Last week, S&P upgraded Croatia’s credit rating from BBB+ (positive) to A- (positive). Following suit, Fitch also upgraded Croatia’s rating to A- (stable) over the weekend. Fitch echoed S&P’s conclusion, emphasizing Croatia’s GDP growth, which is “19% above the 2014 level by the end of the first half of 2024.“

Additionally, Fitch expects further fiscal consolidation, with the budget deficit projected to narrow to 2.2% in 2024 and 1.8% in 2026. (below two percent). Other reasons for the rating upgrade were previously explained by my colleague Ivan in last week’s blog post (link). At this time, Croatia has achieved credit rating upgrades from two major credit rating agencies, which is in line with our expectations outlined in our Macro Outlook in mid-July.

Meanwhile, on the other side of the world, the market was split between the possibility of one or two interest rate cuts. As mentioned in my recent blog post in mid-July, inflation has decreased significantly, prompting the Fed to shift its focus towards the labor market, ultimately leading to the use of Sahm’s rule. The latest Consumer Price Index (CPI) reading came in at 2.5%, marking the lowest figure since February 2021.

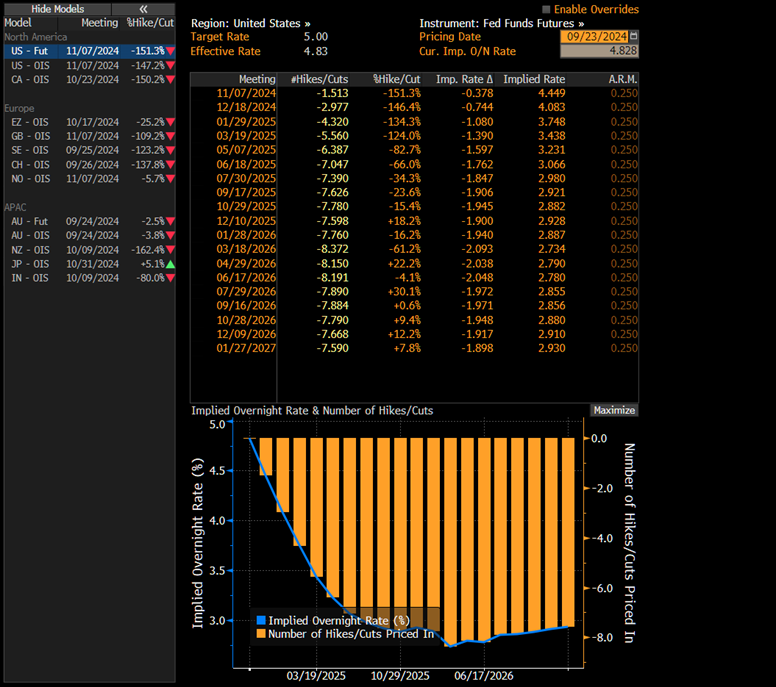

WIRP opened last Wednesday with a rate of around 1.7 in the morning, but it dropped to 1.55 cuts throughout the day. The market hasn’t made a mistake in over two decades, so ultimately, the Fed’s decision shouldn’t be a big surprise. As Powell pointed out, they no longer see inflation as the main problem and are now focusing on the labor market. The dot plots show two more cuts in 2024, while the market is pricing in three full cuts. When I wrote my last blog about the Fed’s decisions two months ago, the market was pricing in 2.5 cuts until the end of the year, and the Fed has already implemented two cuts. It remains to be seen whether the market is pushing too hard, as we saw at the beginning of this year.

WIRP this morning:

Source: Bloomberg, InterCapital

The FOMC minutes will be released in two weeks, a few days after the NFP report, and one day before the CPI data. They may provide more insight into the recent interest rate cuts and why they were implemented despite the economy not showing major distress. These two weeks will likely be crucial in shaping the narrative for the next two months. If you haven’t formed an opinion on the Fed’s next moves, it may be best to avoid trading during this period, as there could be significant volatility. On the other hand, if you have a clear view of the Fed’s next moves, these two weeks will be important.