Last week, I wrote about the concept of time and highlighted the number 60—specifically how one minute has 60 seconds and one hour has 60 minutes, among other examples. The Sumerians in ancient Mesopotamia developed a base-60 numeral system that has been passed down through the ages. Today, we utilize various numeral systems, such as base 2 for computers and base 10 in everyday life.

We are accustomed to the significance of the number ten, primarily because we have ten fingers, making it easy for children to count and center their understanding around the number 10. However, the number 60 holds its own special importance. When the money system was being developed around 3000 BC, pricing something like 13.37 would present challenges. For instance, if someone paid you 20 units of currency, returning the exact change of 6.63 would be difficult. To do so, you would need many small denominations, like 0.01 units, which wouldn’t hold much value. Since they didn’t have machines to produce coins, they had to be clever in their approach. They chose the largest “small” number that had the most divisors, which is 60. This made transactions more manageable and practical in their economy.

Divisors of the number 60 are: 2, 3, 4, 5, 6, 10, 12, 15, 20, 30.

Divisors of the number 10 are: 2, 4, 5, 10, 20, 25, 50.

In today’s financial system, it’s not easy to take one-third of the value of something because there isn’t a coin that represents a third. Even if you argue that you could create such a coin, it wouldn’t be represented as the sum of smaller coins. With advancements in science and our understanding of time, it makes sense to divide time into 60 smaller periods and then combine them to create larger periods.

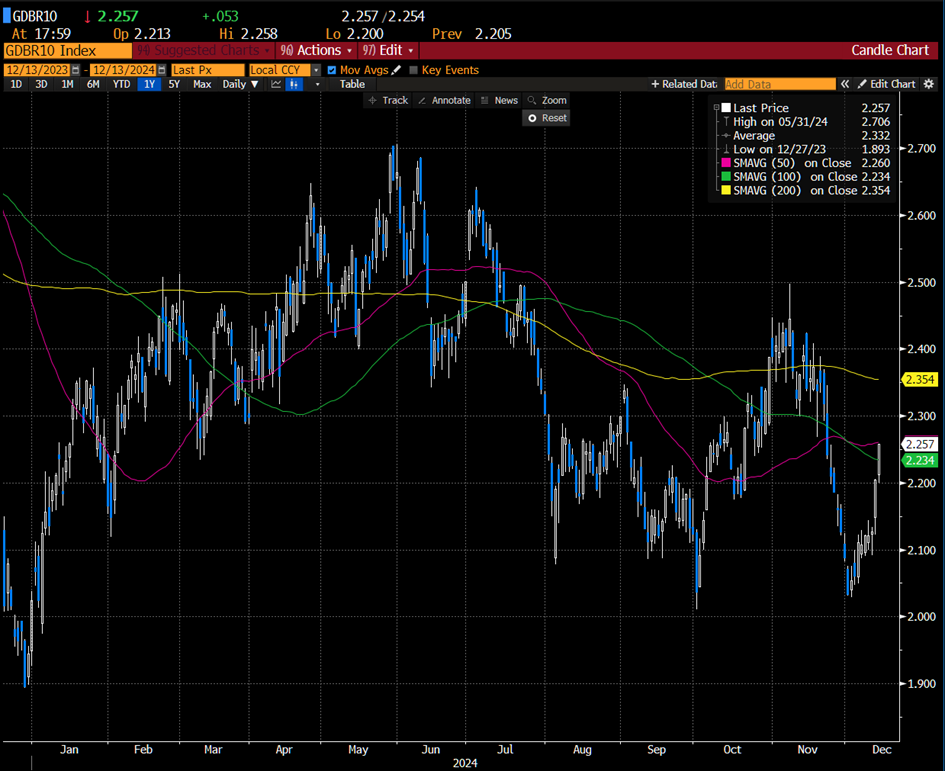

Now, let’s return to this year. It began with the Federal Reserve’s unusual course of action and market expectations for interest rate cuts, initially predicting seven cuts during 2024. After a strong December last year, yields began to rise, peaking at the end of May. Instead of the expected seven cuts, by the end of April, the market had adjusted expectations down to just one cut. As it stands now, it looks like we will end up in the middle with four cuts.

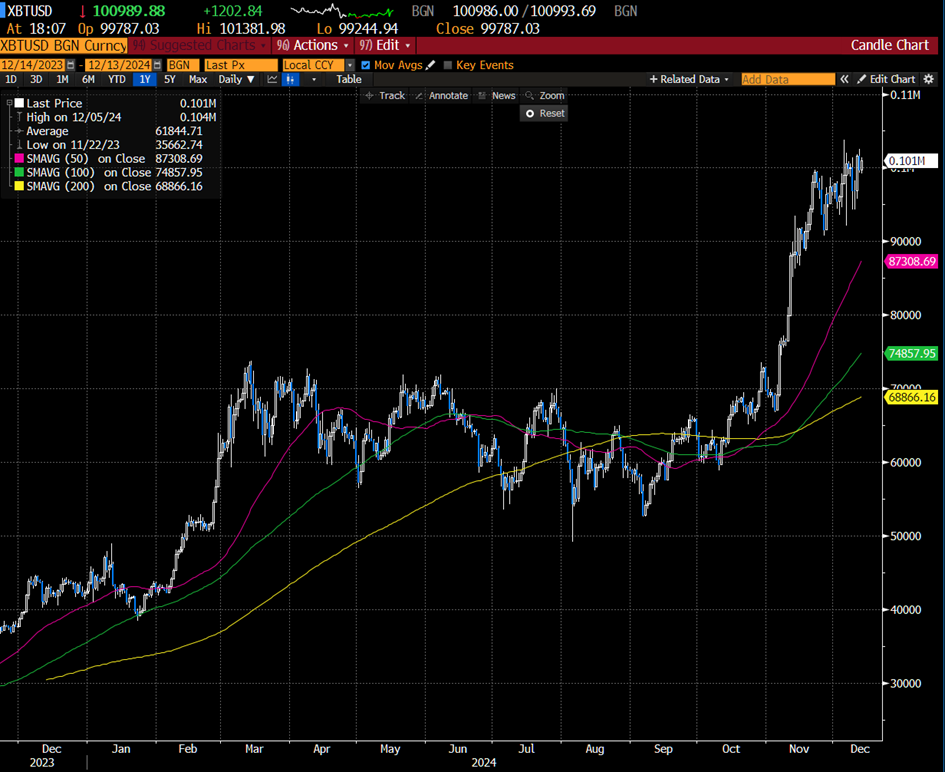

Data was a significant focus at the beginning of the year as we awaited every Non-Farm Payroll (NFP) and Consumer Price Index (CPI) report, which were major drivers of the market. However, during the summer, as CPI growth slowed and central banks began reducing interest rates, the market’s attention shifted away from data. With presidential elections approaching, what would happen after the vote became the primary concern. Eventually, Trump won the election, and a rally in both bitcoin and equities began.

As of now, yields on Bunds and the US 10-year Treasuries are approximately 15 basis points higher than at the start of the year, experiencing some intra-year volatility, but it is certainly not shaping up to be a favorable year for fixed income.

Source: Bloomberg, InterCapital

Equities continue their rally that started in 2013, with a remarkable year-to-date increase of 27%. I recall being in London in April at the JPM Conference, where most attendees anticipated that the S&P 500 would close below 5,000. As I mentioned last week, equities can experience rallies lasting over 20 years without major corrections, so I would advise caution with “short equity” strategies simply because we are at all-time highs or because they appear “overpriced.”

Source: Bloomberg, InterCapital

In May, we witnessed the GameStop mania, featuring Roaring Kitty as a central figure. I have previously discussed this period, which proved to be very profitable for those trading implied volatilities. At the end of June, we experienced some turbulence in France due to new elections, which caused Bunds to go on a roller coaster ride.

The main event this summer occurred at the beginning of August when the VIX exceeded 60 for the first time since the pandemic. Equity markets experienced a significant but brief correction. We observed a substantial exit from the yen carry trade and reached yearly lows in bond yields.

In September, we witnessed the first interest rate cuts, with the Federal Reserve reducing rates by 50 basis points and the European Central Bank (ECB) cutting by 25 basis points. This marked the beginning of a new era of rate reductions. Due to concerns about GDP growth in the EU for the upcoming year, the ECB is expected to implement cuts in all five of its forthcoming meetings.

There are also concerns regarding the potential emergence of “Trump 2.0” at the start of next year. He has already threatened new tariffs—an additional 25% for Mexico and Canada, and another 10% for China. Additionally, he has mentioned the EU several times, indicating that a new trade war could be on the horizon. However, these threats may primarily serve as leverage for negotiations in the near future. If these plans come to fruition, we might face another recession accompanied by a new wave of inflation in the US.

Currently, the Fed is being more cautious, and it is not anticipated that they will announce any new cuts at the beginning of the year. Gold has continued its extraordinary rally, gaining more than 28% so far.

Source: Bloomberg, InterCapital

Following Trump’s election victory, Bitcoin surged over 40%, peaking above $100,000, or as reported on Bloomberg, over 0.1 million dollars.

Source: Bloomberg, InterCapital

In conclusion, I expect a tumultuous year filled with volatility, which could create a favorable environment for traders.