Arctic Monkeys have just yesterday performed their first concert in Croatia since 2013, so it’s quite natural that the title of this research piece is inspired by one of their songs. Supply on Croatian eurobonds has recently been rather weak, which is the reason why the spreads have tightened significantly even in the midst of benchmark yield eruption. What can we expect going forward – find out in this brief research piece.

Throughout the past several months attention of fixed income money managers has been switching back and forth from CPI prints to central bank reaction function. What we have learned from latest FOMC minutes is that the current FED fund range set at 2.25%-2.50% is considered by most officials as neutral once the inflation drops to 2.00%. With the present macroeconomic setup, it would require some time for US CPI prints to come down from vicinity of 9.0% YoY to FOMC target. Against the backdrop of the highest CPI prints in at least 40 years, FED chairman Jerome Powell reiterated that as time goes by “it likely will become appropriate to slow the pace of increases”. However, it seems that FOMC officials are still wrapping their heads around the third successive 75bps hike on September 21st, bringing FED fund rate to 3.00%-3.25% target range. Incidentally, September 21st is also the last day of summer (fall equinox arrives on September 22nd) and when you go through the FOMC forward guidance remembers the lyrics of British band The Cure that “the last day of summer never felt so cold”.

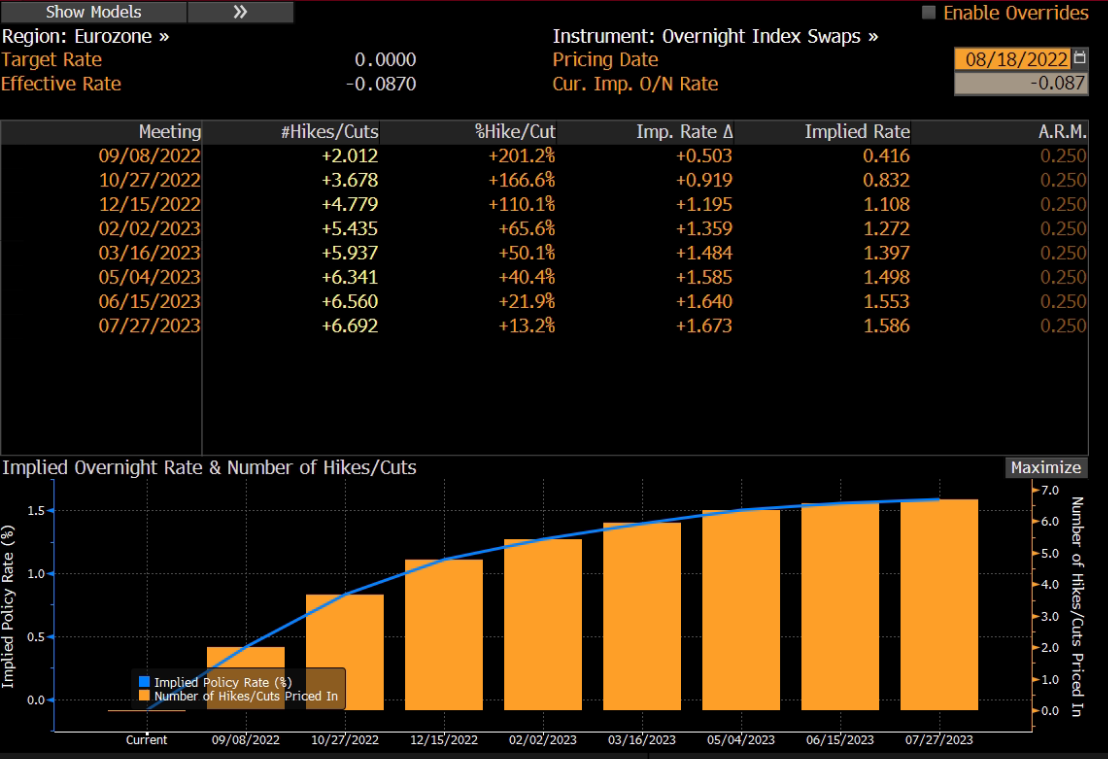

ECB GC meeting is much closer on the calendar and the big wigs of European monetary would assemble in Frankfurt on September 08th. According to the latest interview with Isabel Schnabel, the GC is split between 25bps and 50bps hike, but she holds 50 bps hike as appropriate considering the circumstances. Nothing new here, actually – if you glance at the Bloomberg WIRP EZ function, you can see that’s exactly what the markets are expecting:

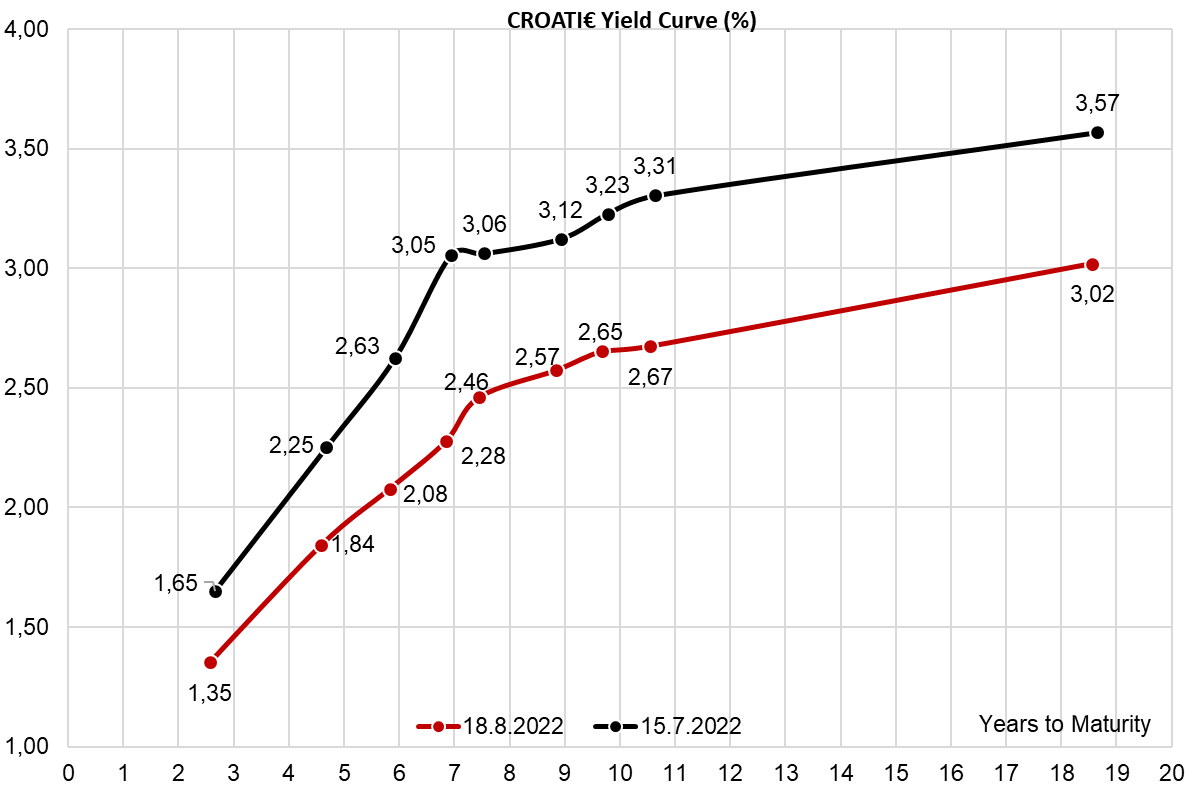

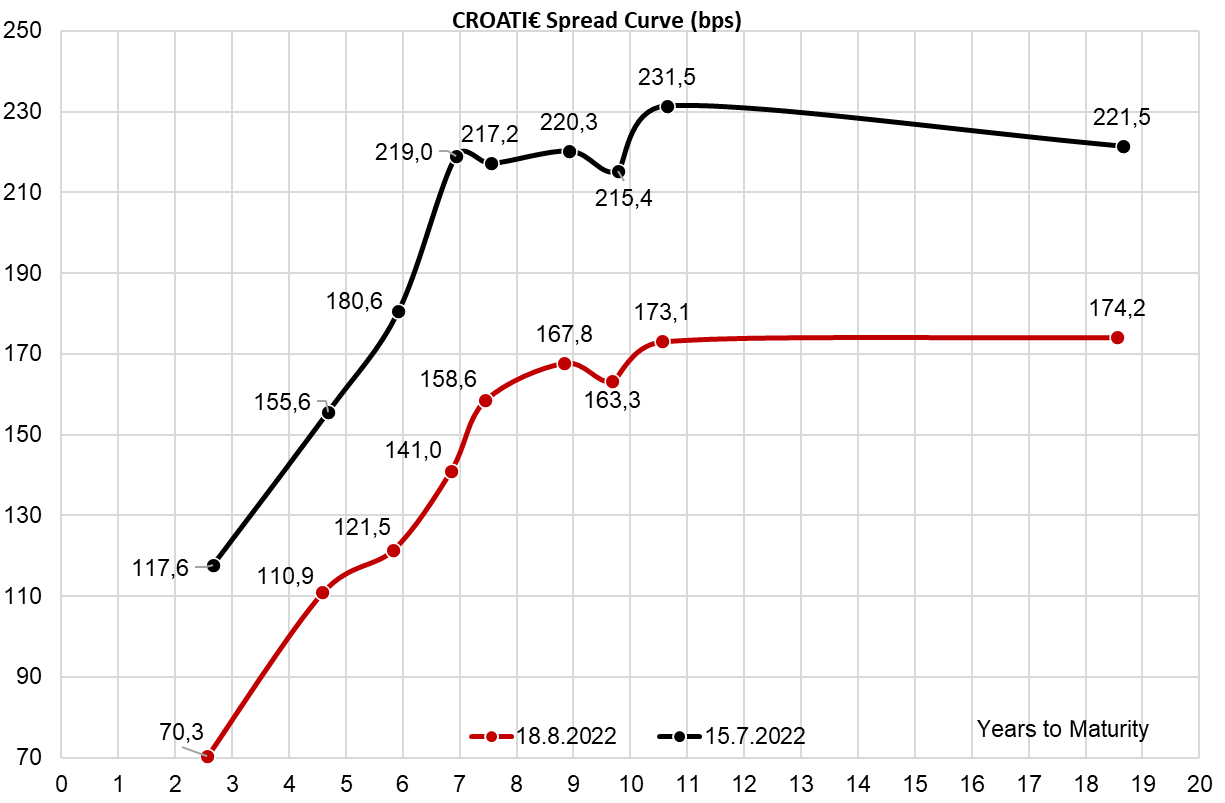

In the latest 14 trading sessions German 10Y yield went up from 0.70% to 1.13% (+43bps), but the thing is that +22bps of that move happened in the last two sessions. What’s going on? The soundest explanation we could find is that the recent rise in gas and electricity prices has driven European yields up and equities down, but bear in mind that we are still in the dog days of summer in terms of liquidity. What’s quite interesting is that in the recent benchmark yield eruption Croatian eurobond yields have been holding steady, meaning that spreads to Germany have contracted massively. This is the beginning of our story.

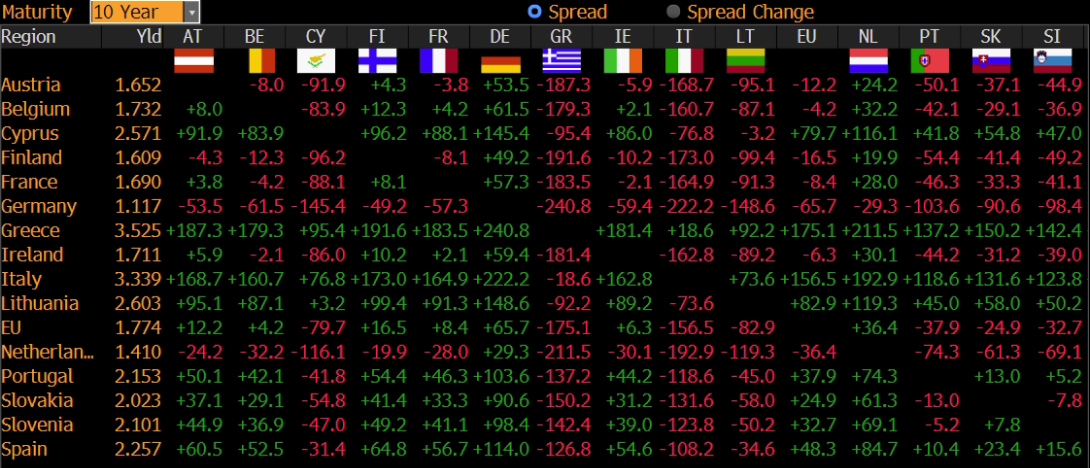

How sustainable is this spread contraction and can we expect sudden widening? To understand better the question being presented, take a look at this morning’s selected EGB 10Y yield matrix (GOVI function on Bloomberg):

Now notice that Portuguese 10Y (PGB 1.65 07/2032€) is traded at 2.142% YTM, while Portugal (BBB) is rated one notch below Croatia (BBB+) according to Fitch and S&P. But that is just part of the story: Spain (A-) is rated two notches above Portugal but trades at roughly 23bps higher yield. Rating is not everything – otherwise, this job would have been piece of cake. Nevertheless, CROATI 2.875 04/22/2032€ currently trades at 2.60% YTM. Positioned right between Portugal and Spain in terms of credit rating, you might arrive at the conclusion that there’s still some juice left in the CROATI€ yields.

From the flow perspective, it’s likely the spread might continue to narrow down due to high liquidity overhang and asset managers looking for paper to buy. We would like to outline that there are risks to this view: namely, these last couple of days when you show somebody an offer on CROATI€, the buyer tends to ask what other paper can we offer (POLAND€ for instance). This leaves us with the conclusion that CROATI buyers are forced to invest the cash flow they receive, but are reluctant to purchase CROATI€ assets even with the possibility of more spread narrowing down the road. Why is that so? One bond veteran explained to us the big picture: OK, Croatia has sound fundamentals, but we’re worried about the possibility of central banks having to hike more aggressively in the autumn if CPI print doesn’t come down. According to this playbook, higher benchmark rates inevitably lead to wider periphery bond spreads and even the good macro/flow fundamentals won’t save you in this case.

You can subscribe to any point of view presented here, but bear in mind that liquidity overhang will have to be put into play eventually and that assets would be sought after. The purpose of this research piece was not to give you a definite forecast of yields/spreads path going forward, but rather to take the batteries out of your mysticism and put ‘em in your thinking cap, to paraphrase another song performed by Arctic Monkeys.