Back in 1950 Japanese film director Akira Kurosawa taped his seminal movie Rashomon, in which several perspectives of the same event are used to depict a more comprehensive picture and develop a deeper understanding of forces shaping peoples lives. Today we will use a handful of data sources (perspectives, if You will) to try to develop a deeper understanding of forces driving te recent appreciation of EURHRK exchange rate, and possibly get a glimpse of what might lie ahead. The two principal perspectives are generated from flow data (compiled by the central bank regarding spot transactions) and the effect of gradually increasing kuna deposits and loans in commercial banks’ balance sheets.

Past month has been marked by exceptional appreciation of euro versus kuna – although its quite common for EURHRK to move up in early fall after the tourist revenues dry up, the scale and speed of the move is something that got everybody’s attention. By looking at the Bloomberg’s SEAG function, we concluded that in terms of upside EURHRK volatility we have just seen the best October since 2012.

Central bank data about spot transactions reveals some insight about what lies under the hood (we’re looking at the N4 table compiled by the central bank). In the past month, larger than usual FX trading was recorded on a handful of dates, and each time it was driven by exceptionally high demand for euros coming from legal enterprises (i.e. government and corporates). But to fully understand the chain of events that drove EURHRK to a two-year high, we might look back to June 2019 for more clues.

Back then the Croatian government placed a total of 1.5b EUR of brand-new international bond (CROATI 1.125 06/19/29) and generated proceeds amounting to 1.47b EUR (notional multiplied by 98.148, a reoffer price). According to the latest central bank bulletin and corresponding Excel files, about 710m EUR of the total proceeds were deposited with the central bank, while the remainder was probably converted into local currency and subsequently deposited with the central bank as well (this notion could be validated by looking at G11 table compiled by the central bank; cell LU34 shows that 662.6mio EUR were traded between the central bank and the Ministry of Finance, roughly corresponding to the remainder of the proceeds). The proceeds were intended to be used to pay off the 1.5b USD notional of the international bond CROATI 6.75 11/05/19, becoming due tomorrow (November 05th). Since this is the only USD-denominated international bond issued by Croatia without the accompanying FX swap to transform the liability from USD into EUR, some 1.36b EUR would be required to settle this paper with the current EURUSD exchange rate.

According to the central bank balance sheet (the C1 table), Croatian government bought some euros in the secondary market in September, driving the FX deposit with the central bank to about 978m EUR. Additional 380m EUR would be required to settle the debt maturing tomorrow and although government has ample cash, still this cash needs to be converted into appropriate currency (this implies buying EUR in the domestic market and then converting it into USD at some point in time).

It’s quite plausible that the Ministry of Finance was buying euros to settle the international bond maturing tomorrow – this would explain the direction of the market, as well as the concentration of the flow.

Why didn’t the government buy foreign currency directly from the central bank? To answer this question, take one more look at G11 table: historically, it was quite uncommon for central bank to sell foreign currency to government. Although that happened back in February when 463m EUR were sold to Ministry of Finance in order to pay for the maturing FX-denominated treasury bill (RHMF-T-906X), still You would have to go back to October 2012 to see the second-to-last large sale of foreign currency from the central bank to the government. History teaches us that for some reason these transactions are not so common and it’s reasonable to assume that to buy the required FX, government simply had to rely on it’s own devices, i.e. the secondary market.

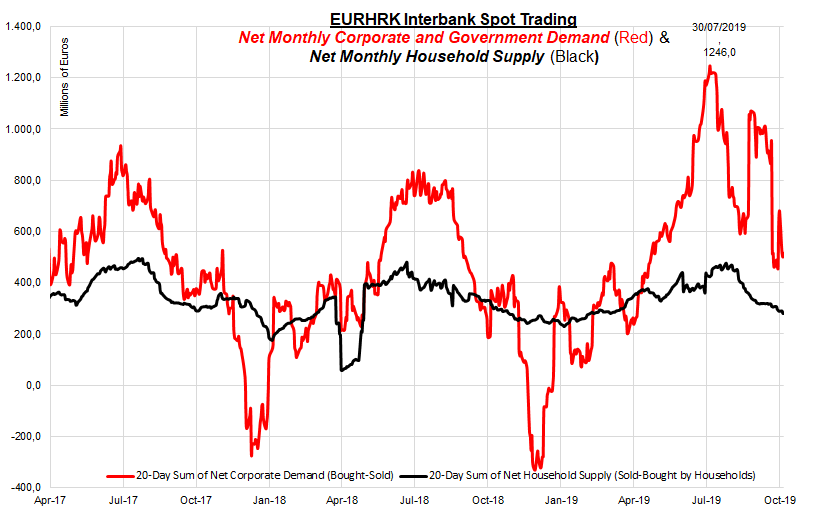

Back to spot transactions on Croatian FX market – unfortunately, the table N4 (daily FX turnover) reveals very little about the possible direction of EURHRK exchange rate, and moreover it can occasionally be misleading. Take a look at the chart submitted below (“EURHRK Interbank Spot Trading”) on which we depicted monthly net purchases of legal persons (corporations and government units, red line) versus monthly net supply of foreign currency by individuals (black line). To make sure You understand what each curve represents, observe that on 30th July 2019 there was a net corporate demand for euros in size of 1.246b EUR. This number means that in the 20 working days preceding July 30th Croatian legal persons bought a total of 2.213b EUR and sold a total of 967.2m EUR, netting a value of 1.246b EUR (small differences are caused by rounding). The trouble with this figure lies in the fact that this includes only spot transactions – swaps and forwards, a more liquid market, is not included, meaning that we’re observing only the tip of the iceberg of demand by legal persons. Nevertheless, this chart is really useful in visualising the point in time when the corporate demand starts shifting into negative, i.e. when corporations become a net supplier of foreign currency. It usually happens between mid-December and mid-January and it’s reasonable to assume that this flow is driven by FX speculators.

Another angle on EURHRK dynamics comes from commercial banks’ balance sheets.

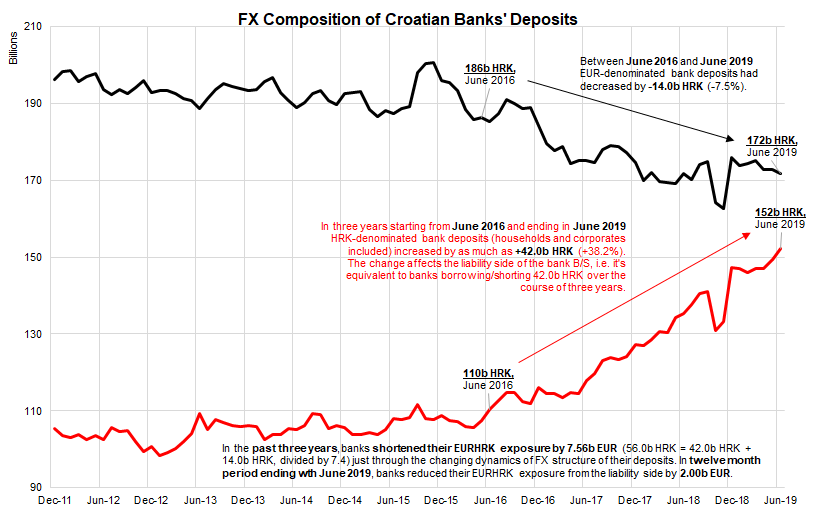

First a couple of words about the anatomy of Croatian banks. In June 2019 Croatian banks had an aggregate B/S in size of 420b HRK; on the liability side total deposits make up about 340b HRK (44.7% HRK-denominated, 50.4% EUR-denominated, close to 4.0% in USD and remainder in CHF). The currency structure of overall deposit went through a significant change in the last three years, as chart depicted below clearly demonstrates. It’s curious to note that in the last twelve months the size of local currency deposits increased by 14.8b HRK (the change in EUR deposits at the same time is too small to be considered important). In other words, looking at just the liability side, the short EUR position is gradually decreasing (i.e. EUR-denominated deposits are shrinking), while the short HRK position is increasing (HRK-deposits are on the rise) – this means that the banks are going long EURHRK through the changing structure of their liabilities. If nothing was happening on the asset side, they would have to sell EURHRK to hedge themselves against strengthening kuna.

What were banks doing to hedge themselves against weakening euro/rising kuna? A significant part of FX hedging came from the changing FX structure of bank loans, although You have to know one more thing about the anatomy of Croatian banking sector: in absolute size, they’re much smaller than deposits (as a matter of fact, in June 2019 overall bank loans amounted to 254.9b HRK). Nevertheless, it’s worth mentioning that according to the table SP4 (compiled by the central bank as well), since June 2016 EUR-denominated loans decreased by 27.2b HRK (to 143.0b HRK), while HRK-denominated loans increased by 21.8b HRK (to 109.2b HRK). Through the changing loan structure Croatian banks effectively went short on EURHRK. The trouble with this analysis is that it’s still difficult to see the off-balance sheet items, preventing us from delivering the final verdict on the effect of bank B/S rebalancing on the EURHRK exchange rate.

In other words, commercial bank B/S data can also deliver misleading results, for the sole reason that it simply doesn’t convey all of the necessary data.

So where exactly does that leave us? Famous forecaster Nate Silver said that before engaging into forecasting You should try to determine what You can forecast effectively. In other words, the recent purchases of euro on the secondary market (regardless of who did it) have increased the amount of local currency in the financial system by considerable amount. It’s a question of time when this liquidity might start spilling over into liquid financial instruments – local bonds might be a target in this process. Currently, this spill over is on hold because it’s clear the government is planning to hold a local bond auction in the coming weeks to roll over the maturing RHMF-O-19BA. It’s quite likely that cash rich market participants are waiting to see what they might get on the primary market. Nevertheless, the liquidity is ample and it’s quite likely that after the primary market ends, HRK-denominated fixed income paper might be bought into year end. That is… unless the eurobond yields start moving up.

If You think this is complicated, try watching Kurosawa’s Rashomon. Then please read this research piece one more time.

It will look much simpler than the first time.