We have a feeling that a lot of long fixed-income positions taken recently depend upon a few good CPI prints – and yet FOMC tends to downplay recent inflation deceleration. Why did they do that and what can we expect moving forward? Well, you’ll just have to read the article to find out.

Tuesday’s November US headline CPI reading continued its slide all the way down to +7.1% YoY from a peak reached in June at +9.1% YoY. US Core CPI is also lower at +6.0% YoY after peaking in September at +6.6% YoY (that was a four-decade high and if we’re fortunate enough it might be something you tell your grandchildren about). Nevertheless, the consumer price story is showing clear signs of bifurcating because although goods prices stayed flat or even dropped on an MoM basis, service sector inflation remains elevated and this is probably where wage growth from BLS’s survey continues to bite. Considering the former, it’s worth mentioning that gasoline has dropped to about 3.25 USD/gallon, from the mid-June peak of about 5.02 USD/gallon. More good news came from OPEC’s global oil supply outlook for 2023 stating that the Vienna-based institution doesn’t expect any significant drop in the supply of Russian crude next year, despite the price cap. This is all good news, but still not sufficient to claim that medium-term inflation is poised to drop all the way back to the 2.00% YoY goal. For that to happen we really need the other shoe to drop as well (service sector inflation) so in the coming CPI prints we won’t be looking at the headline inflation at all, just the service-related component to get more clarity about the FED pivot.

Now to the more important events such as yesterday’s FOMC. On Tuesday the most successful FED analyst Nick Timiraos (WSJ) presented his map of the current monetary policy tightening, breaking it up into three parts. In the opening phase of tightening, FOMC found itself behind the curve, fooled by economic models, and had to hike aggressively in order to make up for the lost time. The four consecutive 75bps hikes rocked global financial markets and this is the reason why almost every asset class reports negative YTD returns this year. It’s worth mentioning that the last three out of a total of four jumbo rate hikes got unanimous support from the FOMC. In the second phase starting from yesterday, FOMC is not behind the curve anymore, but it’s not really there yet in terms of terminal rates, so more modest rate hikes could be expected. The most hawkish thing we have observed on yesterday’s dot plot is that the median 2023 dot moved up by 50bps to 5.125%, meaning that we have only three steps left before reaching the terminal rate. Reaching the terminal rate would mean the end of phase two and in the final phase, the crosshairs switch away from flow elements of the monetary tightening (i.e. raising rates) to the stock elements (i.e. keeping them elevated as long as it takes). Notice that both FED and the markets broadly agree on what would happen in the first two phases but diverge on what would happen in the third phase. Notice also that the dots imply a 5.125% FED fund target rate by the end of 2023 with seven eagles in an otherwise hawkish committee seeing rates even higher. Markets see it differently – base effects and cheap goods (energy included) would be sufficient to bring inflation down and force FED to cut earlier than expected. This could be wishful thinking since monetary policy veterans in Washington see too much uncertainty stemming from the service sector to claim that the battle has been won.

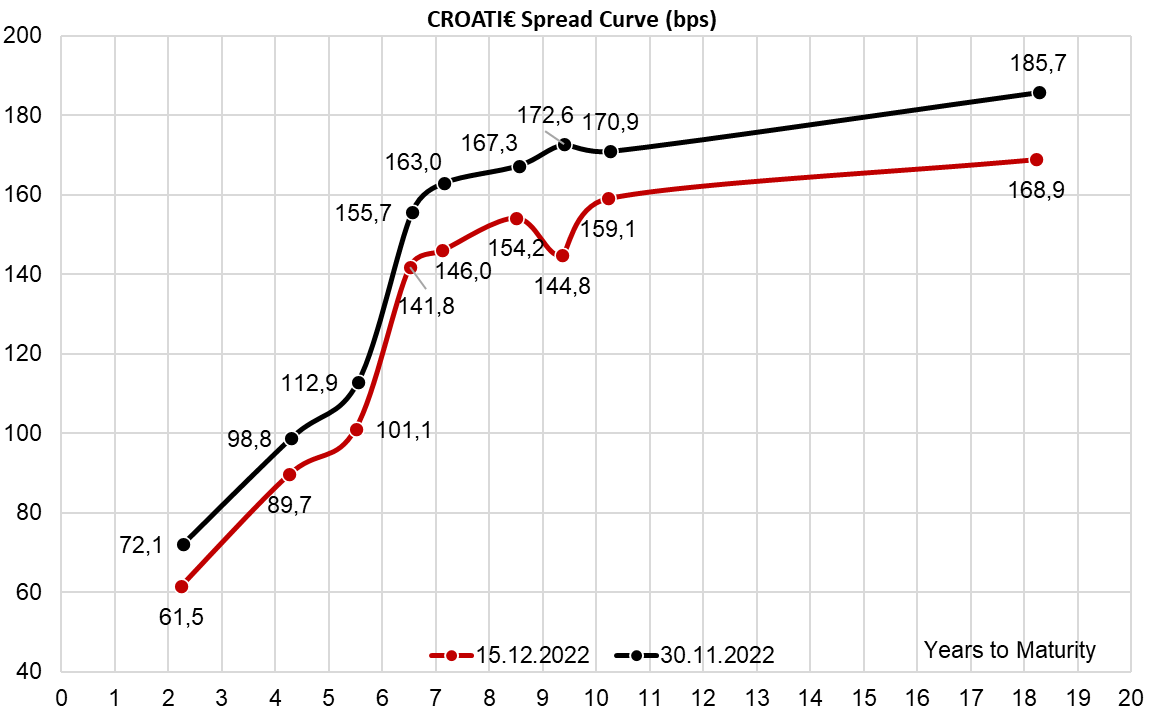

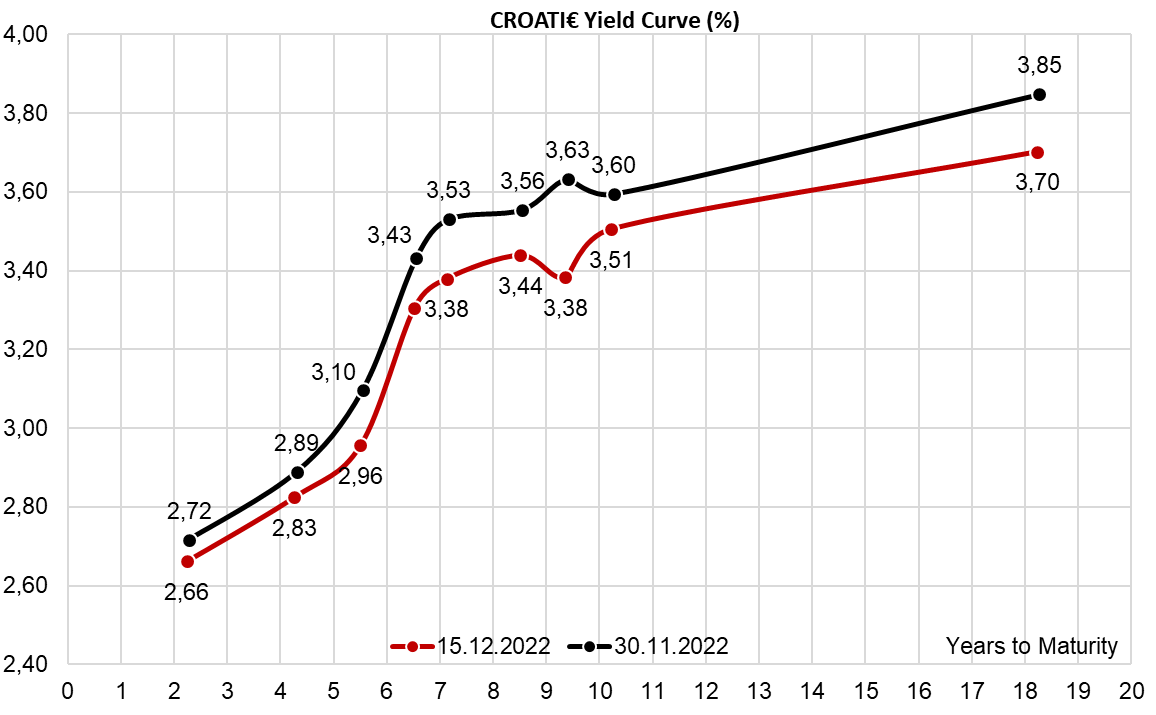

What do we make of this FOMC? Recent CROATI€ spread compression has been driven by institutional asset managers being underinvested into a turn of the year. A similar move was observed on SLOREP€, REPHUN€ and ROMANI€. A few asset managers used this opportunity to sell longer CROATI€ at razor-thin spreads and make room for the issuance-heavy first half of 2023. For instance, CROATI 2.875 04/22/2032€ could have been sold at 95.55 (3.44% YTM, B+148bps) and even better if you were lucky enough. CROATI 3 03/11/2025€ could have been sold at 100.70 (2.67% YTM, B+66bps) with a number of buyers focused on the front-to-belly part of the curve since it is precisely this partition that could be least vulnerable to another cold shower from the FED about keeping rates higher for longer. Notice that 66bps spread to German paper is just 20bps above the Spanish paper of equal duration so be careful not to cut your fingers on a spread this sharp. The bid is out there, but it comes with a time stamp that may expire by the beginning of next year.