When you’re on a roll, obviously not even Friday the 13th can do anything to slow it down. Croatia received its long overdue credit rating upgrade last Friday and Fitch is expected to publish its report this Friday (September 20th). Are we waiting for the second shoe to drop (one more credit rating upgrade from BBB+ to A-), or has it all been priced in already? Find out in this brief research piece.

Absorption of EU funds, tourism inflows, and relative fiscal prudence contributed to the long overdue Croatian credit rating upgrade to A- with a positive outlook. This is the essence of the verdict delivered on 13th September by S&P Global Ratings. The rating agency highlighted the fact that the 2021-2023 Croatian economy expanded by an average of 7.6% YoY and managed to reach 76% of the EU average in 2023. We do remind our readers that the population census of 2021 might have had a hand in this since it decreased the denominator significantly through population decrease (a 10% decline between the last two censuses). Additionally, the rating agency notes that the convergence to euro area peers might have more room to run since GDP per capita is expected to rise by an additional 25% in 2024-2026.

The kicker of the 20-page report published by S&PGR is that even if tourism falters in the short term, EU fund absorption should cushion all the potential weaknesses. Namely, Croatia has a share of EU funding to GDP of 24.5% GDP (second highest!), but the good thing is that it’s spread over multiple envelopes with different expiry dates. The agency also praised the diversification of energy supplies (notably through the LNG terminal on the island of Krk) since it opens up the door to more energy exports, especially after additional pipeline connectivity is added in 2025.

With respect to the fiscal side of the GDP equation, S&PGR acknowledges that a strong labour market, rising wages, and tourism receipts have strengthened the revenue side of the budget, but nevertheless more work could be done on the expenditure side. Nevertheless, the agency also notes that the principal driver of recent budgetary deficits could be found in still-running anti-inflation measures (electricity price cap, lower fuel excise duties, etc.) that are expected to be gradually phased out in 2024. The new legislation aimed at public wages means that it’s quite unlikely that the public deficit drops below 2.0% of GDP in the near term (the government’s own forecast is 1.5% in 2026). On the other hand, strong GDP growth ahead also means it’s quite unlikely it can rise above 3.0% GDP either.

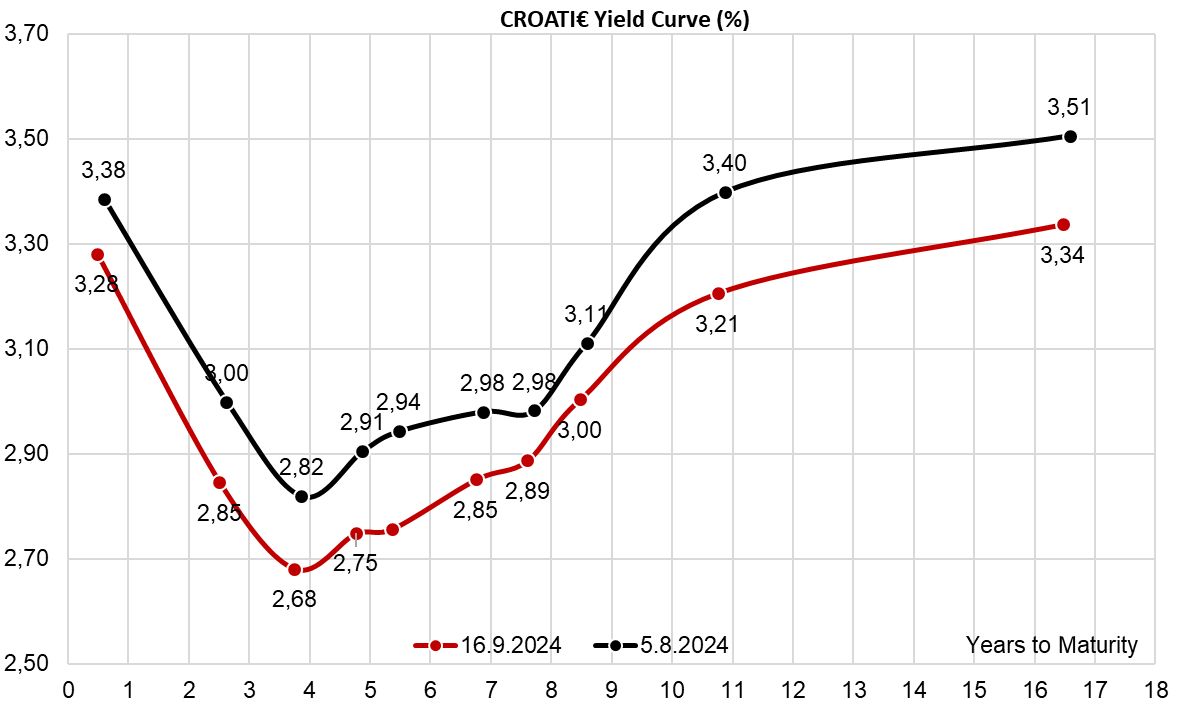

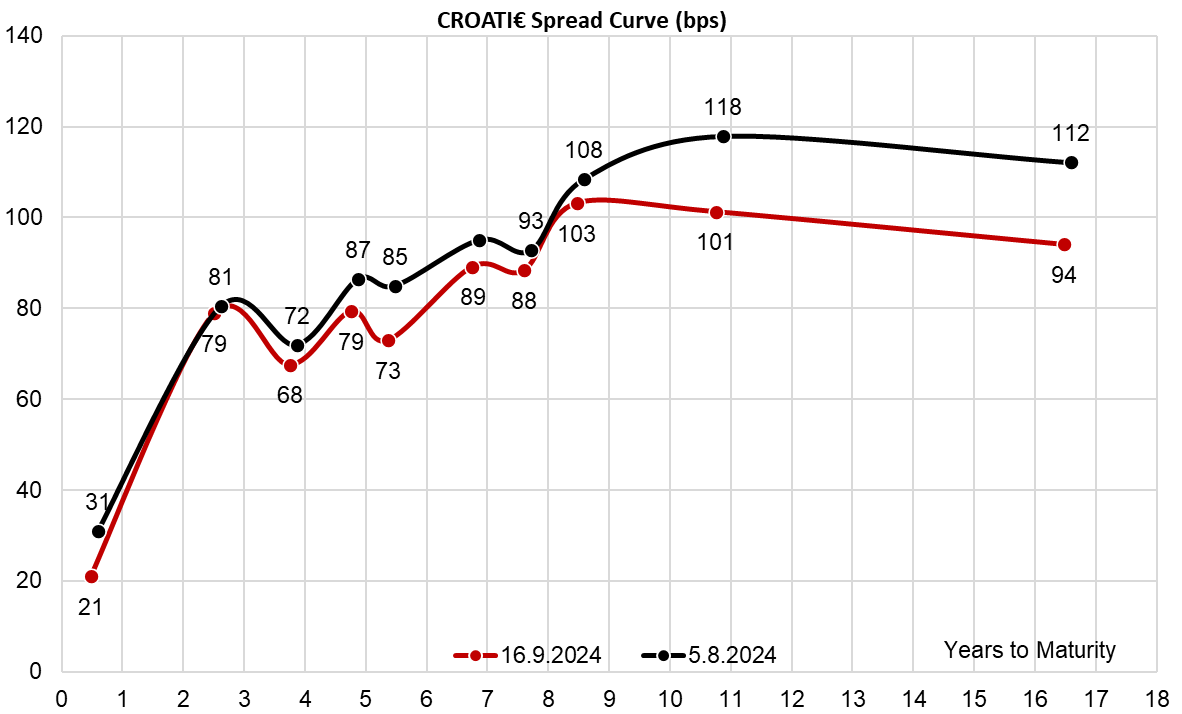

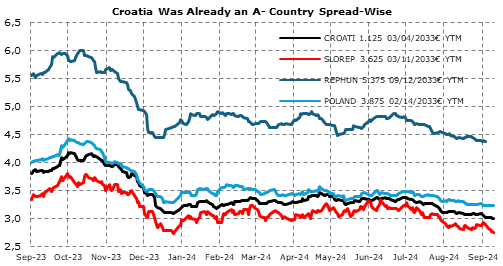

What does all of this mean for financial markets and bond spreads? CROATI€ has been traded by a razor-thin spread to Germany by at least two years and currently, there are only two papers traded wider than B+100bps (CROATI 3.375 03/12/2034€ at B+103bps and CROATI 4 06/14/2035€ at B+100bps). Compared to CEE€ peers, this yields that the rating upgrade has already been in the cards and discounted in the yield equation.

To compare it with other peers, SLOVGB 3.75 02/23/2035€ is traded at 3.40% YTM (B+126bps), while Polish international bonds are also traded some 20bps wider than CROATI€. We do however expect that the next bond rally (Christmas?) might extract the last remains of the term premium on the CROATI€ curve and bring 34s and 35s below the 90bps line, exactly where they belong once you model the yield curve. There’s a caveat of course – some traders believe it’s not the 34s and 35s that are mispriced, but rather the rest of the curve due to poor liquidity. Time would be the judge on that. In the meantime, our focus is set on Fitch reviewing Croatian credit rating this Friday, September 20th, just two days after FOMC’s decision to lower the rates (25bps/50bps is still too close to call). In a nutshell, things are looking bright for Croatian bonds, despite the upside being capped.