On Wednesday and Thursday, Federal Reserve and European Central Bank delivered their decision regarding the rate hikes and guided the market toward their future decisions. Federal Open Market Committee paused the tightening cycle for the first time in fifteen months. On the contrary, European Central Bank delivered another rate hike. Both central banks reiterated their hawkish stance due to the high inflation and tightness of the labor market. However, Ms. Lagarde delivered a much stronger message that the projected inflation path is not satisfying and that the upside risks remain significant. On the contrary, BoJ did not make any major policy changes and continues its loose monetary policy.

On Wednesday, FOMC skipped the rate hike and indicated that further hikes are on the table. Precisely, two more rate hikes are on the table this year and cuts are expected to be delivered in 2024. The new dot plot indicates that the new median target for short-term rates this year is 5.6% which refers to two more rate hikes this year. Mr. Powell stated that they covered a lot of ground and that the effects of tightening are going to be felt. This is a slight dovish change of rhetoric as „we have more ground to cover“ was the crux of previous meetings. However, Mr. Powell explained the change of rhetoric as prudency to assess new data regarding the state of the economy and deliver decisions in the future.

On Thursday, European Central Bank delivered a rate hike of 25 bps as the market expected, and guided the market towards more hikes in the near future. Inflation is still too high for too long, thus leaving ECB with no other option. ECB staff lowered their economic growth forecast for 2023, 2024, and 2025. The notorious services inflation dropped for the first time since November 2022, but it remains at worrying levels. Both headline and core inflation projections for the next three years are revised upwards. Therefore, the hawkishness of Ms. Lagarde seems justified, expressed by the announcement of another rate hike in July. Moreover, hawkishness of the Ms. Lagarde is beyond the expectations of the market and the 4% deposit rate seems easy to reach.

Market reaction after both Fed and ECB decisions pushed yields on both 2-year Treasury and Schatz up to 4.70% and 3.15%, respectively. Much stronger hawkish statements came from Ms Lagarde than from Mr Powell which pushed EURUSD above 1.095 as the tightening cycle is not nearing the end in Eurozone. However, the Bund yield remained almost unchanged as ECB may overtighten monetary policy and cut rates more in the future.

Considering everything said in the last two days, it seems that the European banking system and the economy are much more resilient than expected. No banking stress happened to this date in Europe and the tightening cycle has no apparent reason to be stopped as wage inflation and price inflation remain significant. On the contrary, Federal Reserve is in need of a pause to prudently deliver their decisions and not over-damage the economy as their banking system is much more fragile than the European banking system, at least for now. Currently, everything depends upon new developments regarding the labor market in Eurozone and the US. Also, BoJ decided to make no new changes to its policy. The rhetoric by Governor Ueda is dovish as he admitted that price forecasts above 2% may not lead to a policy shift. All in all, the three central banks have different approaches with ECB as the biggest hawk currently, Fed as the mildly hawkish central bank, and BoJ which still does not want to abandon its ultra-loose monetary policy.

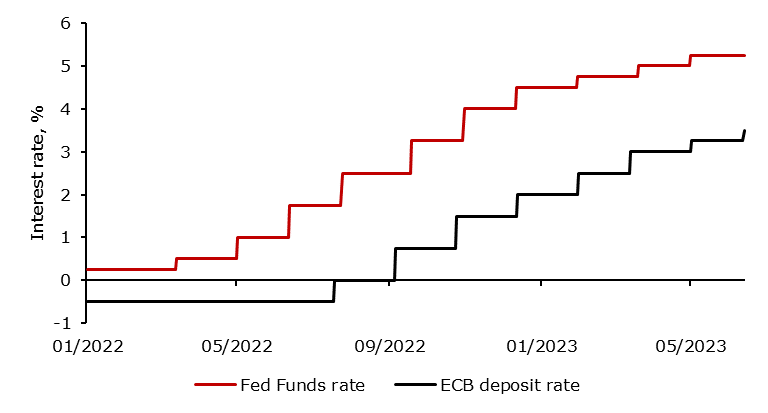

Central bank rates (2022 – 2023 YTD, %)

Source: Bloomberg, InterCapital Research