Financial markets started 2023 on the right foot with most of the assets being in solidly positive territory driven by decelerating inflation data across the globe. Yesterday we saw another decline in US headline CPI to 6.5% but markets were rather flat due to traders front-running the data. In the first blog of the year, we are looking at the macro releases that have driven assets skyrocketing.

On the second working day of the year, Destatis informed us that inflation in Germany was lower compared to already decreased expectations. Namely, CPI in December stood at 8.6% YoY compared to 10.0% in November (9.0% consensus on Bloomberg) while in MoM terms prices decreased by 0.8%. Most of the European countries reported a deceleration in inflation hence Eurostat on the 6th of January reported that EA inflation decreased from 10.1% in November to 9.2% in December. There were several one-off drivers for the strong drop in inflation but the biggest one was obviously the energy complex that kept dropping due to warmer weather and recession forecasts. Core inflation overjumped both expectations and November’s levels but investors shrugged off this information and bought across the markets. That is, investors started to calculate a faster fall in inflation and some of the think tanks started to forecast that Europe could miss the recession meaning that ECB could lower rates faster than previously expected. EUR yields ended 2022 at the year highs and since December 30th, bund yield went from 2.56% towards yesterday’s 2.17% i.e., it fell by 40bps in only 6 working days. This means that bund futures were up by almost 600 pips in the same time span. However, Schatz and most of the short-term papers did not change much as they are priced as OIS, meaning they are mostly connected with ECB’s rates, resulting in the yield curve being inverted significantly (2-10y more than 40bps).

However, the first ten days of the year were even more interesting in equity markets with the DAX index being up by more than 7%. The drivers are obviously warmer weather and lower energy costs, lower inflation, and China reopening which is strongly positive for German exporting companies. DAX is currently standing at 15k, the level last time seen in mid-February 2022, and only 6% below the all-time high levels seen at the beginning of 2022. If I would say to you that we have a war in Europe, inflation stood above 10% just a month ago and the ECB is priced to set rates at 3.5% in the middle of this year, would you say that the equity market in Germany will be close to its highs? I doubt. But that is the beauty of the financial markets and their predicting forces.

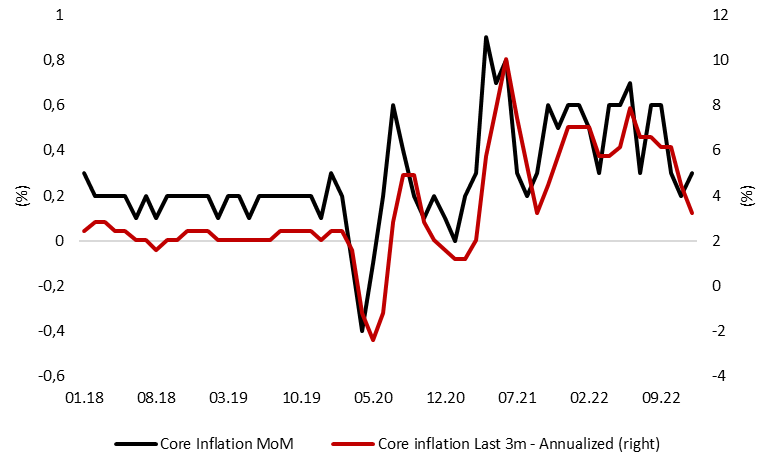

Back to CPI data, yesterday we saw that BBG consensus could sometimes be correct with all 4 data being spot on. Namely, US CPI in December stood at 6.5% versus 7.1% a month before, while core prices were 5.7% higher compared to December 2021. However, it is important to note that headline inflation stood at negative 0.1% MoM as gasoline prices slumped by 9.4% MoM. Core inflation stood at 0.3% MoM, 10bps above the level in November driven by a still strong rise of shelter growth which stood at 0.8% MoM. Many analysts are currently saying that prices of shelter have a lag of more than 12 months, meaning that prices of shelter are mostly overstated in CPI reports which are shown by several high-frequency data such as the Zillow report. In any case, the data showed that inflation is on a firm downward path and if we do not witness another energy crisis, inflation could reach 3-4% in the middle of this year. Markets did not move much, as the data met expectations although it is worth noting that both equity and bond markets already rallied before the release.

To conclude, 2023 started the year with all assets being in green, but as you may recall, that was the story in 2022 as well and then we witnessed one of the worst years for financial assets in history. We doubt that 2022 can repeat, especially for bond markets, but we witnessed markets overreact many times and I think that this could be another example of that, overreaction.

US Core CPI

Source: Bloomberg, InterCapital