Yesterday’s ECB meeting and the accompanying press conference were uneventful and did not generate any movements in the German yield curve. More important for the spread between 2-year and 30-year yields in the past couple of weeks were events in the US, mainly those connected to the US elections.

After the Governing Council of the ECB decided to keep the three key ECB policy rates unchanged, President Lagarde, at the following presser, did not offer any insight about the timing of the next cut and was pledging data (not data point!) dependence and a meeting-by-meeting approach. She has also said that the decision on September remains wide open, although it seems that the current baseline is a September cut, provided that the upcoming inflation prints align with their forecasts, which she has acknowledged is currently happening by saying how the incoming information supports their previous assessments.

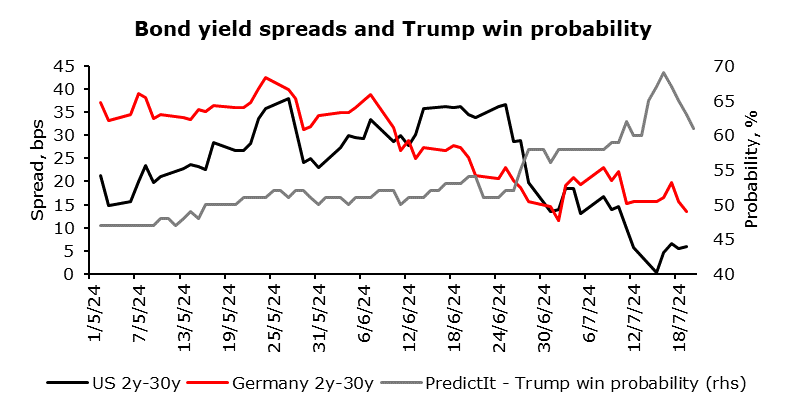

Examining the changes in the spreads between 2yr and 30yr bonds in Germany and the US reveals that the US curve has steepened around 35 bps in the past three weeks or so while the German curve has steepened as well, albeit by a much smaller amount, namely less than 10bps. The first catalyst was the debate held on the 27th of June, which, according to PredictIt, increased the likelihood that Trump will secure the win in the elections by 6%, bringing it to 58%. The second catalyst stemming from US election odds was an assassination attempt at a rally on the 13th of July that has raised the precepted odds of Trump replacing Biden. This higher prospect of a Trump 2.0 presidency affected the yield curve from two sides. First, the short end’s yield was downwardly pressured by the perceived influence that Trump might try to exert on the Fed, wanting them to lower rates. Second, the long end’s yield was upwardly pressured by Trump’s stance on taxes and the prospects of higher fiscal deficits that will need to be financed through longer-term coupon issuances. Of course, a significant part of that yield curve steepening was influenced by contributory US data, most notably higher unemployment (now at 4.1% ) and lower CPI reading. This positive information made the investors more confident that the Fed is going to start cutting soon (pricing 2.5 cuts by the end of the year), which is a positive signal for steepeners given that cuts mean lower rates and in this environment the re-emergence of the term-premia is expected to occur.

Returning to Germany and the EU, it seems that there were no spillover effects from the prospective Trump presidency. If his perseverance on the stance on Ukraine and NATO members’ spending on defence as a share of GDP remains in place, some extra financing is likely to be needed, affecting the long end of the Euro curve via elevated supply and higher term-premia. To summarize, with the cutting cycle already on the way, providing a further impulse to steepening of the EUR benchmark curve, and with political spillovers from the US, we believe that there is still some value left in playing the upcoming events through the steepness of various parts of the German yield curve.