on the macro picture across economies

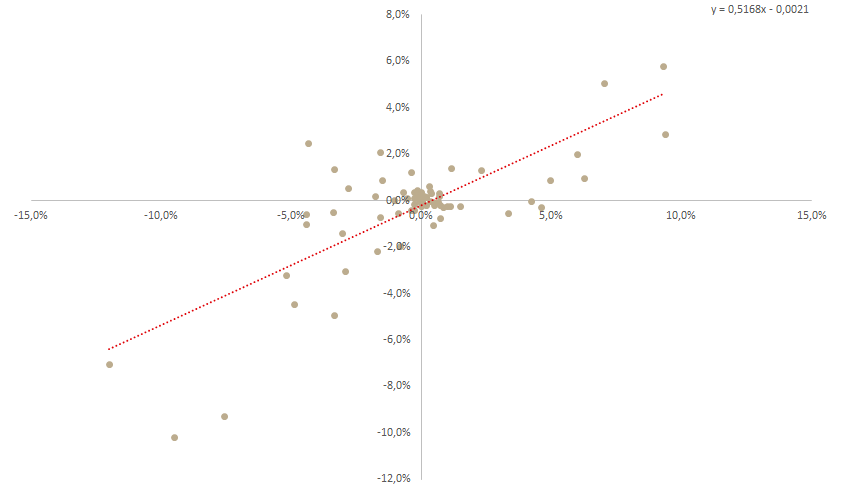

If we were to run a regression of YTD daily returns of CROBEX and S&P500, the slope of the regression gives us additional information of relative volatility of CROBEX. In the graph below, you can see that the slope of the regression amounts to 0.52 indicating that CROBEX has been roughly half as volatile as S&P500. So for example, an increase of 10% of the S&P500 would indicate a 5.2% increase of CROBEX.

Regression of YTD Daily Changes of CROBEX Against S&P500