Eurostat released Q2 GDP growth figures for the Euro Area and EU member states recently. A key takeaway is Europe’s significant lag behind the USA, with growth more than three times slower. The Euro Area and EU posted a mere 0.2% growth in the second quarter, compared to USA’s 0.7%. This raises the question: is Germany alone steering Europe toward stagnation, or is this just a temporary slowdown for the European economy?

Since Q3 2021, the Euro Area and the EU have not registered QoQ growth exceeding 1%. In the second quarter of 2024, seasonally adjusted GDP increased by just 0.2% in both compared to the previous quarter, according to estimates published by Eurostat. This follows a 0.3% growth in both zones during the first quarter of 2024. YoY seasonally adjusted GDP rose by 0.6% in the Euro Area and 0.8% in the EU in Q2 2024, following growth of 0.5% and 0.7% respectively in the first quarter. In contrast, the United States saw GDP rise by 0.7% in Q2, following 0.4% growth in Q1. On a yearly basis, United States GDP surged by 3.1% in the second quarter, after a 2.9% rise in the first.

GDP growth over the previous quarter in the Euro area, EU, and the US (seasonally-adjusted data, Q1 2018 – Q2 2024, % change)

Source: Eurostat, InterCapital Research

GDP growth over the same quarter of the previous year in the Euro area, EU, and the US (seasonally-adjusted data, Q1 2018 – Q2 2024, % change)

Source: Eurostat, InterCapital Research

As for the member states, Poland recorded the highest QoQ GDP growth (+1.5%), followed by Greece (+1.1%) and the Netherlands (+1.0%). Spain and Croatia (both +0.8%) are right behind them, mostly due to the strong influence of the tourism sector on countries’ GDP. This is also reflected in the service production trends for July 2024, where service sectors in the EU saw a decline except for accommodation, real estate, and food services – industries closely tied to tourism.

On the other end of the spectrum, the largest GDP declines were observed in Ireland (-1.0%), Latvia (-0.9%), and Austria (-0.4%). Germany, Europe’s largest economy, posted a contraction of -0.1% in Q2 2024, signaling potential challenges ahead for the broader European economy.

EU, EU member states quarterly GDP growth rate (Q2 2024, % change vs. previous quarter)

Source: Eurostat, InterCapital Research

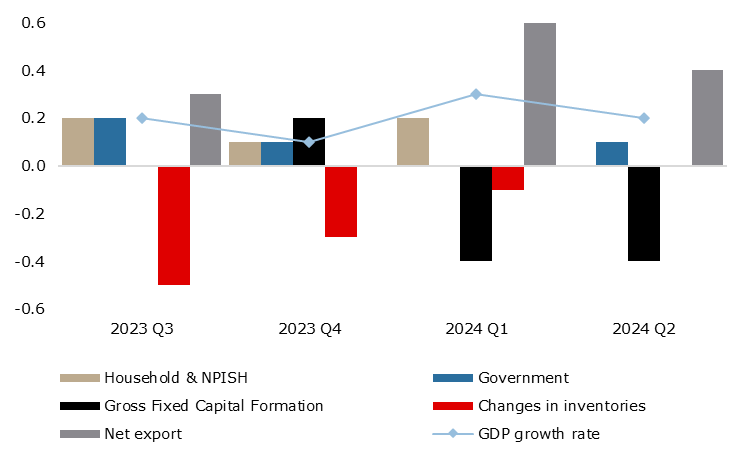

In terms of GDP growth contributions by components, the most significant positive impact came from net exports, contributing +0.5 pp for the Euro Area and +0.4 pp for the EU. Government final expenditure also had a positive effect, though modest, at +0.1 pp, while household final consumption expenditure and changes in inventories made negligible contributions. However, a concerning factor is the negative impact of gross fixed capital formation, which reduced growth by -0.5 pp in the Euro Area and -0.4 pp in the EU, reflecting a weak investment climate across Europe.

Decomposition of the GDP growth of the EU by expenditure aggregates (p.p. contribution to growth over the previous quarter, Q3 2023 – Q2 2024)

Source: Eurostat, InterCapital Research

While these negative results can be partially attributed to macroeconomic shocks – stemming from inflation, the energy crisis, and the war in Ukraine – the more troubling issue is the pessimistic outlook for future growth, a modest growth after a period of stagnation. Europe’s challenging demographic structure is negatively affecting labor markets, leading to labor shortages, particularly of skilled workers in high-growth sectors. This labor shortage spills over into the lagging European tech sector and exacerbates high dependence on certain industries, such as the automotive industry (e.g. Slovakia) and tourism (e.g. Croatia). Additionally, Europe’s energy crisis is exacerbated by its dependence on energy sources from Russia, the Middle East, Africa, and the USA, compounded by geopolitical risks. In response, the EU is aggressively promoting immigration and renewable energy as solutions to the problems mentioned above, but this transition is costly. In an environment of high interest rates, weak global growth (emphasis on China), and the dollar’s dominance over the euro, Europe finds itself disadvantaged in investing in the energy transition, new workforce, and continuing to rely on exports.

Former Italian Prime Minister and ECB president Mario Draghi offered his critical view of Europe’s short-sighted economic strategy, identifying key issues of which the lagging tech sector, dispersed R&D, high energy costs, fragmented financial markets, and polarized politics are highlighted. His proposed solutions include energy market reforms, relaxed merger regulations, and joint borrowing, intending to generate EUR 800bn annually in public and private investments. However, political resistance from countries like Germany and the Netherlands, combined with Europe’s fragmented political system and slow legislative processes, pose significant obstacles to implementing these ideas effectively.