As our regular blog series returns after the winter break, the American markets will be closed today for the coronation of Donald Trump. He already knows the drill (baby drill) as he is set to return to the position he vacated four years ago. The markets eagerly await his reinstallment and first executive orders amid a particularly uncertain period for bond markets. Stay with us to find out what has been going on after we took a break for festive activities and what we expect will be in the spotlight over the next couple of weeks.

After a relief rally in the bond market in the first month after the elections, market participants switched their focus onto prospective tariffs and measures intended to support the economy along with a copious supply of bonds issued by the Treasury. It remains to be seen how many of the promises will be kept and how many were just mendacities used as bargaining tools similar to what he did the last time before stepping into the Office. Nevertheless, they sparked a scare that the prospective policies will amplify inflationary pressures. It is worth noting that policymakers and economists disagree on whether those policies will turn out to be inflationary or disinflationary for Europe. Klas Knot, the governor of De Nederlandsche Bank, argues (as does our own Kristijan Božić) that high US tariffs on Chinese imports would result in a flood of cheap products in Europe, thus causing the price pressures to abate. For now, the market is taking the threats about tariffs seriously (unlike his brass jabs directed at Canada, Mexico, and Greenland), although from what we heard from his economic team in written and oral form – it seems that the tariffs will be introduced cautiously and then intensified if the targets of the tariffs and sanctions don’t comply with the administrations’ requests.

Oil prices have risen around 10$/barrel in the recent weeks after cold winter weather (weather forecasts suggest the chilly weather will persist) in the US and Europe modestly tightened the oil supply and could tighten it further. That same cold weather also led to a rise in natural gas prices, which induced gas-to-oil switching. Freeze-offs may cause some reduction in oil production, but the most significant decline in oil supply will come from the broadest and strictest sanctions package on Russian oil production and exports. Further escalation of US relations with Venezuela and Iran also threatens to take a toll on the oil supply. Those higher oil prices feed into inflation expectations and slowly elevate the general price levels.

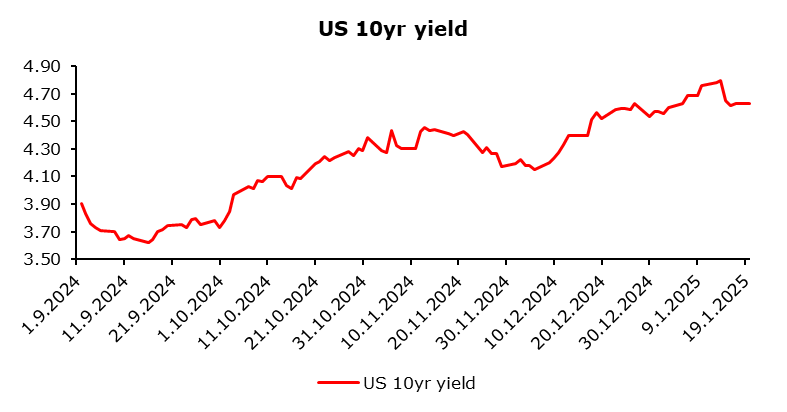

Let’s pivot back to some hard data points, similar to how the Fed pivoted at its last meeting on December 13, when the dots showed a median of 2 cuts in 2025, and they signalled caution and increased uneasiness about the stalling disinflationary process. Commentators are no longer discussing the possibility of a downturn in the labour market (why should they? – the last two NFPs printed around 240k with the unemployment back to 4.1%, displaying evidence of a healthy labour market), and the Fed’s eyesight shifted its gaze onto inflation. They suggested a wait-and-see mode because of slower than expected pass-through of higher rates and ambiguities connected to Trump’s policy decisions. That steered the bond market downwards, pushing the Treasury 10y yield slightly above 4.80%, and caused the yield curves to steepen mercilessly. Some chatter evolved, suggesting that the subsequent policy move in the US should be a rate hike and that some of the previous moves were a mistake. But lo and behold – here enters the CPI print on January 15, and it is basically inline (an inch below expectations, to be honest). Now Christopher Waller, an influential member of the FOMC, suggested that cuts will be appropriate and that if everything evolves as predicted, cuts are to be expected in the first half of the year. This, in turn, led to a drop in yield and gave a push to equity markets, which became uneasy about higher rate prospects that hurt their valuations.

All of this shows how the narrative is behaving erratically and how little it takes to move a market when it becomes too one-sided. It remains to be seen how concrete policies will give shape to the economic outlook, but at this point, we see value in owning bonds in Europe, where yields have taken a cue from the US, all the while as the economic outlook remains grim amid disinflation and issues with productivity and competitiveness of the European economy.

Source: Bloomberg, InterCapital