As of end August, total financial institution’s loans amounted to HRK 271.2bn, which represents a 7.0% increase YoY.

Croatian National Bank (HNB) published their monthly statistical report on loans placement of other monetary financial institutions. According to the monthly statistical report as of end August, total financial institution’s loans amounted to HRK 271.2bn, which represents a 7.0% increase YoY, while the figure is flat on a MoM basis.

Its biggest categories household loans and corporate loans evidenced growth of 3.9% YoY and 3.7% YoY, respectively. Note that corporate loans have since April been observing a negative trend, recording MoM decreases. As of end August, corporate loans amount to HRK 84.82bn, representing a decrease of 0.88% MoM.

It is also worth adding that loans to central government witnessed sharp increase of 30% YoY to HRK 42.86bn, which was mostly evidenced with the beginning of the pandemic. To be specific, this relates to a HRK 6bn loan to the state (for Covid-19 support) which occurred in parallel to HNB reducing the required reserves for banks freed additional funds. Meanwhile, loans to local government amounted to HRK 5.34bn, representing an increase of 14%.

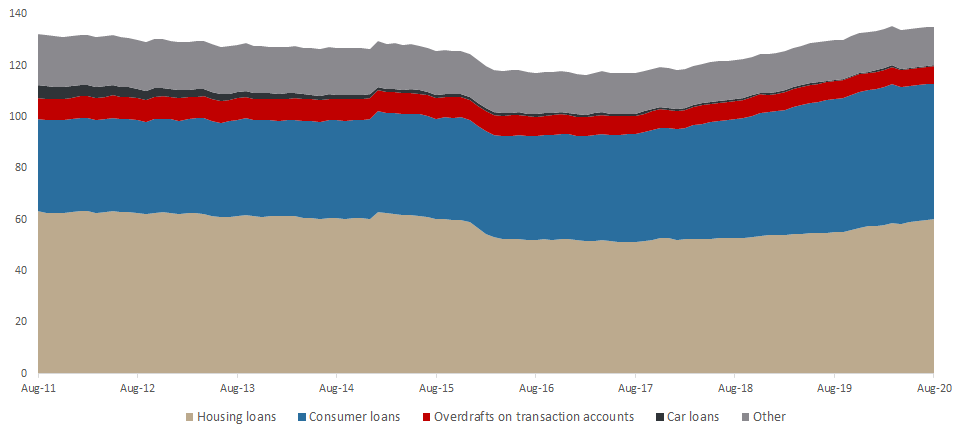

Total loans issued to households amounted to HRK 135.17bn, representing an increase of 3.9% YoY (or HRK 5.13bn). Such an increase was almost entirely driven by a rise in housing loans (+9.1% YoY or HRK 5.04bn) and somewhat consumer loans (+1.9% YoY or HRK 992.8m). It is worth noting that these two items account for 83.6% of the total loans to households. The mentioned increase was partially offset by a decrease in almost all other loan segments (besides mortgage loans). It is worth noting that car loans observed a sharp drop of 21.4% or HRK 122.9m, which is the highest drop of all segments. This does not come as a surprise, given the low car sale trend which has been observed throughout this year.

Loans to Households (HRK bn)

Source: Croatian National Bank, InterCapital Research

If we were to compare total loans issued to households since the beginning of the pandemic, one can notice a slight decrease of 0.1% or HRK 201.6m. Such a decrease mostly came on the back of a decrease in consumer loans of 2.3% or HRK 1.23bn, while being somewhat offset by an increase in housing loans by 2.3% or HRK 1.35bn. Meanwhile. the majority of other loan segments also recorded a decrease in the observed period. It is worth noting that we expect consumer loans to further decrease by the end of the year, given the shaken consumer confidence caused by the Covid-19 crisis. This has been a steady trend since the outbreak of the pandemic (when observing MoM development). However, it is worth noting that the decrease has seen a steady slowdown in these months. Assuming that banks enforce a stricter credit policy, we could potentially again witness higher decreases in consumer loans.

On the flip side, housing loans continue recording MoM increases, with the exception of April (lockdown period), when housing loans observed a 0.6% decrease.

Structure of Loans to Households (August 2020)