In 2022 it seems that bonds cannot take a breather as investors repriced their expectations on inflation and central banks’ actions. Last Friday we witnessed yields going South sharply due to escalation between West and Russia but that lasted only for a day. This week bonds were sold once again with de-escalation, Bullard confirming his stance and PPI in US coming way above expected. In this brief article, we are looking at the recent news that has driven yields around the globe and what to expect looking forward.

Last week yields in the developed markets were breaching new multi-year highs with US 10Y overjumping 2.0%, while 10Y EUR benchmark stood above 30bps after closing 2021 at -20bps. However, after the European close on Friday, media warned that there is a risk of Russian immediate invasion and US officials asked its citizens to leave Ukraine which pushed investors in risk-off mode. Bund price shoot-up almost 200 pips, going below 20bps in yield terms at one point while UST 10Y went to 1.90%, reflecting a move of almost 15bps in one afternoon. Obviously, equity markets sold-off. It seemed like bond markets were finally catching a break after a strong sell-off since the mid-December.

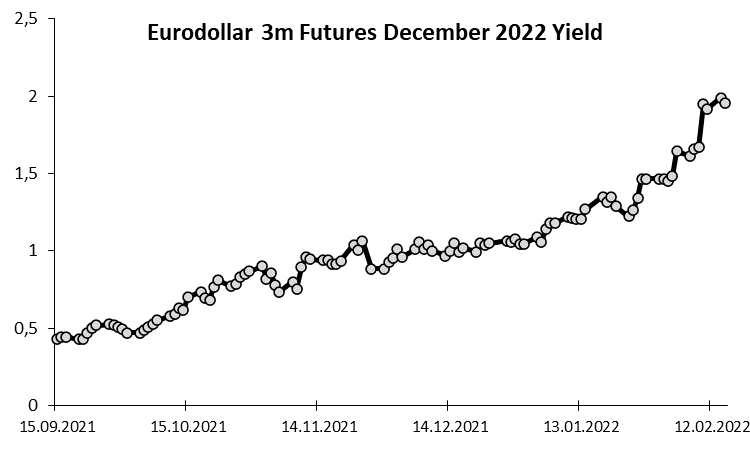

Nevertheless, on Monday Russian Foreign Minister in talk with Putin said that there are still a lot of diplomatic options not being used before going to a full-blown war. Furthermore, on Tuesday, Russian media reported that some Russian troops are withdrawing from Ukraine’s border. Not to forget, that news of de-escalation was coupled with higher than expected PPI in the US that is only another puzzle for higher inflation and hawks to react. And on top of all this news, Fed’s Bullard confirmed its stance on rate hikes, saying that he wants to front-load rate raises to show central banks’ credibility and to curb inflation. Needless to say, that was a perfect storm for safe heaven assets, with bund 10Y once again overjumping 30bps while US 10Y once again above the significant 2.0% level. In other words, investors seem to be much more afraid of high inflation risks and central banks that are now in almost full tightening mode than they are of possible war.

Looking at the economic implications of the war for Europe, it is obvious that prices of energy complex would rise from already elevated levels which would almost surely influence rise of other goods’ prices. However, one would have to look at the demand side of the equation also. According to European Commission, Russia is EU’s fifth largest trading partner, representing almost 5% of total trade in goods while EU is Russia’s biggest trading partner with 37% imports and exports coming from EU. Furthermore, in case of a full-blown war between Ukraine and Russia there would be consequences on many services, especially tourism which still did not recover fully from the coronavirus. So, what would ECB do in the case of war? Well, it would most likely continue with its tightening plans as inflation would increase further although having even smaller chances of a soft landing for the economy. This means that even in the war scenario bonds would not be beneficiaries although we would most likely see even flatter curves. However, there are some subjects on the market that are buying safe heaven assets such as bund no matter what, which happened on Friday. Also, it is worth noting that rates were crushed at such a pace that a bounce of 200 pips should not be surprising.

To sum it up, we still do not see rates bottoming as many investors are using any opportunity to sell as many bonds as possible as they think that 40-years of bonds has come to an end due to unusually high inflation. The main question is what could stop 2020’s inflation? Is it a new supply of energy, central banks that will fight aggressively with their tools or something more unusual, like war? We opt for a mix of an energy price decrease and slower than currently expected tightening of central banks. The first test of our opinion comes in March when we will see by how much Fed and ECB are scared of inflation trends.

Source: Bloomberg, InterCapital