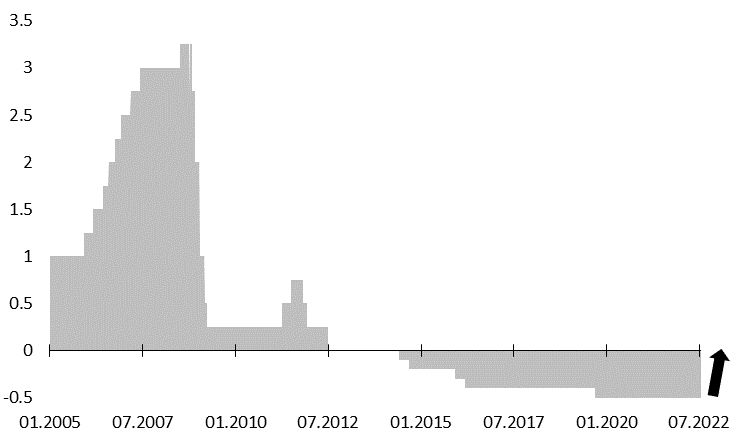

Yesterday marks another era as ECB raised its rates after more than 10 years and it had done that by 50bps surprising the market. ECB’s deposit rate currently stands at zero but is expected to rise further in September. Transmission Protection Instrument (TPI) was also announced although BTPs spread rose further. In this article, we are looking into more details on yesterday’s meeting and what could be expected for the rest of the year.

“Accordingly, and in line with the Governing Council’s policy sequencing, the Governing Council intends to raise the key ECB interest rates by 25 basis points at its July monetary policy meeting… If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting.” This is the part of the statement from the ECB’s monetary policy meeting from June 9th, 2022, and the stance on hiking by 25bps was confirmed several times after by Ms Lagarde and other ECB officials. However, only a week before yesterday’s meeting there was some media speculations that ECB could hike by 50bps as hawks became louder and because that would leave doves with some dry powder to negotiate better terms on TPI. In any case, yesterday ECB decided to lift its rates from negative territory and approved the Transmission Protection Instrument although it needs another decision before it starts the instrument.

In the statement, ECB said that further normalization of interest rates will be appropriate while the frontloading to exit from the negative interest rates will allow GC to make a transition to a meeting-by-meeting approach. In plain English, forward guidance from June should be scrapped (confirmed by Ms Lagarde in Q&A session) and ECB will not have any forward guidance but will be flexible from meeting to meeting. This means that despite it decided to lift rates by 50bps yesterday, ECB is still not prepared to pre-commit to bigger rate hike rates but would rather listen to the market and look at the inflation and economic data each month. What will happen in case inflation comes around 7.0% in August (vs 8.6% in June)? Will the ECB pause rate hikes, or hike by only 25bps as inflation decelerated? This question will stay unanswered until the next meeting and so on which will obviously increase volatility in financial markets. Yesterday we saw bund yields rising from below 1.30% to almost 1.40%, only to reverse the trend and end the day at 1.20%. Volatility was similar in short-term papers as well, with Schatz rising from 0.63% towards 0.80% and falling to 0.60% levels once again.

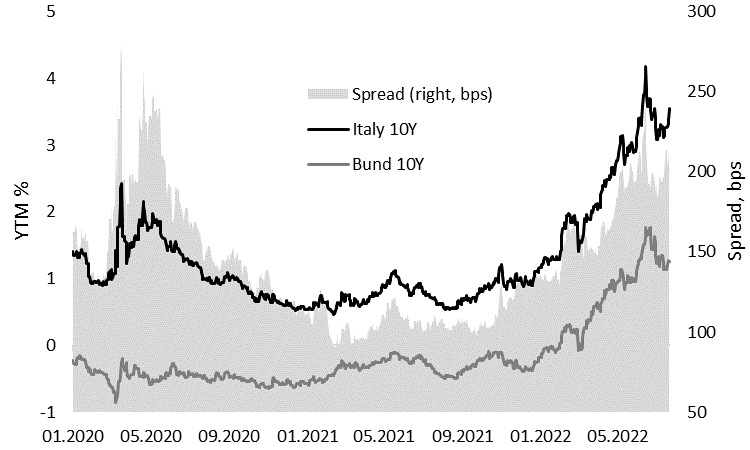

Regarding the TPI, the statement says that purchases will not be restricted ex-ante, but Ms Lagarde said that she would rather not use the newest tool if she does not have to. Furthermore, in the separate statement, there were several criteria mentioned that should be fulfilled to conduct purchases under the program. The criteria include compliance with the EU fiscal framework, absence of severe macroeconomic imbalances, fiscal sustainability, and sound and sustainable macroeconomic policies. It is still not clear how ECB will assess all these criteria fast once the spreads go wild in case of any risk-off scenario but that is to be seen when the event occurs. The main reason for introducing the new tool was to stop spreads from widening, especially the Italian one but the announcement of the program did not compress spreads as the BTP 10Y spread stood close to 230 bps before and after the announcement of TPI.

To sum it all up, this was one of the main events this summer and it did not disappoint in terms of surprises. However, we think that the ECB’s decision to not have clear forward guidance will make markets more unstable while it still did not show details on how it plans to stop spreads from widening once the spreads increase briefly.

Talking about the anti-fragmentation tool, it is worth bearing in mind that this week Mr Draghi resigned as Italy’s prime minister as he did not get support from three parties in the government in a confidence vote in the senate. In his second attempt to resign (the first was denied by President Mattarella), the Italian president accepted the resignation but asked the ex-ECB governor to stay as caretaker until the snap elections that could take place already in September. Current polls show that the right-wing could take the victory and it will be seen whether TPI is enough powerful monetary incentive for the new government to implement reforms to be eligible for TPI. Or maybe, ECB will shoot from its bazooka and later say that the criteria is flexible similar to their forward guidance.

Chart 1. ECB Deposit Facility Rate

Source: Bloomberg, InterCapital

Chart 2. 10Y Italy-Germany Spread

Source: Bloomberg, InterCapital