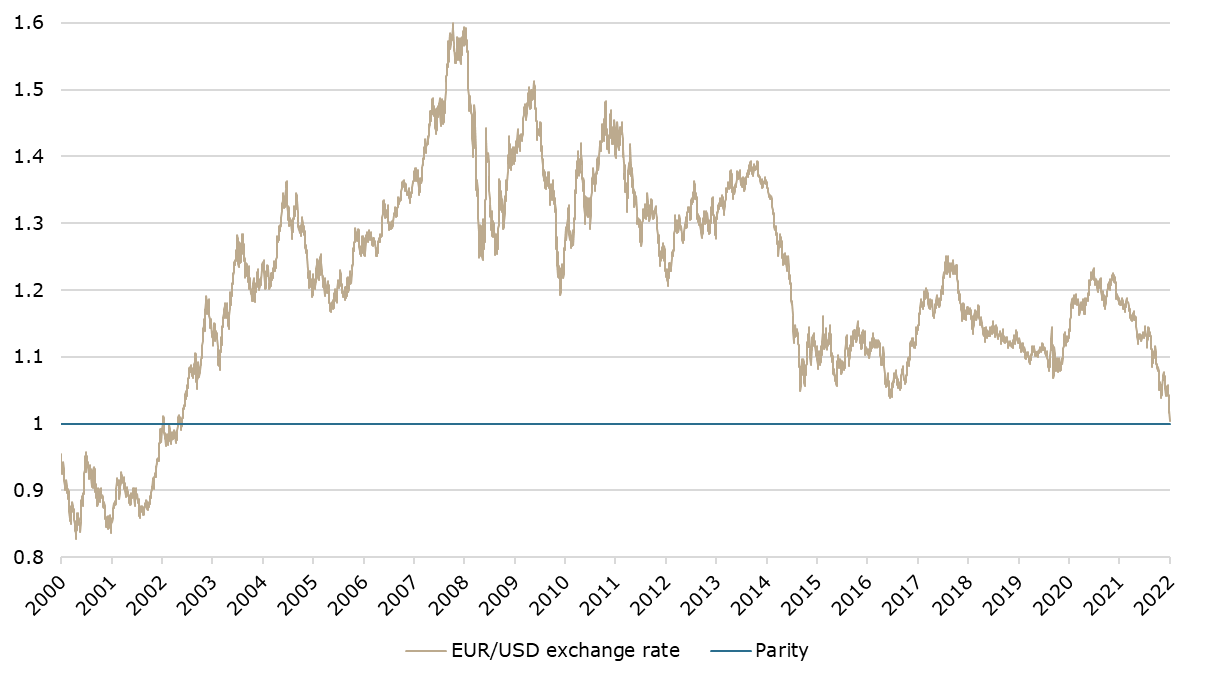

Ever since the beginning of 2021, the EUR/USD exchange rate has been driven ever closer to parity. Since then, EUR has lost 17.8% of its value towards the dollar, while on a YTD basis, it lost 11.7% of its value.

The story of the EUR/USD exchange rate is quite telling. The two most popular and traded currencies in the world used by a lot of countries, especially the dollar, are here to make the trade around the world work. So the current environment depicted by the strength of the dollar and by extension, the weakness of the EUR can tell us a quite interesting story.

Throughout 2021, with the reopening of the global economies and the surge in demand for goods and commodities, the primary exchange currency and the reserve of the many countries in the world, the dollar, saw its value appreciate. Of course, the sheer amount of dollars printed during the pandemic should have offset this value increase, and while this would be the case if the US was the only country that increased its money supply, almost all of the central banks around the world decided to follow suit and print massive amounts of their own currency. Combined with the above-mentioned fact that a lot of trade and a lot of the countries’ reserves are held in dollars, what do you get? Dollar appreciating in value.

EUR/USD exchange rate (2010 – today)

Source: Bloomberg, InterCapital Research

This is quite evident from the graph, but what we have to ask ourselves is, why did it accelerate so much in 2021, but also in 2022? This is why the story of the EUR/USD exchange rate is so interesting. The massive amounts of money printed, combined with the surging demand across the world, which the supply side of the equation just could not cope with, in the end, always leads to inflation. We could see the first signs of this inflation when the prices of commodities and certain goods that were in demand started increasing considerably. The reopening also had an effect on commodities which while the lockdown lasted, only retained a smaller portion of their usual value (i.e. coal, oil, gas, etc..), bringing them back to or above their pre-pandemic levels. With the already strained supply chains (a story we could read about all the time in 2021 and even now in 2022) this created even more cost pressures, a pressure that the companies had to pass on as increased prices. Combined with the fact that the EU, and especially the USA recorded some extraordinary labour shortages, this also had an impact on wage increases, which again, increased prices, and by extension, inflation.

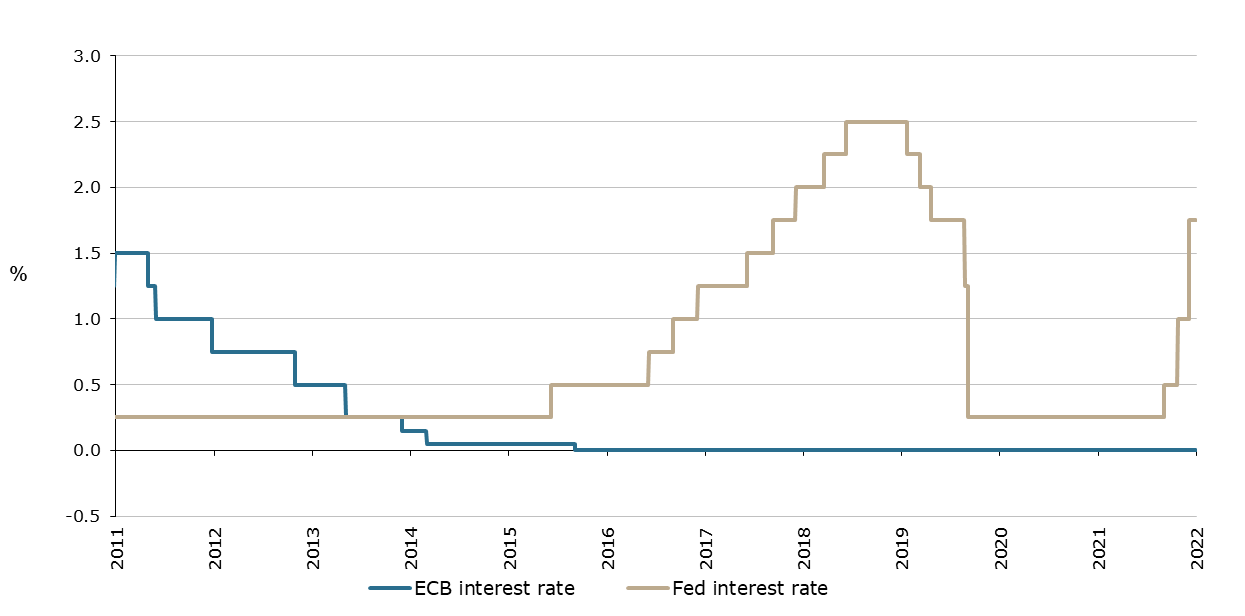

What does all of this have to do with the exchange rate, you might ask? Well, the primary way that a central bank, and in this case Fed, can fight inflation is by raising interest rates. Raising interest rates automatically increases the value of a currency, making it appreciate in value as compared to other currencies. It also makes the exports of the goods in that currency more expensive, and in turn, the imports less expensive. Considering the fact that the majority of the world trade is done in dollars, in one form on another, this only exacerbated the dollar’s value. This effect is even stronger when a country decides to more aggressively increase its interest rates as the Fed has been doing in order to combat inflation.

You might ask, well why doesn’t the European Central Bank (ECB) do the same? Increasing its interest rates will mean borrowing and exports in the Euro will also become more expensive, which might mitigate some of the appreciation of the dollar. This is where we come to the crux of the issue. Even though almost all the countries around the world are experiencing some form of inflation, we should take a look at the inflation in the US and the EU to answer this question. Both the US and the EU are affected by the growing fuel prices (gas and oil) due to the Russian invasion of Ukraine, as well as the subsequent sanctions on Russia. This had a cascade effect on the energy prices, which hit the EU harder than the US.

The reason for this is simple: The US has higher gas and oil supplies and production capabilities, while at the same time, the EU has to import the majority of these commodities abroad, and thus far, Russia has been one of its largest exporters. Even though the EU and the US have similar inflation levels, the drivers of that inflation are not the same, at least not completely. Food and energy prices are for sure drivers for both of these blocks’ inflation growth, but the inflation in the US is more orientated on the supply side (due to supply chain disruptions, labour shortages, etc.), while the inflation in the EU is more cost orientated (prices of food, energy, and goods, in general, is growing because the prices of their underlying commodities are increasing, and the EU does not have a quick way of finding alternative sources of these resources). Coming back to the exchange rate question, this is where the answer lies: As the US is not as affected by the energy price increases, and as they are more affected by the supply chain issues, the hit to their economy from the interest rates, even if it leads to recession, would not be as severe.

On the other hand, even though the ECB announced it will start increasing interest rates to combat inflation, it cannot increase them as aggressively or as fast. The European Union is a lot more exposed to energy price shocks. Even though they already announced an increase in the interest rates, it would still not influence the fact that if they could not import enough commodities to keep the economies up and running, the economies would start to stagnate. Combined with the fact that making the euro more expensive by increasing the interest more aggressively, this would also make the exports in the currency a lot more expensive, something that some of the largest countries in the EU (like Germany, Italy, France, etc.), are heavily reliant upon.

What happens, in this case, is stagflation – when the central banks increase interest rates to combat inflation, which makes exports and borrowing more expensive, which slows down or even stops economic growth. Combined with the fact that the energy crisis will likely only get worse, we can see the reason why the ECB just can’t as aggressively increase the interest rates as the US. As a result of this dynamic, the trend in the EUR/USD exchange rate we have witnessed for the last few quarters is pretty apparent – the dollar almost reaching parity with the euro. Almost, as it currently stands at USD 1.004/1.00 EUR.

With all the underlying causes and challenges still present, there is a potential that the dollar will be valued even higher, meaning it will end up worth more than the euro, something that hasn’t happened for the last 20 years, i.e., from 2002.

ECB and Fed interest rate changes (2011 – today, %)

Source: ECB, Fed, InterCapital Research