As we had the pleasure to host Dalekovod for our traditional Investors’ Day @InterCapital, we are bringing you the highlights from the meeting.

As we had the pleasure to host Dalekovod, a Croatian construction company, for our traditional Investors’ Day @InterCapital, we are bringing you the highlights from the meeting attended by Mr. Tomislav Rosandić (CEO), Mr. Ivan Kurobasa (COO), Mr. Tomislav Đurić (CFO) and Mr. Đuro Tatalović (CRO). The company’s representatives gave an overview of Dalekovod’s financial performance in 2018.

According to it, the company recorded sales of HRK 1.2bn, which represents a decrease of 20.5% YoY. The management attributes this decrease to the postponement of tenders expected in 2018 to 2019.

Dalekovod Operating Revenues ( 2015 – 2018) (HRK m)

When observing the gross margin, it amounted to HRK 60.6m, which represents a decrease of 67.3%. Such a high decrease could partially be explained with above-mentioned postponement of tenders. Besides that, Dalekovod observed a couple of one-offs including a claim regarding 2 projects in Norway of HRK 25m, which was not recorded in their 2018 P&L, however a higher expense was recorded. Furthermore, the company observed a strike in 2018, which cost the company HRK 30m, according to the management.

Going further down the P&L, the company recorded a negative EBITDA of HRK -32.5, which is by HRK 113m lower compared to 2017. When adjusting EBITDA for value adjustments, it amounted to HRK -18.9m.

When observing EBT, Dalekovod recorded HRK -70.8m which could be attributed to a FX loss of HRK 20.3m which was offset by extraordinary revenue of HRK 32.7m.

In 2018, Dalekovod recorded a net loss of HRK 76.4m which is a decrease by HRK 88m compared to 2017.

EBITDA & Net Income (2015 – 2018) (HRK m)

It is also noteworthy that in 2018 Dalekovod sold Dalekovod Professio for HRK 115m. Of that 55% of the amount will be used to service their Mezzanine debt, which is in line with

Turning our attention to the outlook for 2019, the management stated that 2019 started well regarding new deals being contracted, as a result of the above-mentioned postponement of tenders from 2018. As of 28 February 2019, Dalekovod’s non-consolidated deals are worth HRK 955m, which represent an increase of 34% compared to 2018. Besides that, the company also has HRK 537m of deals concluded already for 2020. Also, note that the management stated that they plan on improving their results through operating restructuring which will focus on optimizing G&A costs.

The management also mentioned that according to ENTSOE, investments in transmission lines will observe a significant increase in the EU until 2030, which is expected to amount to EUR 130bn. Of that EUR 32 – 52bn can be attributed to Germany, EUR 7.9bn to Norway, EUR 3.6bn to Sweden and EUR 0.2bn to Croatia. These are all key markets for Dalekovod where it is working directly and has plans to further position itself as key niche player.

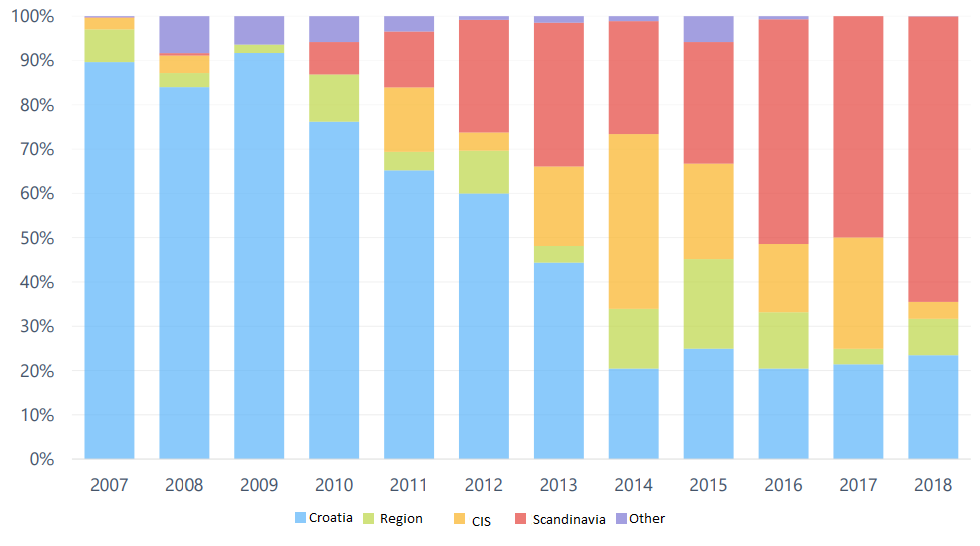

Revenue Breakdown Market Segment*

*non-consolidated revenue