In the last few weeks, we have seen that jump in volatility is not the feature of equity markets only. Namely, sovereign yields around the world increased rapidly and surprised many investors. Central banks reacted on the sharp increase although some of them (Fed) seem to be reluctant doing more than just saying that they will not tighten its policy soon. In this article we are looking at the drivers of the surprising yield jump and what to expect further.

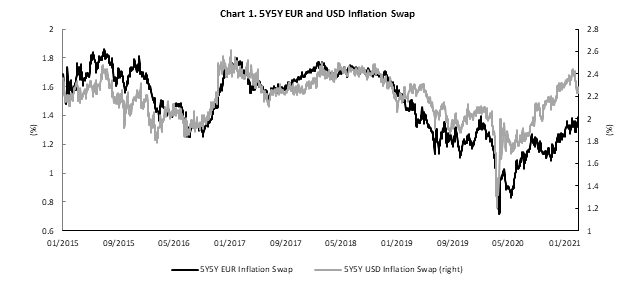

In December 2020, it seemed like both ECB and Fed could go on autopilot for the 2021, keeping their reference rates at the bottom and continuing with their asset purchases. In December inflation was already a hot theme as there were camps saying that massive fiscal stimulus in US could drive inflation much higher than 2.0% while other camp was saying that we could only see short-term bump in the second quarter of 2021 and then back to inflation being subdued. However, inflation expectations in US kept rising strongly and one of the most famous measures (5y5y inflation swap) overjumped 2.40% in the beginning of February, the level last time seen in beginning of 2018. On the other side of the Atlantic, EUR 5y5y inflation swap reached 1.35% which is still way below 2020 levels of 1.80%.

Source: Bloomberg, InterCapital

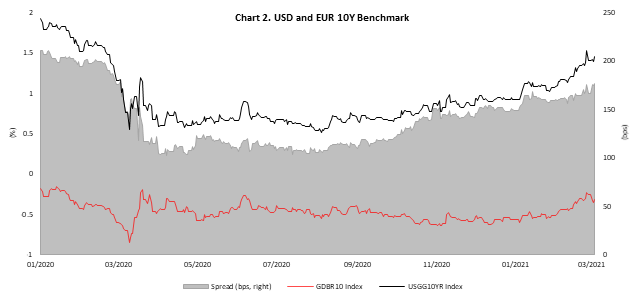

Two months ago, at the beginning of 2021, 10Y Treasury was still below 1.0% but after the Democrats confirmed their victory in Georgia on January 5th, markets started to price large fiscal stimulus and 10Y yield increased by 20bps in a matter of a week and traded in a range of 1.0% and 1.20% for a whole month. However, on February 17th US retail sales data took investors by surprise as January they increased by more than 7.0% compared to the same month last year. After mentioned release, sell-off of treasuries accelerated as investors were calculating whether large fiscal stimulus, increase of savings and better than expected vaccine efficacy (which should accelerate opening of the economy) could pull inflation to the much higher levels than previously anticipated. Besides all the above-mentioned factors, investors’ expectations on Fed’s rates changed, meaning that at the moment market prices that Fed could hike its rates sooner than expected, i.e. already next year.

US Treasury yields continued to climb in the end of February despite Jerome Powell’s comments on his semi-annual testimony on which he stated that “the economy is a long way from our employment and inflation goals and is likely to take some time for substantial further progress.”. Furthermore, Fed’s governor said that inflation could overjump 2.0% in the short term and Fed will not blink an eye as they do not expect elevated levels to be with us for long, reminding the committee that we did not have high inflation for the last 40 years.

Nevertheless, on February 25th sell-off went full-on, with US 10Y rising from 1.37% at the open to above 1.60% intra day before closing at 1.52%. Main driver of such an abrupt selling was that on the same day, auction of 7Y UST had the lowest bid to cover ratio on the record and primary dealers had to take almost 40% of total auction. Since then, US 10Y yield stabilized to 1.40%-1.45% range although it still seems like it has room for rising once again.

As USD yield curve bear-steepened, EUR curve followed. As shown on the chart 1. inflation expectations surged in US while EUR 5y5y is still below the levels seen in the beginning of 2020 which seems reasonable due to several factors. European Union’s fiscal stimulus was way smaller compared to package in US, GDP gap seems to be bigger and 2019 GDP could be reached only in 2022 compared to 2021 in US while euros strength is another headwind for eurozone’s inflation. Despite all said, EUR curve bear steepened as well and on February 25th 10Y EUR benchmark reached -0.20% compared to -0.55% in the beginning of 2021. The main difference between Fed and ECB on the matter of this sharp increase of yields was that ECB’s officials were very loud and clear saying that such a tightening in EUR long dated rates is not desirable in this recovery phase which stabilized EUR curve. On February 26th EUR 10-30Y spread tightened, most likely as a result of ECB buying more long-dated papers under its flexible PEPP program. Because of ECB’s message, this week yields on both sides of the Atlantic seem to be stabilized after several weeks of rising. That could be seen on implied volatility on treasury futures options which in the end of February rose to the levels last time seen in March 2020 and are now back close to their multiyear average although still being a bit elevated.

So, where do we go from now? It seems that ECB will not let yields and spreads to rise, especially at a pace seen in February and they will use its PEPP program in any way they see it appropriate while they could also increase the envelope furthermore (EUR 1.850bn at the moment). Despite we expect inflation to continue rising in Europe due to base effects at least, which would then decrease real yields, we do not expect EUR nominal yields to increase much this year even in case USD curve starts rising once again. On the other side, we easily see USD curve bear-steepening further due to all the factors mentioned before but also due to central bank neglecting inflation in the long run. Although we expect inflation in US to calm after the base effects (in 2022), markets could react violently once again when they see inflation at 3.0% or 4.0%, calling central bank to step in.

Source: Bloomberg, InterCapital