The bond markets are still broken and it’s increasingly difficult to work as a fixed income trader at this time. Nevertheless, euro area primary markets carry some interesting insights about what’s going on below the surface. Now that it’s raining more than ever, who can stand under the investor’s umbrella? Find out in this brief article.

The most important event for Croatian bonds happening recently is Fitch revising sovereign outlook to stable from positive, although the rating was kept unchanged at BBB-. Regular reviews of Croatian rating were scheduled for June 05th and December 04th, but the credit rating agency decided to revise the outlook due to material changes in the Croatian economic blueprint. First of all, the agency expects Croatian GDP to contract by 5.5% YoY in 2020, followed by a recovery in size of roughly 3.0% YoY in 2021. According to their estimates, the aggregate fall in tourism demand is likely to reach 50% in 2020 alone since 45% of tourism arrivals come from Germany, Italy, Austria and Slovenia (i.e. four EU countries with severe travel restrictions). Speaking about the fiscal impact, Fitch estimated that about 7.5% GDP in deficit spending (30b HRK aggregate) would be used to shoulder the burden of falling economic activity, which would drive the public debt up to 77.7% GDP by the end of 2020. The deficit figure looks close to headline forecast, but the public debt figure might go a bit higher in this year, before (hopefully) finding itself firmly on a downward trajectory as soon as 2021.

So what do we make of this outlook deterioration? Both S&P and Fitch brought Croatian sovereign rating back into investment class on the same day, March 27th, 2019. The only difference was that in June of the same year Fitch revised the outlook to positive, while S&P kept it at stable all of the time. Basically, what Fitch did on Wednesday was merely aligning itself with it’s peer and no the agency longer sticks it’s neck out with a bullish outlook.

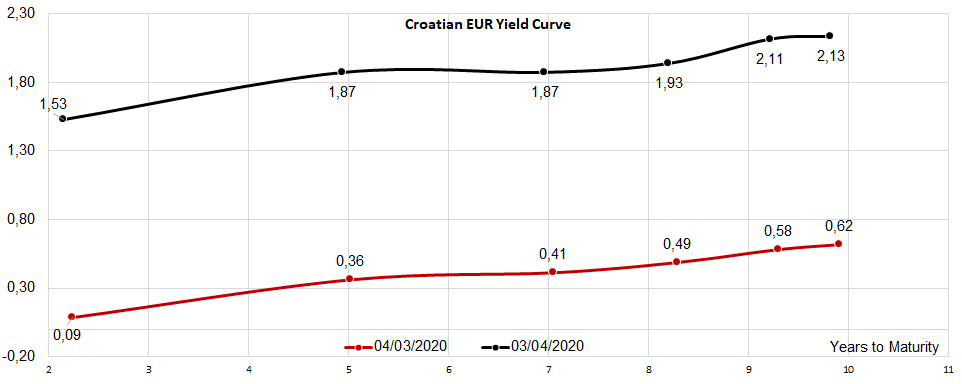

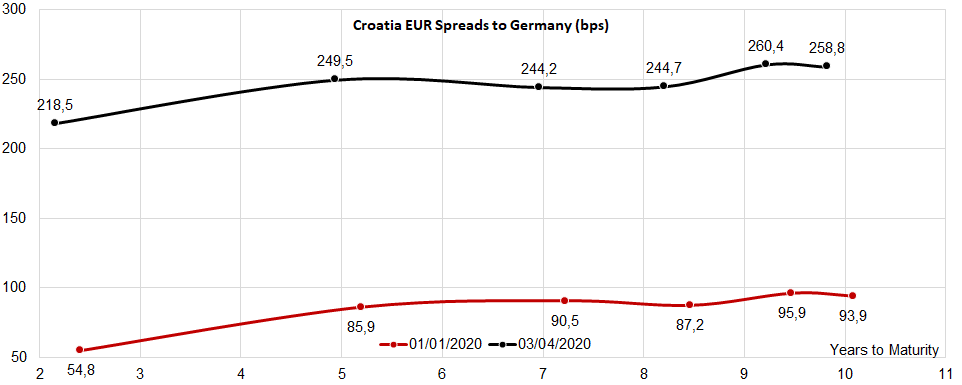

Speaking about Croatian international bonds, the market is still broken, but we can still say that it’s a buyer’s market in a sense that supply exceeds demand. Price discovery is an art itself, but it always comes down to the price that a potential buyer is willing to pay, with little or no concessions. Looking at CROATIs with longer maturities, although the screen prints yields around 2.10%, real bids are mostly concentrated in 2.30% region (if you’re lucky enough to find them).

A silver lining for CROATIs might have come from recent debt auctions held by Slovenia (March 24th), Latvia (March 26th) and Portugal (April 01st). Slovenia placed a dual tranche last week: 850mio EUR of 3Y paper (03/31/2023 maturity) @ 0.253% YTM (89.1 bps above Germany), coupled with 250m EUR of 9Y paper (March 2029 tap) @ 0.695% YTM (109.3bps above Germany). Looking at the Slovenian paper with a 9Y maturity, memories are still fresh of the first tranche being issued in early January @ 0.296% YTM (58.4bps above Germany), so at first it does seem that the yield impact is not so great after all: the yields have gone up by only 40bps, while the spread has widened by some 50.9bps. Nevertheless, Slovenian bonds are protected by a plethora of ECB’s facilities – the most prominent one is the gargantuan PEPP which seems to be designed to protect the periphery spreads from blowing up.

If you’re an investor in instruments issued by entities outside the reach of ECB’s umbrella, be careful before getting your hopes up. Here’s one more thing you should be aware when analysing Slovenian debt auction: back in early January most of the 9Y paper allocation went to investment funds (52%) and insurances/pension funds (18%); last week, the structure of the investors changed and banks/treasuries took 51% of allocation. French institutional investors took about 31% of allocation, which is not considered a frequent occurrence on Slovenian debt auctions (usually dominated by UK/Ireland, Germany, Austria and naturally Slovenia). In other words, it’s quite possible that the banks and treasury departments bought larger quantities in the anticipation that the ECB would have to buy these papers as well, some time around. And before it does, they provide a decent carry along the way. Now that it’s raining more than ever, it plays a big difference to be able to stand under ECB’s umbrella – but let’s look for the first debt auction held by a sovereign outside the euro monetary area to see how these countries fare.