About fifteen years ago American rock band Green Day released its monumental single called „Wake Me up When September Ends“. Well, a dull and mostly uneventful September is over so it’s time to wake up! What was going on and what can we expect on regional bond markets? Find out in this brief article.

Even with September out of the way, the focus of fixed income investors remains on the outcome of US elections which are now merely one month away. The first public debate between the Republican incumbent Donald Trump and his contester for the office, Democrat Joe Biden, left us without a clear winner, however one thing became certain: Biden is not willing to stay polite and suffer below the waist punches from Donald Trump the way his predecessor Hillary Clinton did. Instead, he’s willing to fight back and also punch below the waist since clearly this is the game being played out. That’s the reason why it makes almost no sense to watch the remaining three debates, unless if you’re a US resident registered to vote: you won’t get any useful information about policy changes in the future, since every effort to address one of the many divisive issues of complex US politics would probably crumble under the efforts of each candidate to make the other one look despicable and repulsive. However, if you forget about the presidential debates, there are a few things happening under the radar. For instance, while you were busy looking at the ADP employment report (if you missed, it was better than expected) Washington Post reported an early surge in Democratic mail voting that sparked worry inside GOP. Although Washington Post tends to lean in the direction of Democrats, it still gave a hint that previously absent voters might be favouring Joe Biden and giving him heads up. Notable political forecasters such as Nate Silver also see Biden’s win in November (78% chance of that), but with a large number of the undecided voters it might be a bit premature to start declaring winners. What becomes more certain is that with a surge in mail votes leaning Democratic, the case for a contested election becomes greater and don’t forget that in the coming weeks Mr. Trump will have a 6-3 majority in the Supreme Court. This is the vocal point of uncertainty and it should definitely require some hedging.

Looking at the bond market, the top theme in recent weeks has been the inflation target set by the FED and the ECB. In the last day of Jackson Hole conference Jerome Powell outlined some of the changes in monetary policy framework, espousing symmetrical inflation targeting. In simple English it means that the inflation figure can exceed 2.00% and FED won’t bat an eyelash about it, since it would make up for the decade of low inflation behind us. The same thing was adopted by ECB and Mrs. Lagarde made symmetrical inflation targeting the main theme of monetary policy review that would conclude in September 2021. After 2001 and China becoming a member of WTO and gradual aging of the world population the rapid rise in prices is no longer a bogeyman it used to be. However, pay attention to the fact the markets are not buying the apparent insensitivity of central bankers to inflation pressures: the 5Y inflation swap went down, not up, in September.

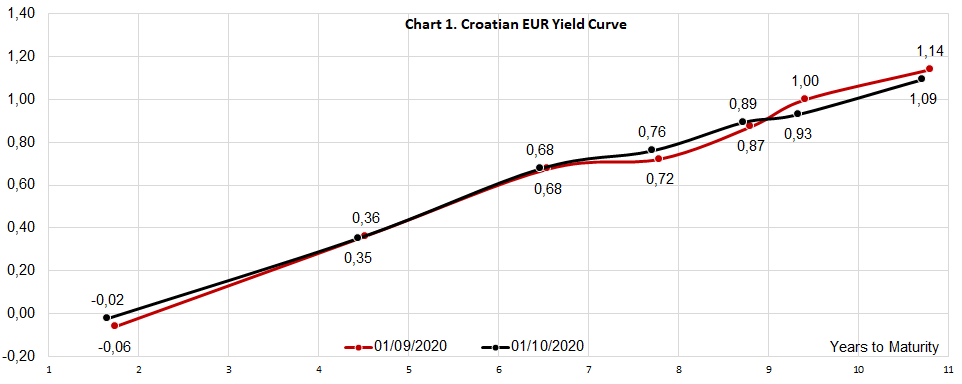

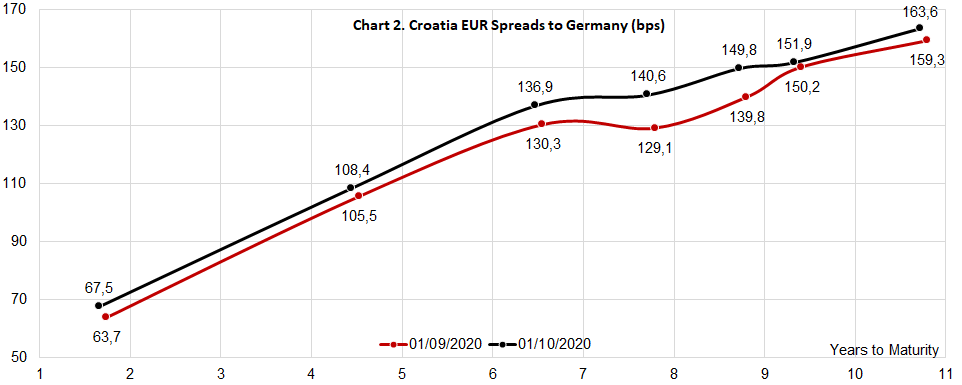

So where does that leave us with yield curves? Well, Croatian EUR-denominated international bond curve went slightly to the north with evident widening of the risk premia. In our opinion, the underlying cause is not the loss of love for CROATIs, it’s just the supply overhang on international markets. Most of the bruised Croatian institutional investors are sitting on piles of uninvested cash with fear of what the autumn brings. Yes, the central banks will be here to help and give a hand to fiscal arm of the government, but what we have learned in second quarter of this year is that when help comes, it comes gradually, while when things go in the wrong direction, they usually do it overnight. As Roman stoic Seneca dubbed it: positive change is gradual, while the decline tends to happen rapidly (that’s why Ugo Bardi called this the Seneca effect). Insecurity over domestic effects of second or third wave epidemics and US election outcome have created a vacuum of demand that might be extended in October as well.

However, there is one big positive thing that might cause another round of spread tightening: news that Covid-19 vaccine has ended phase three of testing and that now it’s safe and effective for usage. We’re pretty close to that, at least if you read between the lines of recent pressure on Pfizer CEO not to cut corners on vaccine testing. It’s possible we might have a safe and effective vaccine by the end of the month, perhaps in early November. It still needs to be approved by FDA and similar public bodies around the world, but by the time the news about the vaccine crosses the wires you might regret if you’re underinvested. In times like these investors tend to overemphasize risk factors and turn a blind eye to the opportunities at hand. The vaccine is a large opportunity, possibly only weeks away.

With all this in mind we welcome October. Even if we’re wrong, hey – it means we’re only three months away in ending the 2020.