Last two weeks we witnessed significant safe heaven demand as equity markets are seeing bear markets and investors price recession. Yields on US treasuries fell strongly while bund trading was mixed due to hawkish comments. In this brief article, we are looking at the most recent macro news and consequences for bond markets.

On May 9th, yield on US10Y paper went up to 3.2% as bond investors threw the towel as inflation kept rising and Fed kept increasing its hawkishness. However, only two weeks later, yield on the same paper stood at 2.70% i.e., 50bps lower as fear of recession started to push investors into safe heaven assets such as US treasuries. This week we saw several high indicators showing that economic slowdown is already here while new home sales was the largest miss with 591k new sales (annualized) versus 748k expected and 763k in March. One should not be surprised with slower home sales as the monthly payment for an average home increased from USD 1.245 in 2021 to USD 1.991, reflecting an increase of 60%.

For the last few months, the rhetoric on the market was clear. Fed will be tightening monetary policy as long as inflation numbers are way off their target of 2.0% or until financial markets are not showing any signs of weakness (Fed put). Equity indices were falling, and bonds were falling together with them. However, below 4.000 level for SPX index, it seems that a negative correlation between equity and US treasuries is here once again as investors bet that Fed’s put is close and that Fed will not be able to lift rates as much as markets calculated once the economy tanks in recession in this or next year. All in all, investors poured their money into US treasuries for the last two weeks and 10Y paper is almost 50bps below highs while 2Y paper currently yields 2.50% versus above 2.80% in the beginning of May. Also, it is worth noting that this week we saw a comment from Atlanta Fed Raphael Bostic who said that a pause in rate hikes in September might be justified while Esther George said that after the Fed pushes rates to 2.0% in August it could see inflation decelerating. In case inflation does not decelerate as both Fed’s doves hope for, Fed will most likely have to hike its rates much higher which would lift yields and harm the economy and push investors in bonds and so on.

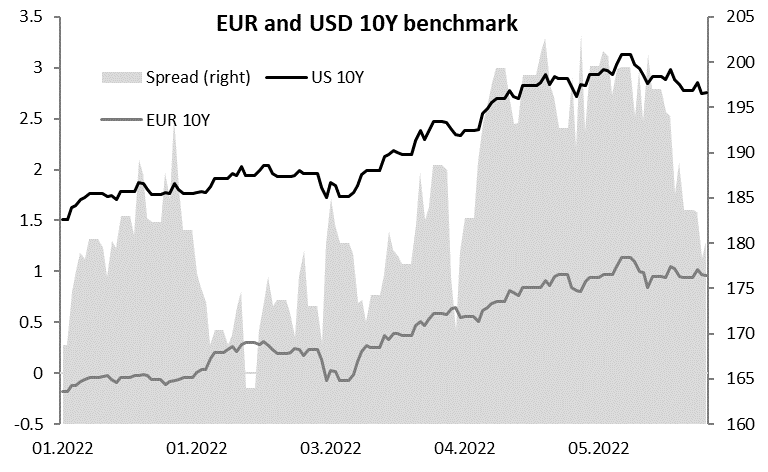

On the other side of the Atlantic we have seen a bit different picture as it is 2021 once again. Namely, ECB’s officials started to communicate way more hawkish than before as inflation in Europe is even more “scarier” than in US due to the energy embargo. Klaas Knot said that 50bps hike in July is not off the table while French governor said that rate hikes in both July and September are very likely. Also, Ms. Lagarde in one of her speeches this week said that rates are expected to be at zero or slightly above until the end of third quarter of 2022. To see how central banks’ stance changed in just half a year period, see Ms. Lagarde’s presentation after the last monetary policy meeting in 2021 on which she said that lifting rates in 2022 is highly unlikely. So, one should not be surprised if markets do not believe ECB’s governor once she says that lifting will be gradual and there is some pricing in June’s hike also. On their recent comments, the market reacted as one would expect, yields on short-term papers went up while they finally managed to lift EURUSD rates from its lowest level in years. Looking at the spread between EUR and USD 10y benchmarks one could see that bund trading was quite unclear compared to US papers, as spread tightened by almost 20bps. Nevertheless, very high levels and strong risk-off sentiment eventually managed to push bunds a bit higher in price, meaning that yield went below 1.0%.

Source: Bloomberg, InterCapital