Chinese New Year would take place on February 1st and according to the Chinese zodiac, the year 2022 is going to be the „year of the tiger“ (last one has been the „year of the ox“). This particular sign is characterized by competitive and unpredictable traits, while US edition of Reader’s Digest associates the sign with the maxim „go big or go home“. Coincidentally, Croatian Ministry of Finance is expected to place a local bond around the same date. Who’s going to go big on the new bond, and who’s going to go home? Read this brief research piece to find out what people in the know already know.

Croatian Ministry of Finance has two bonds maturing in the coming ten days – CROATE 0.50 02/05/2022 (EUR-denominated, 500mm EUR, maturing on February 05th) and CROATE 2.25 02/07/2022 (HRK-denominated, 3bn HRK, maturing on February 07th). The two combined result in a 900mm EUR refinancing need. Local business journals have already started whispering about an 8Y EUR-denominated bond (probably with RHMF-O-302E as SKDD designation) in size of roughly 1bn EUR. Now let’s see where would we price this paper.

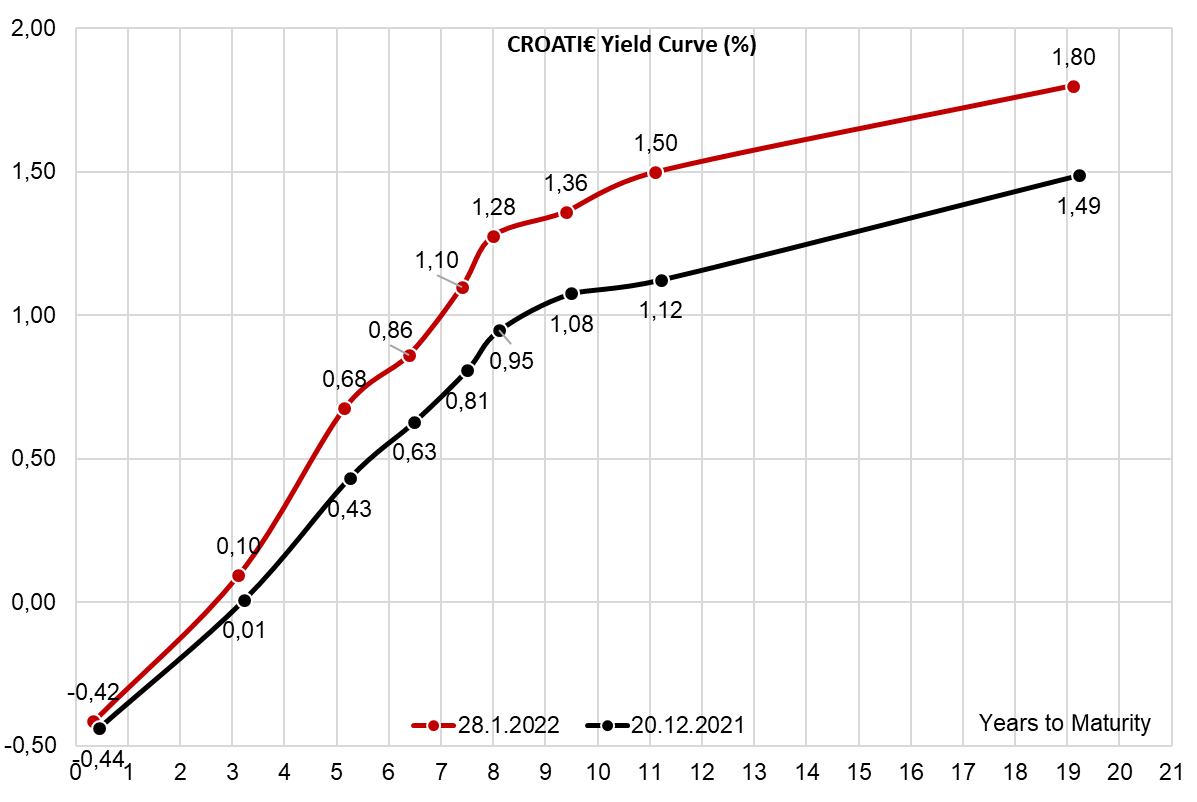

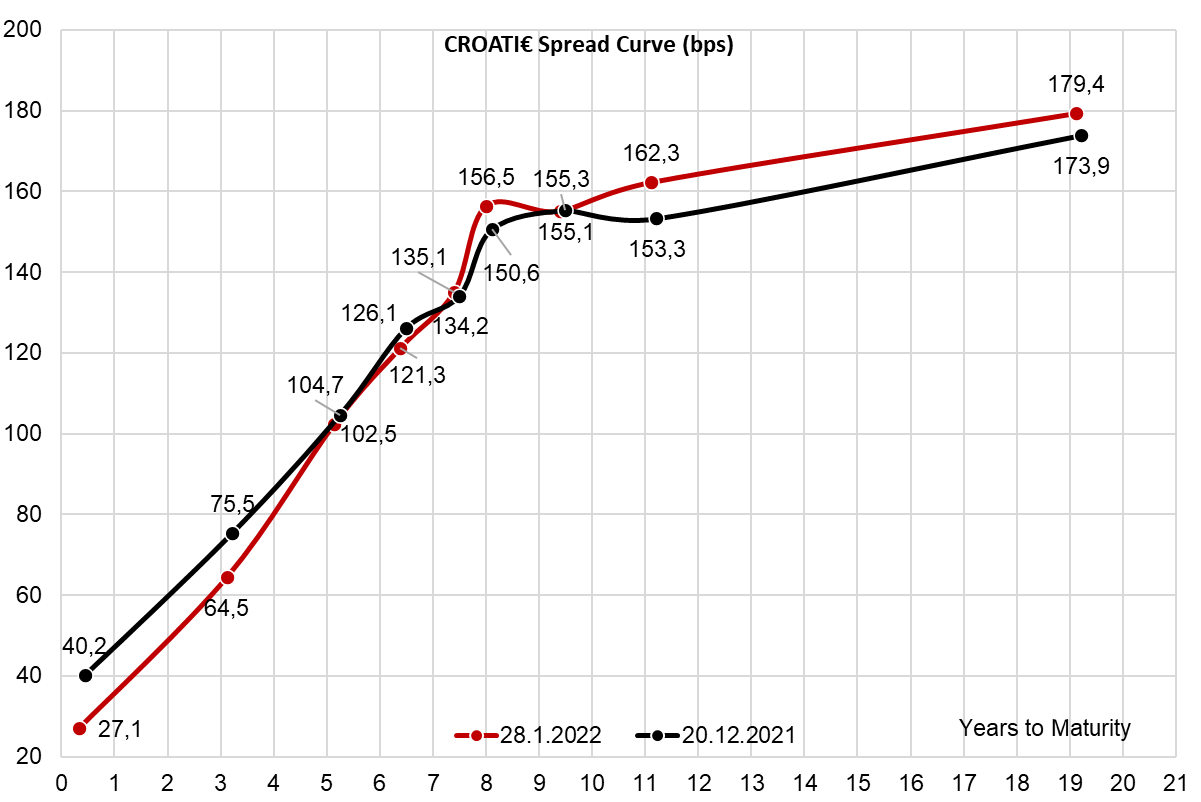

First of all, it’s obvious global rates made a move up month-to-date, driven primarily by elevated inflation prints and FED’s apparent change of reaction function. In a nutshell, Jerome Powell figured out that if the inflation is not transitory, then his second term at the head of FED might be really transitory. At his confirmation hearing, he started delivering hawkish rhetoric, which was further supported on this Wednesday’s FOMC where it became clear the FED is going to hike as soon as mid-March, and the hiking pace in the following months might look more like an elevator, instead of the escalator. This torpedoed the US 2Y YTM @ 1.20%, however, recent US GDP print highlighted the sharp rise in US inventories (it’s plugged into the investment component of GDP). This is starting to look like stagflation, but let’s leave the complicated stuff for the future and stick to the yield curve. If RHMF-O-302E was an international bond instead of a domestic one, the yield to maturity would probably go to 1.30% on the market maker’s bid side (1.28% mid market – 8Y point on the red line). We expect the new local paper to trade at similar levels, meaning that anything between 1.20% to 1.40% is conceivable. But 1.30% YTM is basically our headline figure.

The final YTM print is certainly going to reflect supply and demand and there are some things related to bond flow that are worth considering. Looking at the top ten holders of the maturing CROATE 0.50 02/05/2022 and CROATE 2.25 02/07/2022, one could see that the central bank has 190mm EUR on its balance sheet and we doubt this would be rolled over since bonds maturing last summer were not rolled over as well. This effectively means the Ministry of Finance would have to find new marginal buyers for these 190mm EUR. But where could they find them?

The pension funds have been gradually reducing their exposure to bonds because of the stubbornly low yields – they’re not selling them, but they have abstained from becoming big buyers. With UCITS funds aversion to domestic bonds because of the vivid memory of March 2020 illiquidity, the only ones left are basically insurance companies and banks. The latter is worth looking at more closely.

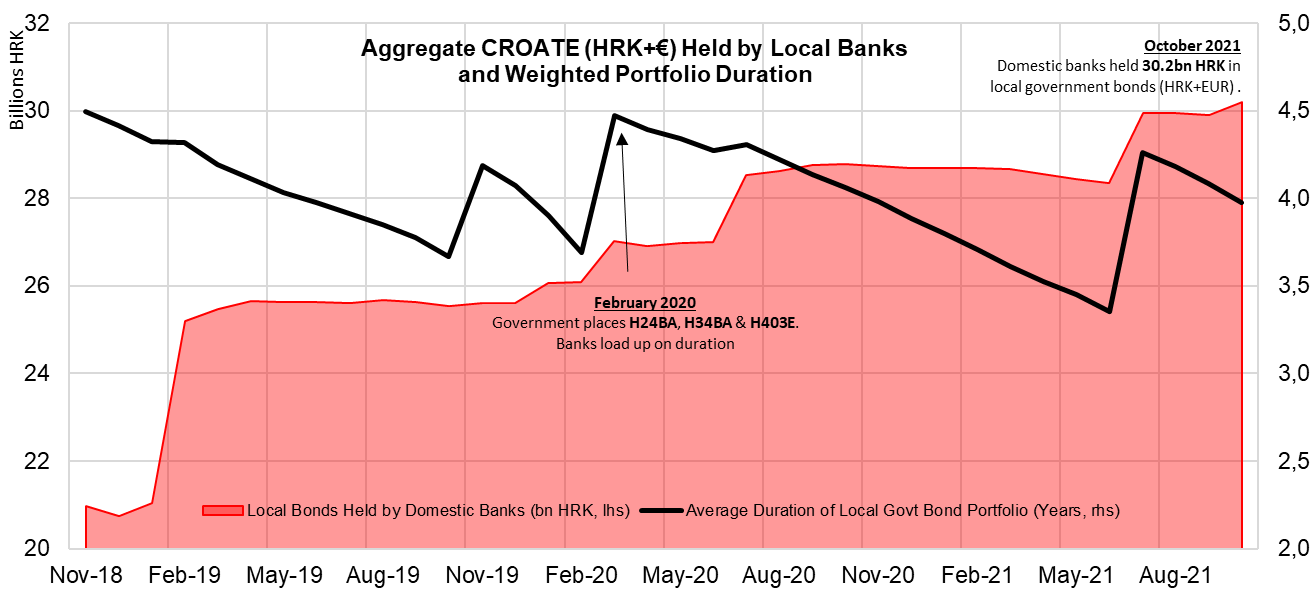

In October 2021 banks had an aggregate balance sheet of 500.7bn HRK (66.5bn EUR) and 53.4bn HRK (7.1bn EUR) was invested in fixed income securities. A lion’s share of the fixed income portion is held in Croatian local bonds – some 56.5% (30.5bn HRK out of 53.4bn HRK) and notice that this doesn’t include treasury bills. Banks have been increasing their holdings of government bonds since at least November 2018 and in the meantime, their holdings grew from 21.0bn HRK to the current value of 30.2bn HRK. Once again – these are just local Croatian government bonds and this figure doesn’t include treasury bills. We found our marginal buyer.

But wait, isn’t 8Y duration a big long for banks’ ALMs? We do not agree – the black line on the chart above demonstrated the weighted duration of banks’ local Croatian bond portfolio and we can see that it’s usually between 3.5 years and 4.5 years. And yes, you guessed it – the spikes in average weighted duration are local bond auctions, which are used by banks to extend the duration. For instance, in summer 2021 banks bought a total of 5.2bn HRK of the new CROATE 0.50 07/05/2028, which at a time had a duration of seven years.

There might be more to this story. On March 23rd 2020 the central bank decided to cut the reserve requirements from 12% to the current 9%. What was the net effect? In February 2020 the banks had 76.4bn HRK deposited with the central bank and by end-March this figure dropped to 67.8bn HRK (-8.6bn HRK). The difference went into other compartments of the balance sheet and deposits held at financial institutions got a 2.8bn HRK raise. It seems that reserve requirements at 9% are still relatively elevated compared to euro area figures, so more cuts could be expected along the line. Yes, you guessed it – that effectively means more cash being held on bank accounts, which would incur at least 50bps annual cost once Croatia becomes part of the euro area.

Banks know how the game works. Cash is trash and more trash is coming on their balance sheet. Therefore bank bids on the primary market might be quite substantial this time around.