Today, we are bringing you the overview of the thus far announced dividends for the Croatian and Slovenian blue chips, part of the CROBEX10 and SBITOP indices, respectively, as well as the current index DY based on these numbers.

As of right now, the majority of the Croatian and Slovenian blue chips have announced their dividend proposals, most of which will be voted upon and paid out in the next 2-3 months. In this analysis, we are bringing you a concise overview of all the dividends, dividend yields, as well as the most important dates for each respective company’s dividends. It should be noted that all the dividend yields presented here are calculated based on the price before the initial dividend announcement. We also took a look at the overall index DY, in case one decides to buy the entire index as opposed to individual stocks.

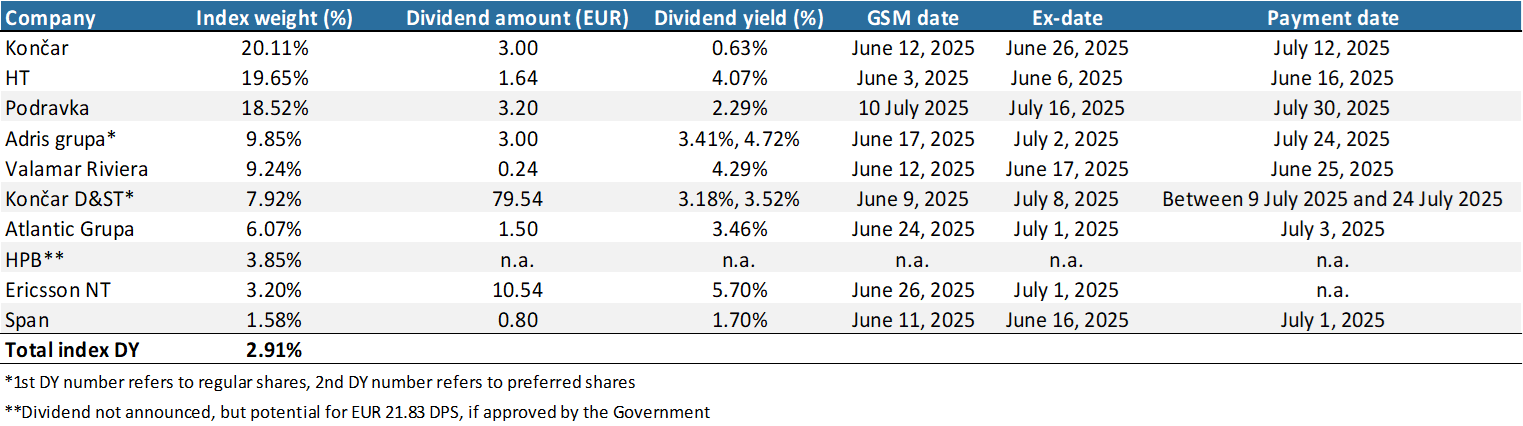

Croatia

Starting off with Croatian, the CROBEX10 index is currently composed of 10 Croatian blue chips, with many sectors and industries included.

Currently announced dividend information of Croatian blue-chip companies (As of 5 May 2025)

Source: Companies’ data, ZSE, InterCapital Research

Out of all the blue chips, the largest dividend yield is currently held by Ericsson NT, whose dividend, if approved, would yield a 5.7% return. While the Company’s operations have struggled in the last year and a half due to external factors, it did decide to pay out one of the highest DYs currently available on ZSE. Next up, we have Adris grupa, whose preferred shares are part of the CROBEX10 index. The dividend announced amounts to EUR 3.00 per share, which for regular shares implies a DY of 3.4%, and for preferred shares a DY of 4.7%.

Following them, we have Valamar Riviera, which announced a dividend of EUR 0.24 per share, which would mean that the dividend yield amounts to 4.29%. Next up, we have Hrvatski Telekom, which announced a dividend of EUR 1.64 per share, implying a dividend yield of 4.07% at the share price before the announcement. Atlantic Grupa also just announced its dividend, at EUR 1.50 per share, implying a dividend yield of 3.46%. Following them, we have one of the best performers on ZSE (alongside its mother company), Končar D&ST. The Company has announced a dividend of EUR 79.54 per share for both the regular and preferred shares, implying a DY of 3.18% and 3.52%, respectively.

Before going further, it should be noted that HPB decided to transfer its 2024 earnings into retained earnings. However, in its announcement, the bank also said that it has “reserved” EUR 44.2m for dividend payments, the money which won’t be used for any regulatory capital calculations. As the bank’s largest shareholder is the Republic of Croatia, it has been noted that a decision by the government is required to pay this out in the form of dividends. If that decision comes, this would imply a dividend of EUR 21.83 per share, which at the current share price (EUR 272.00) would actually imply the highest dividend yield of all the Croatian blue chips present here, just above 8%. Given that if this dividend is paid out, it would help the Government’s budget, it is likely that such a decision would come this year. However, as of now, is it unknown if this amount would be paid out (it could only be lower as the rest of the net profit is used for regulatory capital calculations and cannot be used for dividend payments), but again, given the benefit to the Government, it is unlikely that they would reduce it, outside of things changing and events happening which would bar the bank to do so. The Government has requested payments in the form of dividends from state-owned companies in the past, but as of right now, no decision has been made.

The last 2 remaining companies are Span and Končar, which announced dividends of EUR 0.80 per share and EUR 3.00 per share, implying dividend yields of 1.7% and 0.63%, respectively. For Span, a technology company that is currently in the growth phase, it was expected that the dividend wouldn’t be too high. For Končar, though, even though its subsidiary Končar D&ST is paying quite a high dividend, on the Group level, the dividend still remains low, and there is room for improvement here. However, given that it is also expanding rapidly across its main segments, higher levels of investment are also expected, and as such, the Company’s decision could be understood from that lens.

On the CROBEX10 level, the weighted DY stands at 2.9%. Overall, many of the companies here announced higher dividends than last year, but given the increase in share price for many of them, the DY appears “similar” to levels seen before. It should also be noted that many of the companies present in the index are also running an active share buyback program, and when combined with the dividends, the “real” investor return does end up higher.

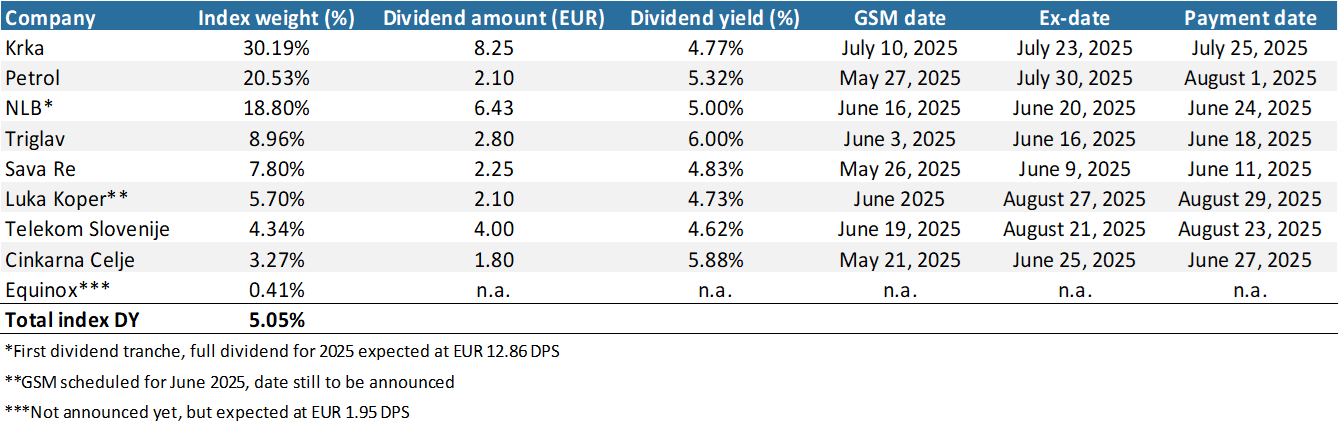

Slovenia

Slovenia has been known for years as a country in which companies return most of the value to shareholders through dividends (as opposed to Croatia, in which companies use a combination of dividends and share buybacks), as the laws in Slovenia are more prohibitive and lead to higher costs for share buybacks. This has led to another year of quite high dividend yields, most of which range between 4% and 6%.

Currently announced dividend information for Slovenia blue-chip companies (as of 5 May 2025)

Source: Companies’ data, LJSE, InterCapital Research

The highest dividend yield here is actually NLB, with one caveat. While the Group has recently announced a dividend of EUR 6.43 per share, this only represents the first tranche of its dividend payment, as has been the custom for years now. If we only look at this dividend, it has a dividend yield of 5%, but if we account for the 2nd tranche which should arrive later this year, the dividend yield (at the share price before the announcement) stands at 10%, or in absolute amounts, a dividend of EUR 12.86. The Group’s track record shows that one could expect such a second dividend payment later this year. One thing to note is that the Group has also announced that its search for potential M&As is ongoing, and if a large enough target or targets are found, the dividend might be reduced somewhat. However, no such information is present at this time.

Moving on to the rest of the companies, the “currently highest” DY is that of Triglav, with a DY of 6% at the share price before the announcement, or in absolute terms, a dividend of EUR 2.80 per share. The Group recorded recovery & improvement in its financials after the hit it took in 2023 due to the changes to supplementary health insurance, but more importantly, the floods that affected the region, primarily Slovenia, during the summer of 2023. As a result, higher levels of earnings were achieved, allowing the Group to also propose a higher dividend this year.

Following them closely is Cinkarna Celje, which announced a dividend of EUR 1.80 per share, with a DY of 5.88%. Given the recovery in titanium dioxide prices and expansion of volumes sold, the Group recorded an 80% YoY improvement in net income in 2024, allowing it to propose a good dividend with a solid dividend yield. Next up, we have Petrol, which announced a dividend of EUR 2.10 per share, implying a dividend yield of 5.32%. While the Group was affected by high costs of energy products in the last couple of years, the situation did improve in 2024, and while the net profit ended up only 2% higher YoY, lower costs of materials and better margins led to stable business operations, allowing it to propose the said dividend.

The next few companies, Sava Re, Krka, and Luka Koper, all recorded similar dividend yields, at 4.83%, 4.77%, and 4.73%, respectively. In dividend terms, the dividend proposed amounts to EUR 2.25 per share, EUR 2.10 per share, and EUR 8.25 per share, respectively. Sava Re did record improved business results this year, as many of the cost drivers present in 2023 (as it was also affected by floods during that year) did not materialize again in 2024. Luka Koper also recorded good results in 2024, and with continued investments and demand for its services, this is unlikely to stop going forward. Even current tariff uncertainty is unlikely to play that big of a role, as most of the trade present in the port is done between East Asian countries, especially China, and Slovenia as an intermediary for the EU market. Lastly, Krka continued to record sales growth across all regions, leading to a double-digit net income growth rate. While the Company was affected by the depreciation of the rouble (meaning its inventories in Russia, “lost” some value compared to the euro), the overall business result was enough to offset this, leading to an increase in the dividend amount paid this year.

Lastly, Telekom Slovenije recorded stable results in 2024, with improvements in top line and net income, also allowing it to propose a dividend of EUR 4 per share, implying a DY of 4.6%. The only company present in the SBITOP index to not announced a dividend is Equinox, although according to the Company’s Management, the results in 2024 are good, and they expect to propose a dividend of around EUR 1.95 per share.

Overall, the SBITOP index’s current DY stands at 5.05%, but if we account for the 2nd dividend tranche and the expected Equinox dividend, the DY of the index should rise to approximately 6%. Given the good performance of the index since the start of the year (still up app. 20% despite the recent drop caused by the uncertainty and the sell-off caused by the moves made by the US regarding tariffs), investors could expect good returns from Slovenian companies going forward, barring some event that would derail consumer sentiment strongly.

As a result, the SBITOP index remains one of the highest dividend-paying indices that one can currently get. The usual problems with the dividends, especially in Slovenia (high taxes), can be avoided if one invests in the total return form of the index, which reinvestments returns from the dividends and thus avoids the high taxation. However, investing in actively managed indices does involve certain costs, such as higher management fees, entry/exit costs, etc. As such, one of the best ways to benefit from both of these indices and their respective company performance is through passively managed ETFs, which have tiny fees compared to the actively managed ones, all the benefits of the total return indices (as ETFs that are currently available are all based on the total return versions of the indices). Such ETFs are currently available on the ZSE, LJSE, and, to a growing number, at the Bucharest Stock Exchange.