As of end December, total financial institution’s loans amounted to HRK 275.65bn, which represents a 5.9% increase YoY.

Croatian National Bank (HNB) published their monthly statistical report on loans placement of other monetary financial institutions. According to the monthly statistical report as of end December, total financial institution’s loans amounted to HRK 275.65bn, which represents a 5.9% increase YoY and an increase of 1.4% MoM. Such figures do indicate that Credit activity, especially certain segments, showed very solid resilience during the pandemic.

Its biggest categories household loans and corporate loans evidenced growth of 2.3% YoY and 5.3% YoY, respectively. In March corporate loans observed a monthly increase of 4.3% which arguably came on the back of higher demand for working capital loans and revolving loans. However, since then corporate loans have been observing a negative trend, recording MoM decreases. This trend was reversed in December, when they observed a 2.48% MoM increase. Corporate loans ended 2020 at HRK 86.28bn.

It is also worth adding that loans to central government witnessed sharp increase of 16.2% YoY to HRK 43bn, which was mostly evidenced with the beginning of the pandemic. To be specific, this relates to a HRK 6bn loan to the state (for Covid-19 support) which occurred in parallel to HNB reducing the required reserves for banks freed additional funds. Meanwhile, loans to local government amounted to HRK 6.5bn, representing an increase of 31%.

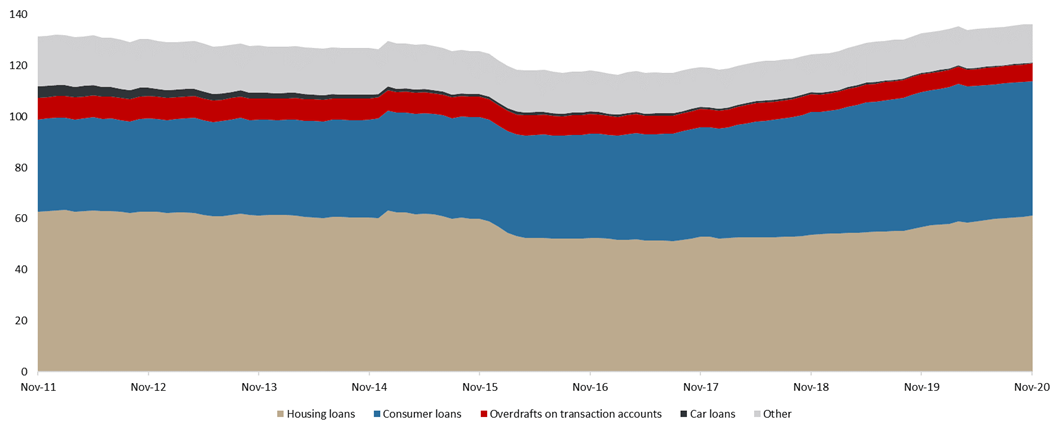

Total loans issued to households amounted to HRK 136.2bn, representing an increase of 2.3% YoY (or HRK 3.08bn). Such an increase was almost entirely driven by a rise in housing loans (+8.2% YoY or HRK 4.74bn). The second largest item within Household Loans, consumer loans, did eventually see a slight YoY decrease of 1.3%, or the highest absolute YoY decrease of HRK 689m. We note that these two items account for 84% of the total Loans to Households.

The largest relative YoY drop was witnessed in car loans (-24.2% or HRK 129.5m). This does not come as a surprise, given the low car sale trend which has been observed throughout this year.

Loans to Households (HRK bn)

Source: Croatian National Bank, InterCapital Research

If we were to compare total loans issued to households since the beginning of the pandemic, one can notice a slight increase of 0.6% or HRK 823.8m. Such an increase could mostly be attributed to a still solid performance of housing loans by 5.7% or HRK 3.34bn, which was partially offset by a 3.2% decrease in consumer loans (or HRK 1.73bn). We note that this loan segment has once again seen a MoM decrease (which has been the trend throughout most of the pandemic). On the flip side, housing loans continue recording MoM increases, with the exception of April (lockdown period), when housing loans observed a 0.6% decrease.

Structure of Loans to Households (December 2020)