If you were expecting a research piece covering the outcome of the US election – well, it’s too tight to call and we are vaccinated against Dunning-Kriger epidemics out there. Instead, we focus on the dubious NFP print that came out last Friday. If the print was weak, why did the markets go the other way? Read in this brief research piece.

Last Friday the US Labor Department had the ultimate read of the American labor market ahead of pending presidential and congressional elections. Speaking about the expectations, analyst consensus was low compared to the 12-month average (+100k consensus estimate, 4.1%) thanks to a couple of hurricanes making landfall during the read (Milton and Helen), as well as a strike in Boeing. It’s worth mentioning that Bloomberg Economics published a negative headline expectation of about -15k and even without the weather conditions, this would awfully look like a recession.

Bloomberg team was quite close since the headline read came barely positive (+12k), while the unemployment rate stayed at a relatively low 4.1% (that’s why nobody speaks about Sahm rules anymore). Once we take a look under the hood, it’s rather interesting that the headline figure included a sharp contraction of manufacturing payrolls (-46k), while at the same time about 33k workers from Boeing went on strike. Transportation equipment manufacturing shed about 44k jobs and this was mostly due to „strike activity“ according to Labor Department’s wording. This is the obvious culprit, however, it’s rather difficult to count the number of jobs lost because of two hurricanes. Brian Bethune (Boston College) estimated that without hurricanes and strikes, the headline figure could have gone up by about 130k.

Since fixed-income futures zigzagged in the trading session right after the publication (went up, but then pared gains almost equally fast), it’s worth asking ourselves what makes this a strong read? In other words, what motivated fixed-income bears to add more short bets in minutes after the publication and the initial knee-jerk reaction that pushed 10Y/Bund futures higher?

Well first of all, the share of employers that responded to the survey was lowest since January 1991, raising the possibility of a revision higher later in the year. More importantly, the unemployment rate was steady at 4.1%, while wages went up by +4.0% YoY (versus +3.9% YoY in September), which is also consistent with hurricane effects since low wage jobs are the first ones to get cut, moving the average wage higher in the process. It’s a healthy labor market after all, signaling no need to step on the peddle of rate cuts. Additionally, with the 25-54 age cohort recording the highest employment since the beginning of the century and an increasing number of people reaching retirement age, the labor market is expected to stay tight as it is and it’s no wonder if it gets any tighter as the immigration influx dissipates. Ironically, immigration (together with inflation and the general economy) remains the top three topics of greatest importance to US voters tomorrow, of course in a negative way despite having beneficial effects for the overall economy, especially labor market.

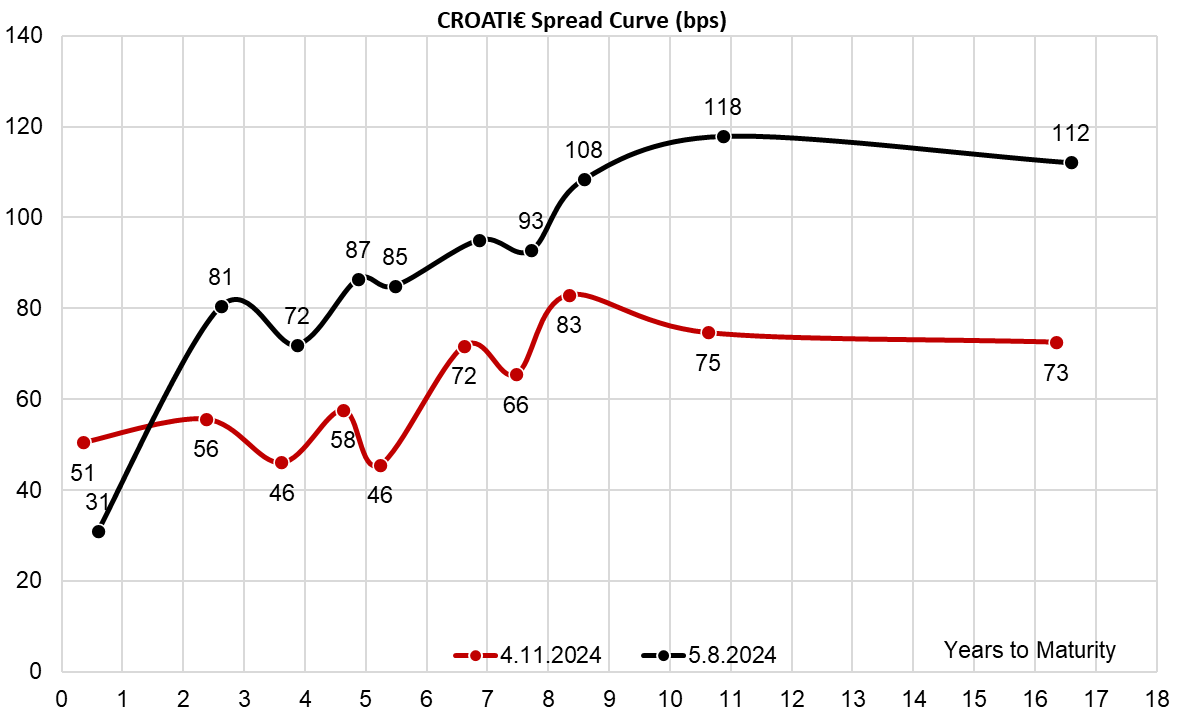

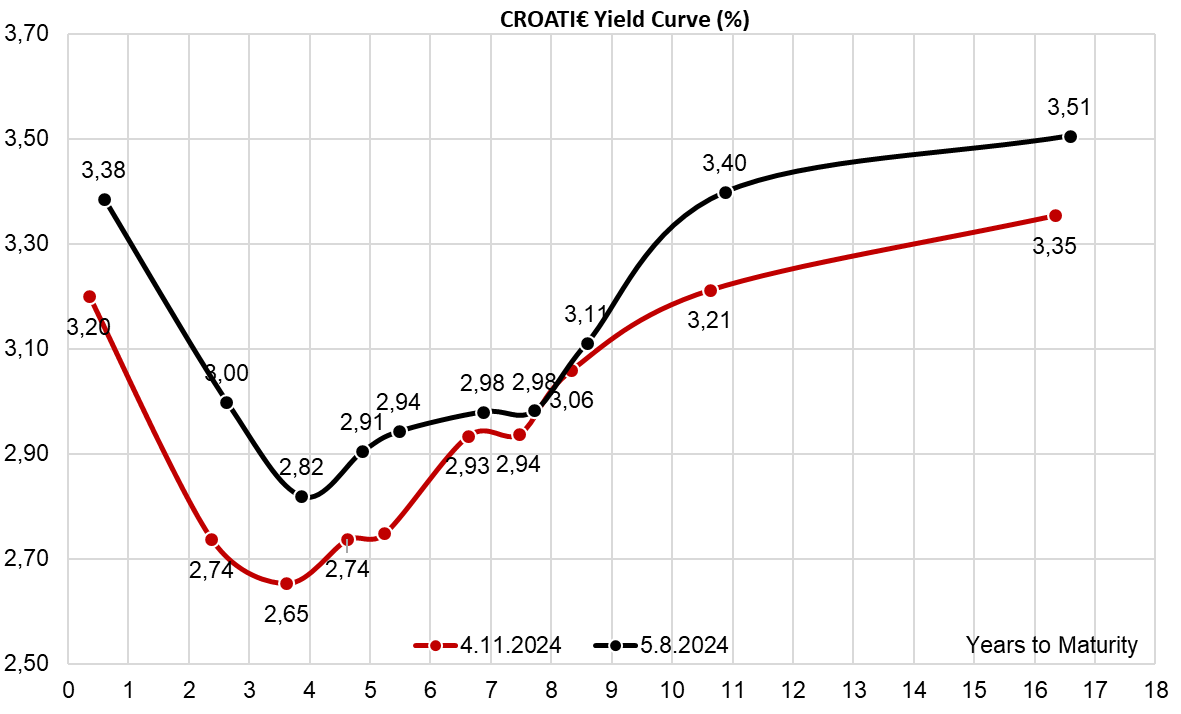

Quo vadis CROATI€ yield curve? In a manner compatible with the rest of the CEE space spreads have tightened quite a bit, but we attribute this to poor liquidity. Lately it was quite an accomplishment to get any bids at all in the Street, domestic buy side stepping aside ahead of the US election. So stay tuned.