In the last three weeks, we have witnessed a significant drop in yields across the globe due to renewed recession worries. The greatest risk of recession lies in Europe and German yields reflected that. Bund yield fell from 1.92% in mid-June to this week’s low 1.12%, meaning it fell by 80bps. In this brief article, we are looking at the drivers of such a move and what to expect in the summer lull.

Only three weeks ago, yields across the developing countries were jumping through the roof as inflation worries were predominant in the market while central banks pushed their hawkish stance forward with the Fed hiking by 75bps, the first time since 1994 while ECB announced it could hike stronger if needed. UST 10Y jumped to 3.50% while the most interesting move was seen in Europe where its EUR 10Y benchmark overjumped 1.90% level while Schatz yield stood above 1.20% on June 16th. Furthermore, BTPs 10Y yield skyrocketed to 4.30% level, with spread versus bund touching 250bps. However, spreads were once again closed by ECB which announced a new tool that should be used for anti-fragmentation.

As we saw several times this year, once inflation worries jump, bond yields go higher, and central banks react. But then we get some economic data that starts slowdown or recession worries which drive investors to pour some money into safe-haven assets. Also, investors start to question whether central banks will be able to deliver all the hikes calculated as recession could be coming and that cycle repeated several times this year. When you combine this narrative with very low liquidity on bond markets which seem to be broken you get 200 pip moves in bund being quite normal. For example, on Wednesday we saw bund going from 151.0 to almost 153.0 in only a few hours before solid ISM service numbers from the US pushed it 100pips in a matter of few minutes and below 151.0 the next morning.

When thinking about the extreme volatility in rates markets one should only look at the oil forecasts or tails risks that two big banks stated in their sell-side research recently. Namely, one of them said that in case of a total embargo from Russia, oil could hit USD 360 per barrel while another one says that recession could push WTI towards USD 60 per barrel! This represents the current situation in the financial markets where one camp is saying that recession is inevitable which will push commodity prices and inflation down, with central banks halting their planned hikes and yields would then once again fall towards the lows. On the other side, there are investors thinking that recession could be avoided or that it will be shallow but with heightened inflation rates that would force central banks to continue with the tightening of the monetary policy. I simplified the reasoning but that is only to get the picture of how far apart are these two camps. There are many different camps, and each new information is calculated with a bias depending on which camp you prefer.

Talking about commodities, in the last several weeks we have seen significant depreciation of copper and aluminum while wheat prices also followed. Also, this week we have seen WTI once again below 100 USD per barrel as investors price recession more likely than before. In the following weeks, we see volatility not falling due to the summer months as investors are kept on their feet with the extremely tough year and we think that yields could once again go higher before we see firm signals from inflation decelerating. The weakness of the commodity complex could be the first hint in that direction, but services are still holding their ground.

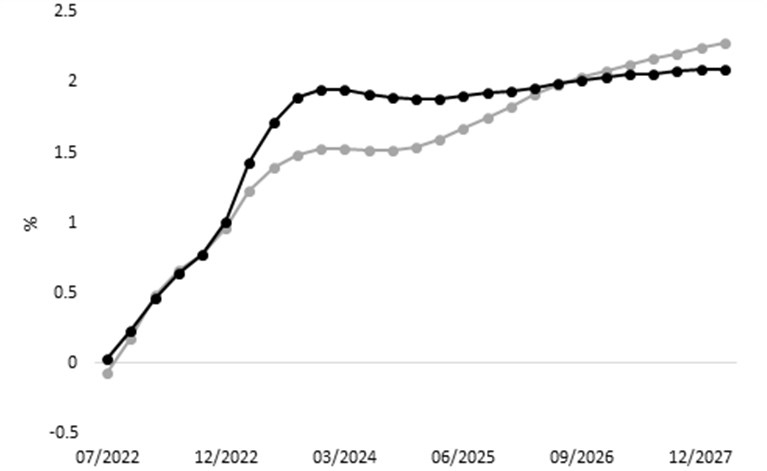

Chart. Euribor 3M

Source: Bloomberg, InterCapital