Believe it or not, it’s been 30 years since Metallica released it’s iconic single “Nothing Else Matters“. Last week’s ECB press conference could be described by the verse “open mind for a different view, and nothing else matters“. All Christine Lagarde wanted to say last week was that inflation was skewed to get higher in the coming months and that the Governing Council (GC) wants to keep an open mind to the prospects of interest rate hikes if the CPI prints get out of control. What happened to the global bonds and what can we expect in the coming months? Find out in this brief research piece.

Recent five trading sessions have been quite a roller coaster for fixed income investors. Exactly one week ago ECB’s GC meeting came with unchanged statement, but the devil was hiding in the Q&A session. ECB’s President Christine Lagarde underlined “unanimous concern” about rising inflation and expresses the possibility of inflation moving even higher in the coming months. Then came the magic words: “we are getting much closer to the (inflation) target”. Now, what exactly does that mean? The two large global central banks (FED and ECB) have espoused average inflation targeting to make up for the post-GFC decade of deflation, meaning that nobody really knows where their inflation targets currently are. However, fixed income traders have a gut feeling telling them that 7.1% YoY (January 2022 US CPI print) and 5.1% YoY (EA January 2022 CPI print) are not exactly the levels they want to be in the long run.

After Lagarde said ECB got a lot closer to the target, it seemed nothing more mattered to the fixed income traders. German 10Y YTM was trading at 0.05% before the Q&A session and got to 0.15% by the end of the day, just to reach 0.25% in the following sessions. François Villeroy de Galhau (head of Banque de France) tried on Friday to reduce the harm by saying that all the ECB’s GC wanted was just “optionality”, but it was too late to bring the genie back in the bottle since EGB markets were already biased in the direction of rising yields. In assessing the aftermath of Thursday’s Q&A session, let’s just take a look at ERZ2 Comdty on Bloomberg (December 2022 maturity of EURIBOR future), which is currently trading at 99.95, implying two rate hikes by the end of the year and shifting the deposit rate from -0.50% all the way up to basically 0.00%.

Markets are expecting that the negative interest rate era came to end even in the euro area. As a matter of fact, if you take a look at BNYDMVU Index (Bloomberg Global Aggregate Negative Yielding Debt, in USD), you could easily see how the value of global negative yielding debt dropped from 11.3t USD (early January 2022) to the current value of roughly 5.0tn USD and pay attention to the fact that 3tn USD of reduction happened last week.

Back to the ECB speakers. On Saturday Klaas Knot (president of De Nederlandsche Bank) came forward with a statement that rate hike in the final quarter of the year appeared to be appropriate (he ruled out two hikes), and since Thursday’s Q&A session also revealed “unanimous support for sequencing” of monetary measures (i.e. first they end asset purchases, then they hike, then possibly reduce the balance sheet, exactly in that order) and there were “one or two” members of the GC calling for immediate tightening, it’s clear that Knot is among the few hawks in the flock of doves.

What happens next? Basically, when you take a deep breath and think above the bond sell off, you can easily comprehend two factors that were important. The first one was inflation not coming down, which signalled red alert to the markets. The second one was ECB’s reaction function, namely the statement that the bank is getting closer to the target. Almost all of the ECB’s speakers stressed the importance of not jumping to conclusions and preparing for the March ECB meeting. Before that, we’re going to see to more inflation prints, bringing abundant clarity to the rate hike possibilities.

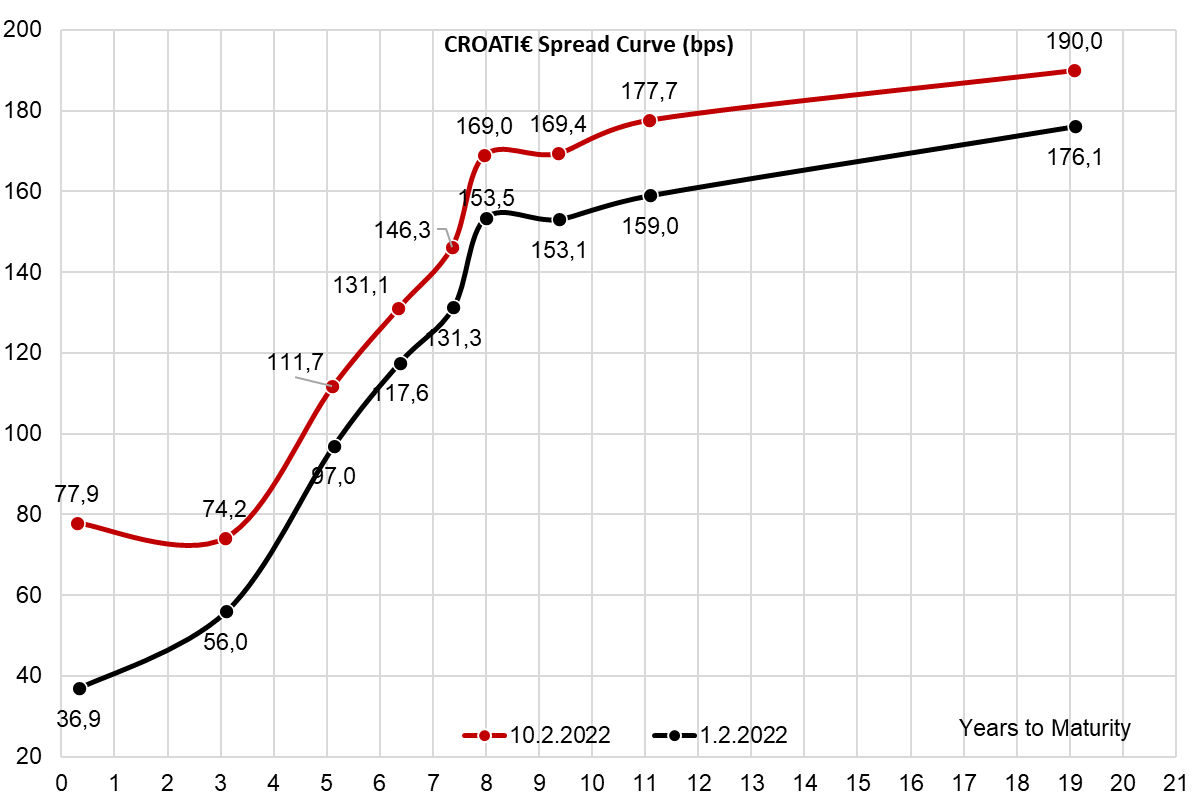

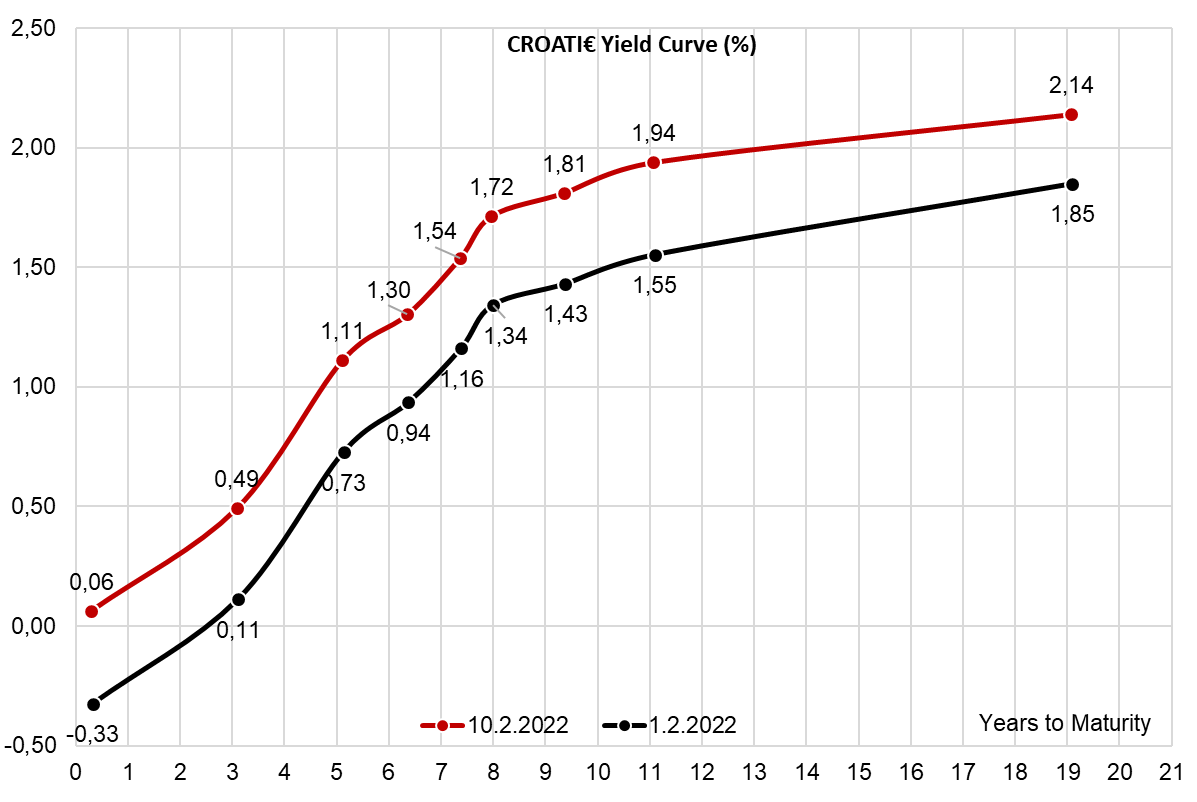

What happened to CROATIs? Let’s start with the notion that currently there aren’t any CROATI€s trading at negative YTM’s and even CROATI 3.875 05/30/2022€ is trading slightly positive. As a matter of fact, if you take a glance at the yield curve (red line, representing February 10th values), only two Eurobonds are trading at yields below 1.00% (namely, the 2022 and 2025 maturities). If you take a look at the spread curve, you could notice that the spreads got 15bps-20bps wider across the curve, excluding the already mentioned CROATI 3.875 05/30/2022€ which is maturing in three months. The funny thing here is that if you also take a look at the Italian spread curve, the spreads also got wider by about 15bps-20bps, depending upon the maturity. Eurobond liquidity is currently not an issue and we’re seeing two way flow, with the only notable exception being the ultra-long CROATI 1.75 03/04/2041€, which even on normal days exhibits somewhat tighter liquidity.