On February 15th, 2025, Christopher J. Waller, widely regarded as one of the most influential FED policymakers, delivered his 2nd speech on stablecoins, emphasizing their importance in strengthening and extending the dollar’s global reserve currency status. During the White House Crypto Summit on March 7th, United States Treasury Secretary Scott Bessent said the US government would use stablecoins to ensure that the US dollar remains the world’s global reserve currency. President Trump told the summit that he hopes lawmakers will get a comprehensive stablecoin regulatory bill to his desk before the August Congressional recess. So, what are stablecoins, and how exactly could they play this role? This introductory piece aims to clarify the basics behind this innovation, namely use cases and business models.

Stablecoins are a type of digital asset designed to maintain a stable value relative to a sovereign currency, hence the name. Specifically, liquid and safe assets (such as US treasury bills, cash, and gold) are pooled as a reserve so that stablecoins can be redeemed for traditional currency in a timely manner. Generally, they’re backed at least one-to-one, but they can also be overcollateralized in terms of reserves. Since traditional money is not used to move assets on public blockchains, stablecoins help fill that gap as an “on-ramp” for digital asset trading. Stablecoins play a key role in being an anchor in a market that lacks a safe haven during volatile episodes, increasing market depth and liquidity. As any means of payment, stablecoins must demonstrate a clear use case and a clear economic case in terms of a business model, which is necessary for stablecoin Issuers to continue operating.

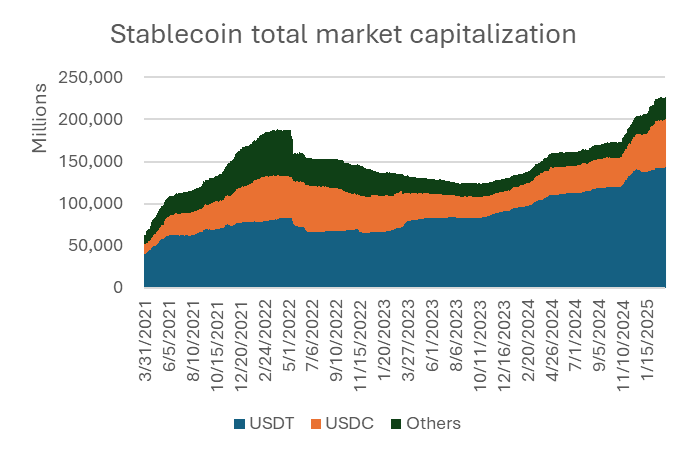

USE CASES: Stablecoins are mainly used as a store of value on-chain. Every financial market needs a less volatile asset with a stable price that can be used by traders to preserve capital while not actively trading. That is the trick: if a market craves such an asset, supply will emerge. That is how stablecoins were created. Since the U.S. dollar is the world’s reserve currency, it is no coincidence that most stablecoins have their value pegged to the dollar. In this sense, they can be thought of as synthetic dollars. Since the dollar serves as a global medium of exchange and a most liquid store of value, by their tie to the dollar, stablecoins represent an equivalent in the crypto ecosystem. The secondary use case is to provide a means to access and hold U.S. dollars. Since digital assets are mostly priced in dollars and 99 percent of stablecoin market capitalization is in dollars, stablecoins could be of great use to people in high-inflation countries or to those without easy or affordable access to dollar cash or banking services. As Chris Waller said: “I believe that stablecoins have the potential to maintain and extend the role of the dollar internationally”. Also, stablecoins can be used in cross-border payments. The idea is to reduce the cost and complexity of cross-border money transfers while also improving transparency and timeliness of the execution. The most common model is called “stablecoin sandwich”, in which fiat A is converted into a stablecoin and transferred to the recipient, who later converts it to his local currency. Anti-money laundering laws and relevant consumer safeguards are crucial to developing this use case. Alternatively, stablecoins can be used in retail payments. The current industry focus is on the usage in P2P payment apps and POS payments. However, current stablecoin usage in retail payments is limited, and it remains uncertain whether this use case will scale since consumer retail behavior is sticky, suggesting this use case is not yet on the near horizon.

BUSINESS MODELS: Alongside relevant use cases, the Issuers must have a sustainable business model. The majority of stablecoin Issuers appear to induce profit primarily by earning larger returns on their reserves than they pay in expenses. They issue a zero-interest liability and use the inflows to acquire assets that yield interest (T-bills), benefiting from the spread. Like with bank deposits, the interest rates are a significant determinant of the Issuer’s profitability. Usually, higher market interest rates result in a higher spread for the Issuer, but higher rates can also dampen demand for non-interest-bearing assets. However, the demand from less interest-rate sensitive users such as ones that hold stablecoins as a safe store of U.S. dollar denominated value might not be that elastic, a phenomenon we already see today with some holders of physical U.S. dollars. Alternatively, Issuers can induce profit is through fees such as charging, minting, and burning fees, which incur when a user acquires a new stablecoin for real dollars or wants to redeem it for real dollars. Furthermore, as it progresses amongst most payment firms, a source of income can come from transaction fees. Eventually, stablecoin issuers may use stablecoins as part of a broader strategy to attract users to whom they may pitch other products and services. In that case, stablecoins could be deemed as a “loss leader” to attract clients to use other products or services offered by the Issuers that are much more profitable for them. The viability of the other business models will depend on the capability of stablecoins to scale as a means of payment and on how consumers and businesses respond. To illustrate, if the Issuer decides to pass through interest earnings on its reserve assets, that increases the demand for their stablecoin at the expense of the contracting profit margin. The lower the profit margin, the more important scale becomes. As industry competition for market share intensifies over time, Issuers will face reduced revenues and profits from stablecoin issuance, as well as declining fees due to new market entrants.

source: DefiLlama, InterCapital