For today, we decided to present you with a short asset structure analysis of Croatian UCITS funds.

The presented figures are presented in euros, using today’s exchange rate.

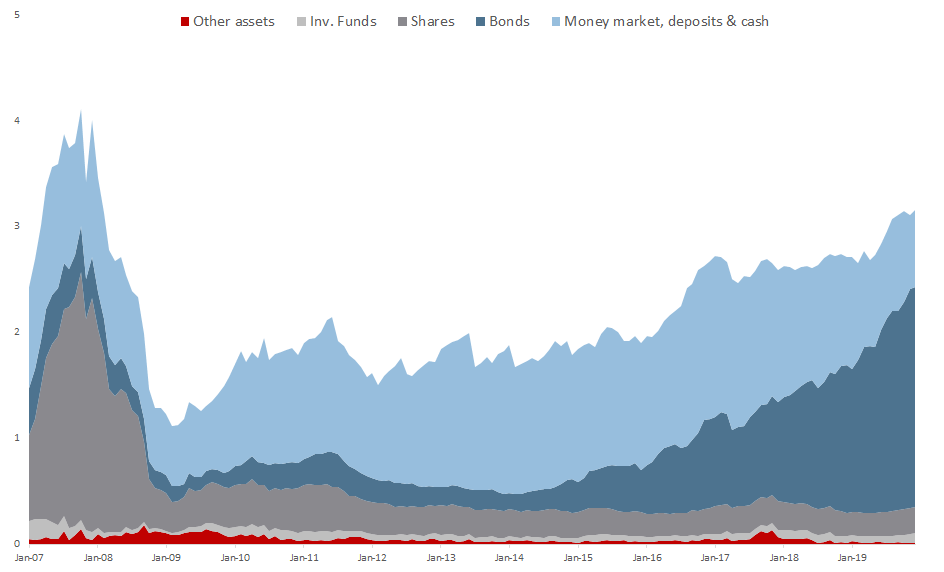

Looking at the asset composition of Croatian UCITS funds, it is clear that asset managers are more prone to investing in debt securities. Since the beginning of 2017, we witnessed a high increase of bonds in the assets structure which went from 31% in 2017 to 65.9% in the end of 2019.

In the same period, we observed a sharp decrease of money market, deposits and cash which went from 56% to 23%. Shares follow, which currently account for 7.6% of the total asset structure of UCITS funds.

The mentioned structure was quite different when compared to 2007 and 2008. In 2007 money market, deposits & cash accounted for 39%, while shares came in second, accounting for 33% of all assets held. Actually, at their high point in 2008, shares accounted for 55% of the total assets.

The total asset value of Croatian UCITS funds as of end 2019 (ex. Pension funds which are the largest individual domestic investors) amounted to EUR 3.16bn, which is represents a solid increase of 16.3% YoY. Note that this value is 77% of the highest value recorded back in October 2007.

Still, today’s asset value marks a significant improvement when compared to the beginning of 2009 when the total assets of mutual funds reached its low (EUR1.1bn), partly due to lower asset value, as well as due to funds outflow as investors pulled out their funds.

Source: Croatian Financial Services Supervisory Agency, InterCapital Research