A new COVID-19 variant from South Africa sends fears across the global equity markets.

On Friday a new COVID-19 variant, currently named Omnicron, originating in South Africa sent fears across equity markets across the world. This new variant, currently thought more infectious than the previous variants due to mutations in spike protein ( a key part that the virus uses to enter cells in the body) is also the part of the virus that’s targeted by vaccines.

As of Thursday, there were almost 100 cases detected in South Africa, where it’s become the dominant strain among new infections. There were also four cases recorded in neighboring Botswana, in people who were fully vaccinated. In Hong Kong, a traveler from South Africa was found to have the new variant, while Israel identified one case in a man who recently traveled to Malawi.

Due to the nature of the new variant, countries across the world have started responding. The UK issued a temporary ban on flights from six African countries, Singapore restricted entry for people from South Africa and neighboring countries within the last 14 days, the European Union proposed halting air travel from southern Africa, Australia is considering tightening border rules for travelers from South Africa, while India stepped up screening incoming travelers from South Africa, Botswana, and Hong Kong.

All of the above stated had an effect on global financial markets on Friday as stocks, treasury yields, and oil sank. In the US, S&P 500 decreased by 2.27%, the highest decrease since February 2021. Meanwhile, Dow Jones was down by 2.53%.

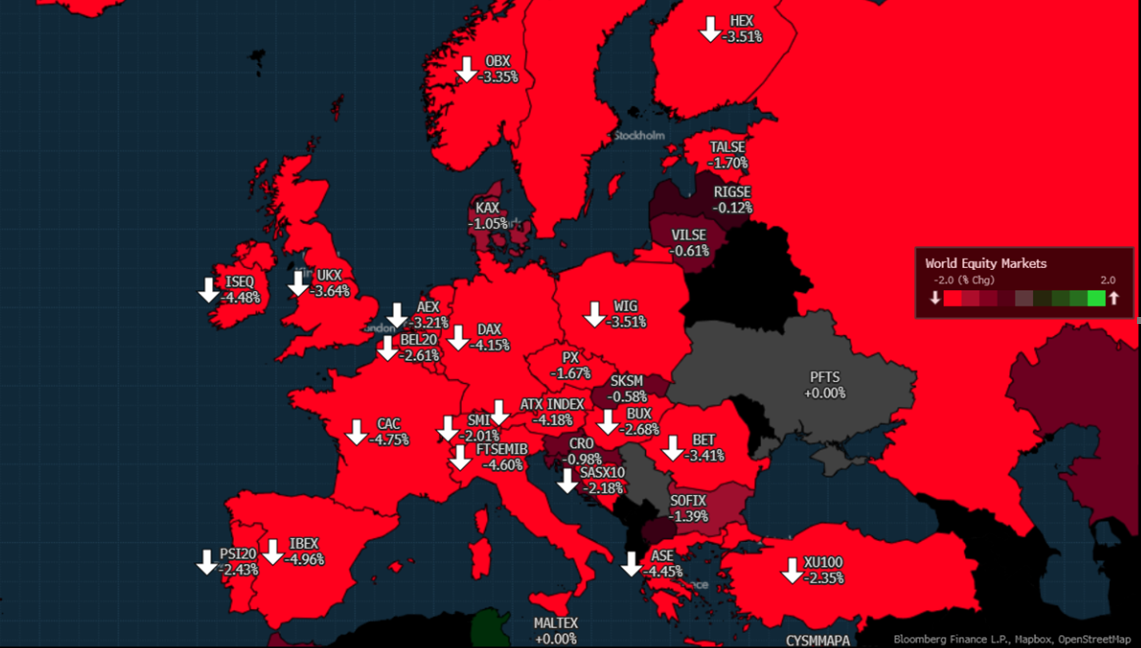

Across Europe, virtually all major indices have ended the trading day in red. . As of closing on Friday, DAX has dropped by as much as 4.15%, representing the highest decrease since October 2020.

The region seemed to be less affected by the news, as CROBEX dropped by 0.98%, while SBITOP noted a decrease of 0.71%

European Equity Markets (26 Nov 2021)

Source: Bloomberg