According to the latest economic forecast released by the European Commission (EC), it expects easing growth momentum amid declining inflation and a robust labour market. As such, the EC revised its real GDP growth rate to 0.8% in 2023, and 1.3% in 2024, decreases of 0.3 p.p. for both, respectively. Furthermore, EC revised its inflation forecast to 5.8% (+0.2 p.p.) in 2023, and to 2.8% in 2024 (-0.1 p.p.) as compared to its last forecast.

Yesterday, the European Commission published its latest European Economic Forecast, for Summer 2023. In this article, we’ll point out the most important points. According to EC, the EU economy continues to show resilience in the face of shocks it has endured in recent years, but it has lost momentum. Economic activity was subdued in H1 2023. Domestic demand, and in particular consumption seems weak, under the pressure from high and still increasing CPI for most goods and services. The growth in CPI has continued despite the declining energy prices, and an exceptionally strong labor market, which recorded both record low unemployment, and continued expansion of employment and wages. Furthermore, the slowdown in bank credit provision to the economy indicates that the monetary tightening policy is working its way through the economy. Surveys are pointing towards slowing economic activity in the summer and months ahead, with continued weakness in industry and fading momentum in services, despite the strong summer season in many parts of Europe.

EC expects that the weaker growth momentum will continue in 2024, and the impact of tight monetary policy will continue restraining economic activity. The EU economy cannot count on strong support from external demand, as other markets are also facing pressure across the world. EC does expect a mild rebound in growth in the next year, on the back of the easing of inflation, continued robustness of the labour market, and real income’s gradual recovery.

In terms of the retail energy prices, they are expected to continue declining for the remainder of 2023, but at a slowing pace. A slight increase is expected again in 2024, due to higher oil prices. Inflation in the services is set to continue moderating due to softening demand, under the influence of monetary policy tightening and a fading post-pandemic boost. Other non-energy components of the CPI will continue to drive inflation down over the forecast period, which also reflects the decrease in input prices as well as supply chain normalization. Taken together, the forecast revises growth downward for the EU and the euro area in both 2023 and 2024.

Finally, the war in Ukraine and wider geopolitical tensions continue to pose risks and remain a source of uncertainty. Monetary tightening may influence economic activity more than what was expected, but could also lead to a faster decrease in inflation, leading to improvements in real incomes. On the other hand, price pressures could turn out to be more persistent, which would lead to a stronger response in monetary policy. The outlook is also influenced by the increasing climate risks.

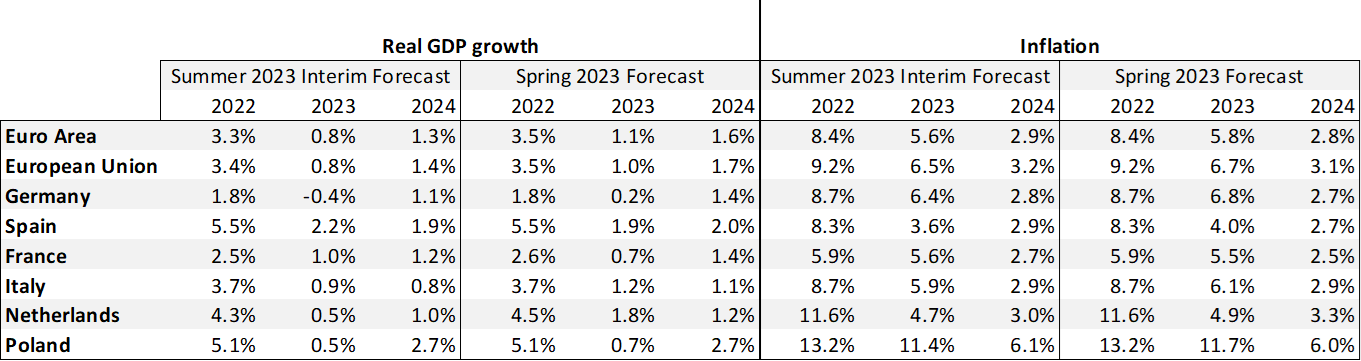

European Commission Summer 2023 Interim Forecast of real GDP growth and inflation for EU, euro area, and select countries (Summer 2023 Forecast vs. Spring 2023 Forecast, %)

Source: European Commission, InterCapital Research

As we can see, all of these factors have led to a forecast for real GDP growth of 0.8% in 2023 and 1.3% in 2024, a downward revision of 0.3 p.p. for both periods, respectively. On the flip side, inflation is estimated at 5.6% in 2023, and 2.9% in 2024, a decrease of 0.2 p.p. and an increase of 0.1 p.p., respectively, as compared to the Spring 2023 forecast. The full and detailed report can be accessed here.