Yesterday’s FED meeting ended up as being even more dovish than the markets were expecting. To see the main takeaways, go through this short article.

March FOMC meeting ended up as a confirmation of broad market expectations. First of all, the Committee lowered the 2019 US GDP forecast from 2.3% YoY (December meeting) to 2.1% YoY, while the unemployment forecast went up from 3.5% (December meeting) to 3.7%. The forecast for 2020 was adjusted in a similar fashion (i.e. growth down, unemployment up), but by a smaller magnitude. Although FED Chairman Powell said that the underlying growth fundamentals are still strong, he also cited overseas economic weakness as a potential cause of slowdown ahead – in other words, the tailwinds of the past are becoming headwinds of the future. It’s worth mentioning that China is undergoing another phase of fiscal stimulus to turn around slowdown prospects, which might materialize down the road. In Europe the governments are mostly running balanced budgets, but on the other hand the central bank has announced another round of TLTRO this year (the timing and the size will be a surprise), which also has some turnaround potential. In both cases, there’s a silver lining, but the one that still has to deliver.

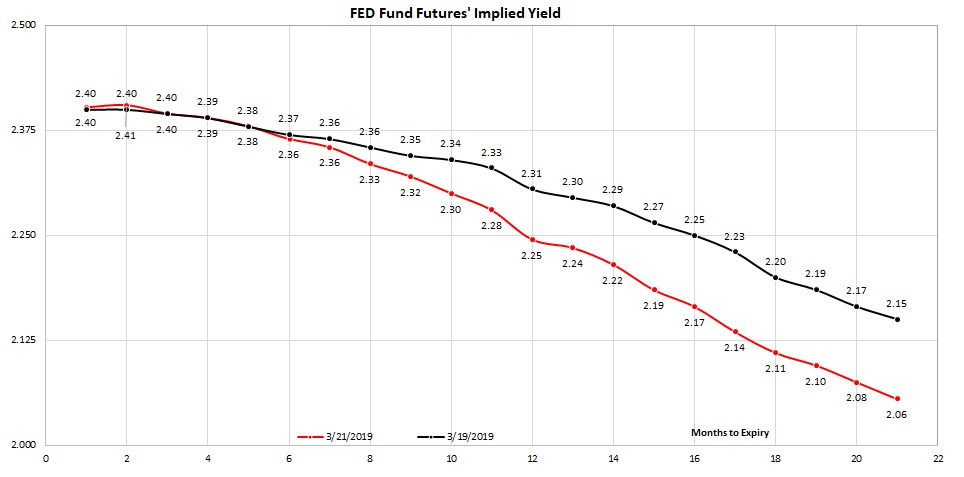

Speaking about the monetary policy, the median 2019 FED fund dot went down to 2.50% and since the FED fund target range is 2.25%-2.50%, this would effectively imply half of a hike this year – in other words, now the FOMC and the market are singing the same song about no hikes at all this year. There is still some divergence in opinions between FOMC and the financial markets in 2020 since in this year the median dot stands @ 2.625% (one hike implied), while the market sees that a cut might be under way. Taking a glance at the FED fund futures’ implied yields, one can see that the futures contract maturing in October 2020 (twenty months on the chart, FFV0 Comdty on Bloomberg) implies a 2.08% Fed fund rate, which is equal to a single rate cut.

This is not where the story ends – the FOMC also announced its’ decision to scrap QT and slow down the balance sheet reduction in the first step, before putting an end to it in six months’ time. Balance sheet downsizing began eighteen months ago when FED’s balance sheet reached an unprecedented 4.4 trillion USD. By March 2019 the B/S was reduced to some 4.0 trillion USD, or by approximately 500 billion USD (11% change). In May, the runoff rate of Treasuries will drop from 30 billion USD a month to 15 billion USD a month, and the plan is to completely phase out B/S reduction in September. Naturally, this is supportive for fixed income prices, which is the main reason why the 10Y US Treasury opened @ 2.62% YTM on Wednesday, and closed about 10bps lower (2.52%).

Pausing rate hikes and retiring QT might seem as a panacea for all of the FOMC woes since supportive monetary policy might shield the US economy from adverse spillovers of Chinese slowdown, hard Brexit, or trade wars getting out of hand (all three of the risks appear to be contained for now), but the U-turn also came in the right time to silence the FED critics. It’s worth mentioning that the accommodative monetary policy brought the US stock market capitalization to unprecedented 154% GDP – the FRED data might be out of date a bit (2017 is the last available data), but it’s worth mentioning that the first moths of 2019 gave back the equity investors almost everything that 4Q of 2018 took away, meaning that the ratio might be quite similar in March 2019.

The wind of change is certainly blowing into the face of US economy, however with the current expectations of rate cuts (US in 2020), fiscal stimulus (China), and TLTRO (Europe), don’t be surprised if the growth forecast turns supportive and You have to listen this song all over again in six month’s time.