Close watchers of yesterday’s ECB GC meeting were under the impression that the fourth consecutive 50bps hike was traded off for 25bn EUR/month APP roll off. Large banks are seeing 3.75% terminal rate in Europe, but €STR swap markets think we’re only one rate hike away from pivot/plateau. What do we make out of this bifurcation? You’ll just have to read the whole article to find out.

European Central Bank raised the deposit facility rate by 25bps to 3.25%, effectively ending a string of three consecutive 50bps hikes. In the Q&A session after the decision Madame Lagarde clarified that some ECB governors suggested how a fourth consecutive 50bps hike could be appropriate, but in the end, the quarter-point hike received unanimous support. It seems that the consensus to slow down rate hikes has been grounded in ending the APP reinvestment in July, meaning that in two short months, ECB balance sheet would start to decrease by 25bn EUR/month.

More on the rate hike pace – during the Q&A session it became clear that more 25bps rate hikes are on the way, the last one probably taking place on July 27th meeting and taking the ECB deposit facility rate to 3.75%. In relation to the terminal rate, Lagarde reiterated that there is no fixed target and the Council will know what sufficiently restrictive is when this target is reached. Notice that with FED pausing and ECB continuing to raise rates a new transatlantic divergence is being revealed, but the question remains how far can this divergence go? Let’s add more clarity to the notion can ECB continue to tighten in the wake of the FED plateau (i.e. end of FED rate hikes, but not the beginning of rate cuts).

First of all, €STR swaps are not buying into 3.75% terminal rate and BBG WIRP tells the whole story:

According to BBG WIRP function, ECB terminal rate would be reached in summer and it’s revolving around 3.45%-3.55%, at least one 25bps hike less than what was interpreted from Madame Lagarde’s statement.

Why is that so? In our opinion because the other two instruments (TLTRO repayments and pause of APP reinvestment) would continue to do the monetary policy tightening after June 15th GC meeting. JPM and GS have reiterated expectations for a 3.75% terminal rate (implying two more quarter-point rate hikes down the road), although the recent GC meeting does leave the puzzled. Namely services inflation is picking up, Madame Lagarde acknowledged that recent deals with German trade unions represent upside risks for inflation figures. Still, nevertheless, the statement said that “incoming information broadly supports the assessments of the medium-term inflation outlook”. This is indeed the most mysterious point of yesterday’s GC meeting – where does Frankfurt see this info about weakening inflation outlook (maybe econometric models)? Since it’s clear that the food and energy components of the headline figure are contributing to lower medium-term inflation, the core EC inflation at 5.6% YoY (April 2023 data) tells that even the 3.75% terminal rate (which markets are doubting) might not be restrictive enough. At least not before you factor in APP 25bn EUR/month roll off starting in July.

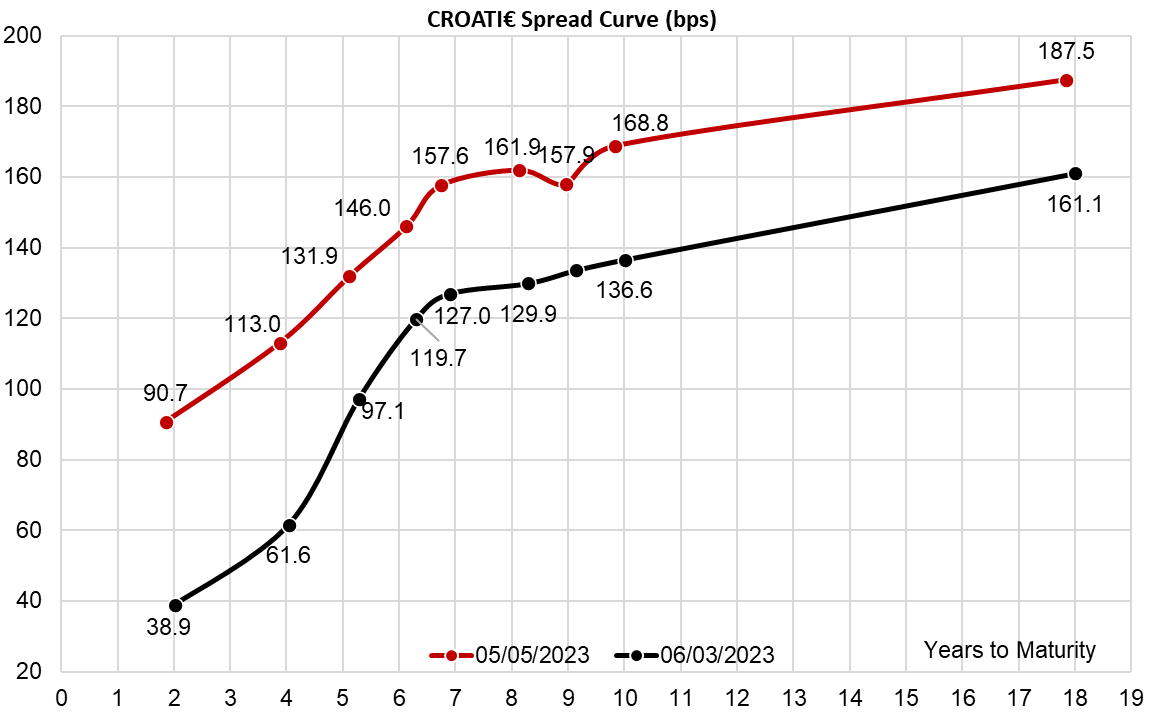

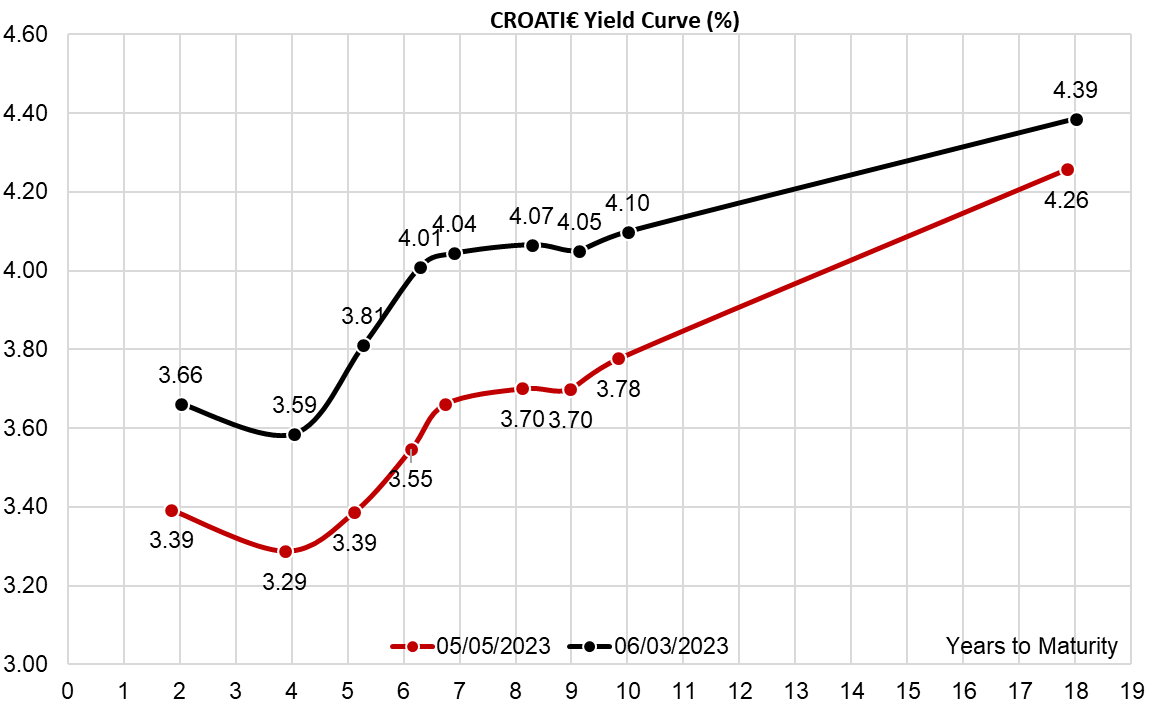

What does it all mean for Croatian international bonds? This week’s 1Y treasury bill auction ended up with yields reaching 3.50% and this has satisfied asset manager’s demand for short-term paper, at least in the following few months. More interesting, the 2Y paper (CROATE 3.65 03/08/2025€) is traded at 100.60 (3.30% YTM), which is some 20bps shy of 1Y TB yield, Naturally, asset manages/pension funds/insurers that are after this duration are aware of their inability to purchase 2Y 3.30% yielding paper in decent size, but the good thing is that CROATI 3 03/11/2025€ can still be found around 99.25 (3.42% YTM), which is even closer to the 1Y paper in terms of returns. More importantly, demand is picking up on longer-dated paper. CROATI 1.125 03/04/2033€ can be found in decent size at 78.80 (3.74% YTM, 155.8bps above DBR 2.3 02/15/2033€) and buy-side is taking larger sizes of this paper in spite of the imminent possibility of new Croatian bond before summer. Notice however that all of the paper we mentioned is traded in a very tight YTM range of 3.40%-3.74%. Demand for longer bonds might be an indication that the buy-side thinks 3.75% returns in spite of being close to analyst expectations of a terminal rate in Europe still won’t last for a decade, so it sounds prudent to lock these returns in while they’re out here. Hopefully, more opportunities to lock these healthy returns would come in the following weeks with the expected 1.5bn EUR Eurobond placement.