For today, we decided to present you with a brief analysis of cash per share of Croatian companies.

In July, most Croatian companies published their H1 results, while the market observed a slight recovery compared to a sharp decrease seen in March. As a result, we decided to revisit (update) our cash per share analysis, with H1 figures in order to see the strength of the balance sheet and how liquid selected Croatian companies are. This figure as the percentage of a company’s share price can give us more insight on the company’s strength on returning the money to shareholders (either through dividends or buybacks), paying down debt etc.

It is important to note that looking at solely cash per share of a company could lead to misleading conclusions if we did not also take into consideration the company’s indebtedness. To see the H1 indebtedness of Croatian companies click here.

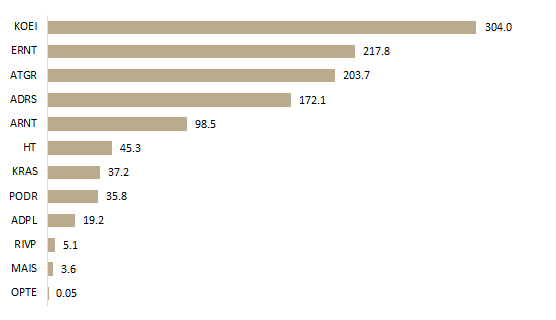

Cash per Share of Croatian Blue Chips (HRK)

A high level of cash per share indicates a solid performance of the company, reinsuring the shareholders that the company is operating with “enough room” to cover for any potential difficulties and that the company has adequate capital.

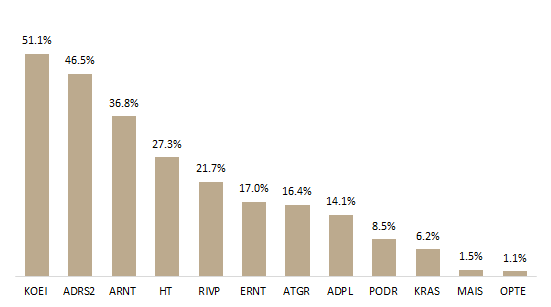

Cash per Share as a Percentage of the Current Share Price

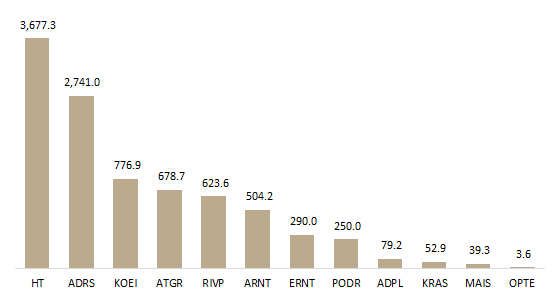

As visible in the graph, of the selected companies, Končar operates with the highest cash per share as a percentage of their current share price of 51.1%, while their cash per share amounts to HRK 304. Adris pref. comes next with 46.5%. Note that the company has a very solid cash position of 2.74bn.

On the flip side, Optima Telekom has the lowest cash per share of HRK 0.05, which translates into 1.1% of its current share price. As a reminder, the company’s cash position has significantly decreased to HRK 3.6m as it has been operating with losses in the recent years. Optima’s share price has also been hit the most of the observed companies this year (-39.8%).

Cash Position of Croatian Blue Chips (HRK m)*

*Cash and short term financial assets (from H1 2020 reports)