How can bad macro news cause financial markets to rally? Easy… if the central banks says that this builds up the conviction that it might be a good time to think about interest rate cuts to spur growth. Read more about it in this short research piece.

Concerning the developments on the global financial stage, let’s begin today’s remarks with a simple glance at the FFZ9 Comdty on BBG – this is a Fed fund future maturing in December and the contract is currently traded @ 98.255. This implies 1.745% (100 – price) effective Federal fund rate in December, meaning that financial markets currently expect two or three rate cuts by the end of the year. Surprising, isn’t it? Rate cut expectations lifted US equity indices, as well as fixed income prices across the board – this is the reason why for instance the German Bund is currently traded @ -0.225% YTM, the lowest it has ever been.

Speaking about the macroeconomic basis for expecting such an accommodative monetary policy in the near future, it’s worth mentioning that ADP employment change (a vague indicator of Friday’s NFP) disappointed yesterday @ 27k versus 185k expected and 275k a month before. Also, FED officials have recently been preparing the global Wall Street for a possible start of a new wave of accommodative monetary policy should the economy surprise to the downside. By this we refer to the most recent comments made by James Bullard, but also on the key takeaways from FED’s framework conference in Chicago that ended yesterday.

Speaking about the conference, it was organized around long-term goals, tools, and communication strategies, but nevertheless a couple of FED officials that made any statements couldn’t avoid questions about the direction of monetary policy. FED Chairman Jerome Powell expressed his concerns about mounting trade wars between USA and apparently everybody else, stating that the central bank „will act as appropriate to sustain the expansion“. It was just the markets wanted to hear – not really a commitment to cut rates whatever happens, but a promise that accommodative policy would be turned on to shoulder the burden of a possible slowdown ahead.

Powell’s and Clarida’s statements were the only communication from FED officials that gained significant attention, but it seems that central bank rank and file came to the conference to listen to experts, not to express their own views. Same of the conclusions the speakers made were that the labor market in the United States is not so tight as previously thought and that full employment might have been attained quite recently, or not at all. Also, the speakers touched on the relatively novel idea of abandoning inflation targeting as one of the monetary policy goals and introducing nominal GDP targeting instead. Nevertheless, this would require a major FED overhaul and departure from it’s dual mandate.

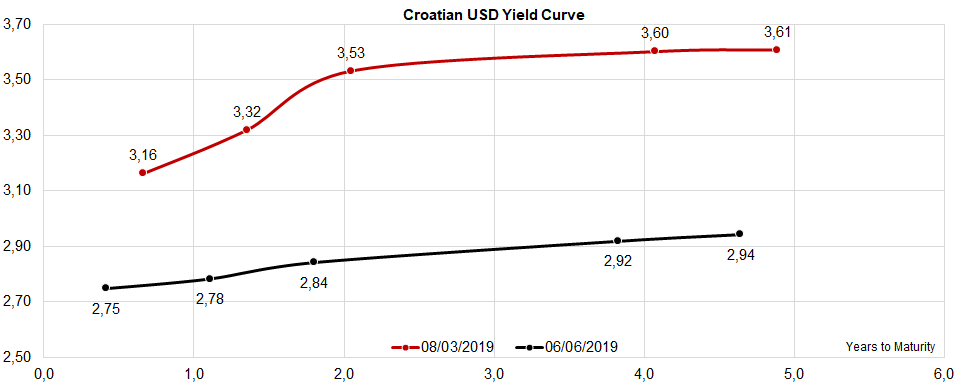

To sum everything up, FED officials perceive the weakness in the US economy and are prepared to act if necessary; the markets believe that it’s quite necessary, but at this point in time three rate cuts in 2019 look a bit farfetched. Speaking about Croatian USD international bonds, the entire curve shifted to the South and currently there’s no USD bonding yielding more than 3.00%.

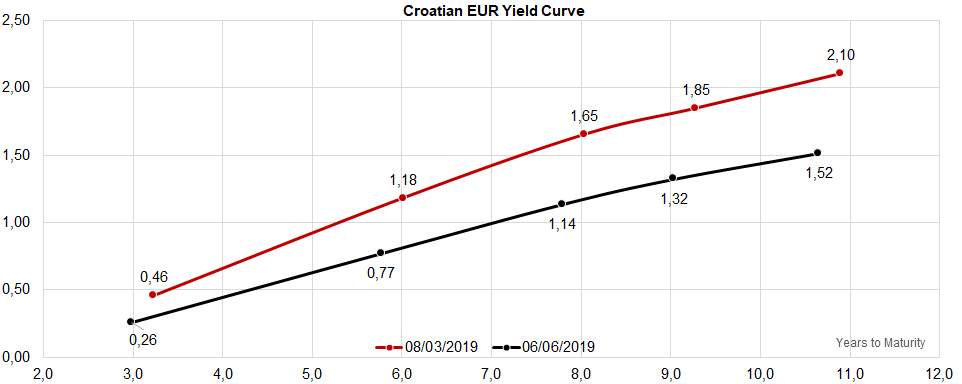

Looking at the EUR curve, the first thing captivating our attention is that lack of supply became ubiquitous across most of the CEE/SEE countries and in the case of Croatia this is quite apparent. This lack of supply makes it hard to source significant quantities of longer dated bonds, but hopefully that would change in the near future since the government plans to issue a brand new international bond any time soon.