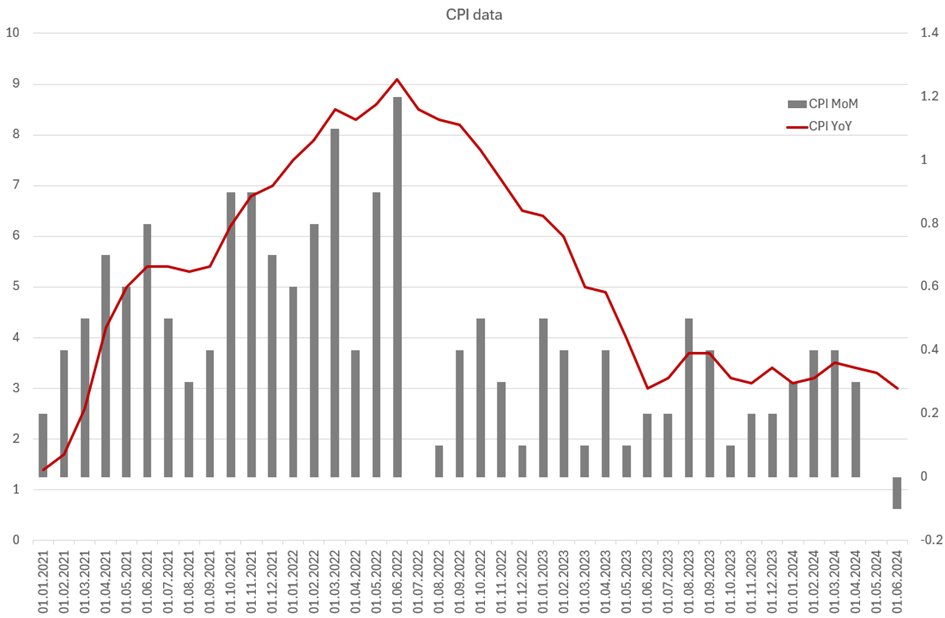

Last week, the Consumer Price Index (CPI) for June 2024 came in at 3.0%, which was 0.1% lower than the consensus forecast. The last time we saw CPI readings at this level was in June 2023, exactly one year ago, when inflation was declining and moving towards the 2 percent target. Over the past year, the CPI has remained between 3.0% and 3.7%, stubbornly refusing to come back down near the target.

It’s important to note that the CPI month-over-month (MoM) data showed a decrease of 0.1%. This negative change hasn’t been seen since May 2020, shortly after the onset of the pandemic. To provide some context, in the last June, when the CPI was at 3.0%, the MoM CPI was at 0.2%. From a mathematical standpoint:

- A 0.2% MoM change over one year equates to a 2.4% change in year-over-year (YoY) terms.

- A -0.1% MoM change over one year equates to a -1.2% change in YoY terms.

In hindsight, it wasn’t evident last June that the CPI would continue to decrease. Now, let’s focus on this July.

- If we project using the last MoM data, it suggests a movement toward -1.4% in YoY terms.

- If we consider the average of the last two MoM data (-0.05%), it suggests a movement toward -0.6% in YoY terms.

- If we take into account the average of the last three MoM data (0.2%), it suggests a movement toward 2.4% in YoY terms.

All in all, it seems like it is much safer today to bet on lower CPI readings next month and the continuing cooling down of CPI data.

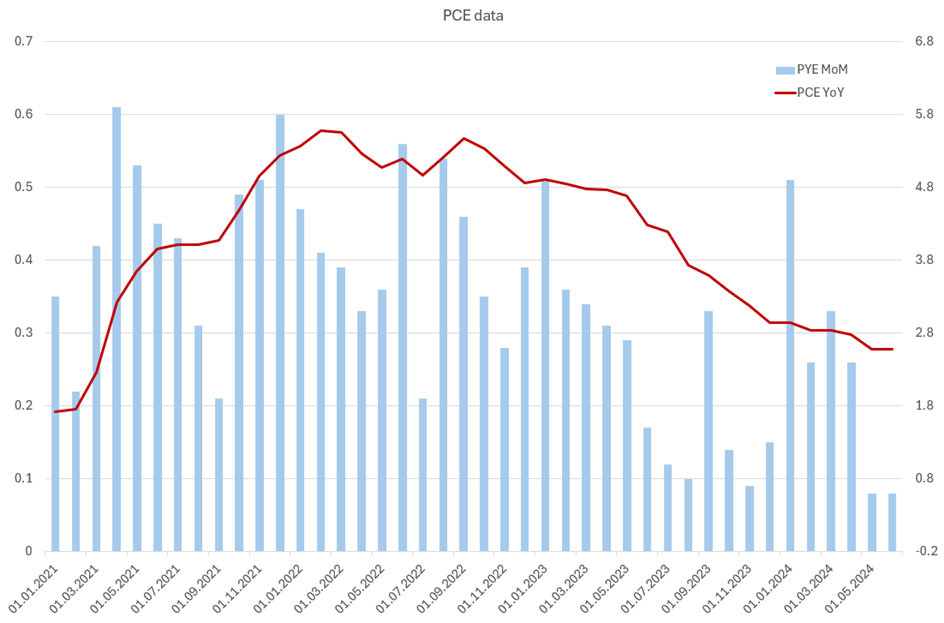

PCE data has continued to decline and is currently at 2.57% YoY and 0.08% MoM (which is equivalent to 0.96% on a YoY basis if it remains at that level).

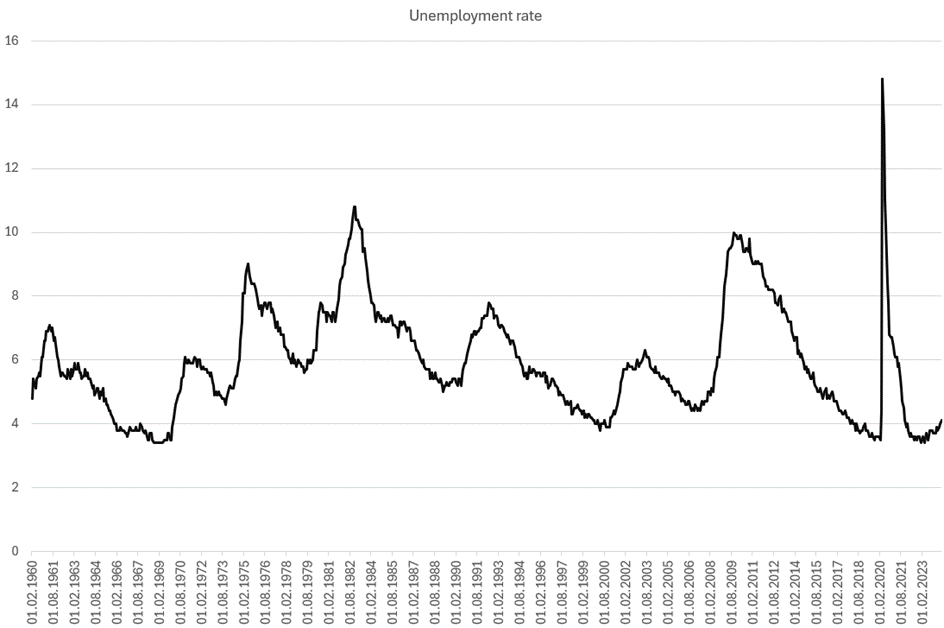

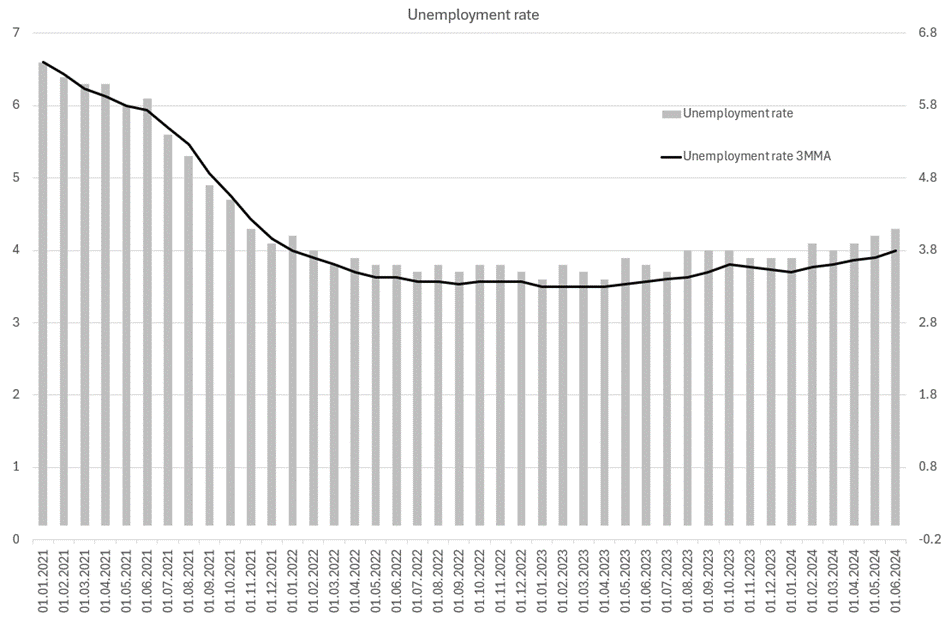

Because the Fed has a dual mandate, or to be precise „two goals of price stability and maximum sustainable employment“, let’s look at the Unemployment rate.

At the beginning of last year, we reached a record-low unemployment rate of 3.4%, a level not seen since 1969 – the year the last good Ford Mustang was produced. However, over the past 18 months, the unemployment rate has increased and currently stands at 4.1%. The 3-month moving average of the unemployment rate is at 4.0% and has increased by 0.44% over the last 12 readings. It’s uncertain whether the Sahm rule will be applied in the next few readings.

The Sahm rule „signals the recession when the 3MMA of the national unemployment rate rises by 0.5 percentage points or more relative to its low during the last 12 readings“.

The market is currently anticipating slightly more than 2.5 interest rate cuts by the end of the year in the four remaining Fed meetings of 2024, especially with the upcoming elections in November. The data for next month is expected to be crucial.