After last week’s brief look into the price and market dynamics of gold and silver, today we turn to a more philosophical question concerning these two precious metals. Historically, gold and silver have shared a close relationship—in their usage, perception, and in the final products derived from them. However, the recent divergence from historical gold-silver ratios may prompt us to ask whether this relationship still holds, especially in a time when more than half of silver demand comes from industrial uses. Is silver, gold’s “close cousin,” beginning to chart a course of its own?

When investors explore the commodity universe in search of metals to allocate capital to, they often face a choice between precious metals like gold and industrial metals such as copper or aluminum. The final decision typically hinges on macroeconomic developments and investor expectations about the direction of the economy. But there is one metal that bridges the best of both worlds: silver.

It’s hard to start any analysis of silver without looking at the gold market, yet increasingly difficult to examine it without factoring in the broader state of the economy. At times, it seems as though a single silver futures contract is a hybrid—a blend of both gold and copper contracts merged into one.

Looking at this year, we see again that many of the same forces driving gold—financial stress, interest rates, inflation expectations, and policy decisions—continue to influence silver. Still, despite its industrial utility, silver remains a precious metal: long regarded both as an investment and as a favored material for jewelry, coins, and other keepsakes. Moreover, with silver currently priced nearly 90 times lower than gold—whether we’re talking bars or coins—it presents a more accessible investment option for the wider public, especially as gold trades near record highs.

On the other hand, silver’s growing resemblance to industrial metals like copper stems from its expanding use in manufacturing. Another link lies in how silver is mined: more than 25% of silver production comes as a by-product of copper mining, meaning that developments in the copper industry often spill over into the silver market. Of course, this doesn’t mean silver will start mirroring copper—or vice versa—if investor perception shifts entirely toward viewing silver as an industrial metal. Rather, it suggests that similar macro or supply-side factors could push both metals in the same direction. A good example came just last week, when news of heavy copper tariffs sparked a 15% price surge in minutes, while silver remained flat.

While we described silver as a bridge between precious and industrial metals, it would be a mistake to view it purely through the lens of other metals. Like any other asset, silver is shaped by its own idiosyncratic events. In addition to tracking gold and copper price trends, any meaningful silver analysis must consider the growth trajectory of industries that heavily consume it, ongoing supply-demand deficits, and even the potential formation of central bank reserves (as recently hinted at by Russia).

In any case, it will be fascinating to observe how silver prices respond—if and when the current wave of central bank gold buying begins to slow—and whether, in a broader risk-on environment, silver starts to behave more like an industrial metal. Only then might we be able to assess whether silver continues to take its cues from gold—or whether the two “close cousins” begin to part ways, with silver heading toward an industrial market identity, or perhaps carving out a path uniquely its own.

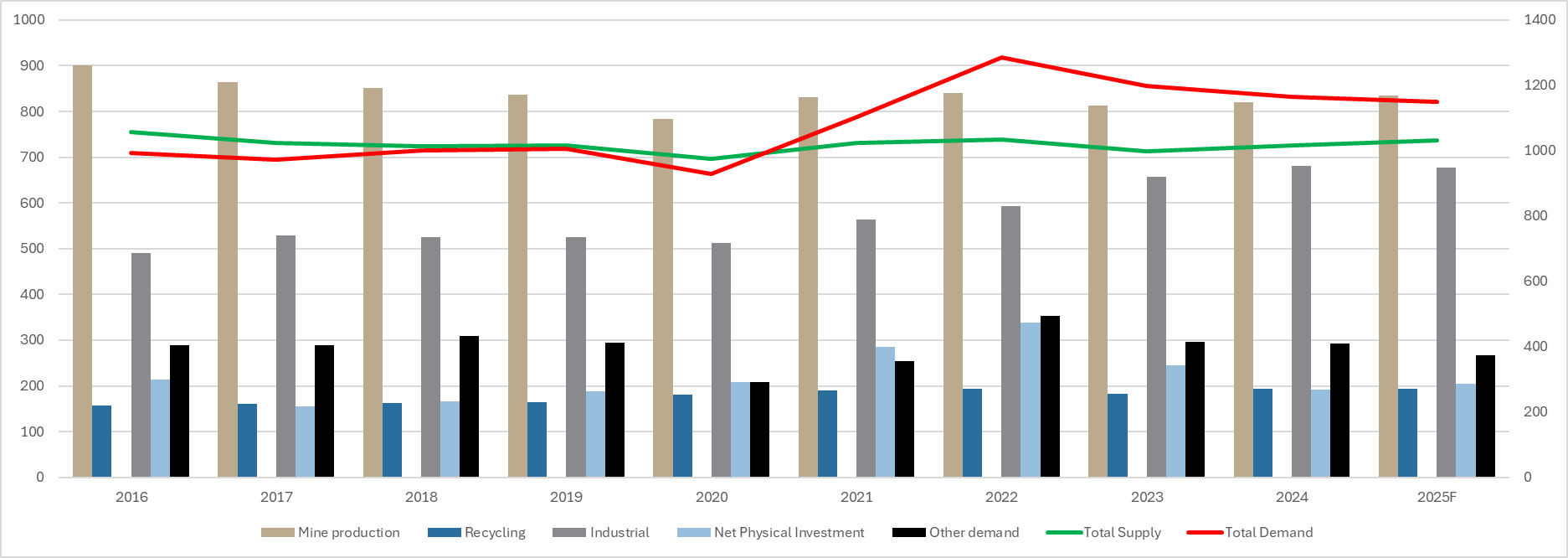

Silver supply and demand (million ounces)

Source: The Silver Institute, InterCapital