For today, we decided to present you with an update asset structure analysis of Croatian UCITS funds.

The Croatian Financial Supervisory Agency (HANFA) published their monthly update on the NAV of all Croatian UCTIS funds. Since the asset managers play a very significant role in the Croatian capital market, it is particularly interesting to see how they have been affected during the ongoing Covid-19 situation. According to the report, NAV of all funds in March 2020 decreased by 32.2% MoM (or HRK 7.42bn), amounting to HRK 15.65bn. This also represents a decrease of 18.9% YoY.

NAV of Croatian UCITS funds (HRK 000)

As a reminder, HANFA noted earlier this month that since 21 February (until 24 March) 86.1% of the decrease could be attributed to withdrawals from the funds, while the rest 13.9% can be attributed to a change in value of assets in which the funds invest.

Asset Structure of UCITS funds (March 2020)

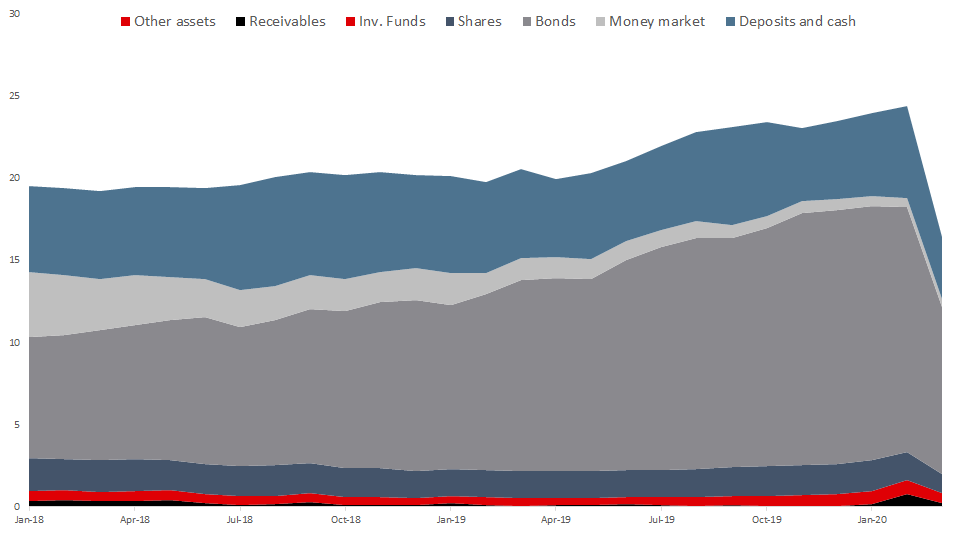

Looking at the asset composition of Croatian UCITS funds, it seems that asset managers have not changed significantly their composition, which can be seen in the graph above. Since the beginning of 2017, we witnessed a high increase of bonds in the assets structure which went from 31% in 2017 to 62% in the March of 2020. In the same period, we observed a sharp decrease of money market funds which decreased by 22 p.p. to 3% of the total composition.

Shares which currently account for 7.2% of the total asset structure of UCITS funds, remained relatively flat MoM.

Total Assets of All Croatian UCITS Funds (2018 – March 2020) (HRK bn)

Source: Croatian Financial Supervisory Agency, InterCapital Research