If you snoozed US labour data, here’s a quick run through: NFPs underperformed (again), yields are down, but markets still expect some sort of tapering announcement on next weeks’ monetary policy meeting. That explains little activity on the eurobond market. On the other hand, domestic investors are scratching their heads over possible local HRK bond in one months time (CROATE 2.75 07/08/2021 roll over). To find more, browse through this brief research piece.

Another cold shower for financial markets came on Friday when NFP figure came significantly under market consensus, printing 559k versus 675k expected by Bloomberg survey. And yes, this is the second time the print disappointed the analysts. Moreover, there are still some 7.3 million jobs lost since the pandemic began and at this pace this loss would not be fully absorbed until late next year. In a classical twist of bad news becoming good news if it might cause FED to postpone the tapering decision, USGG10 dropped to 1.57% and financial markets are looking closely at next week’s policy meeting (scheduled for June 15th-16th). Looking at other employment indicators, such as the broadest measure called U-6 (USUDMAER Index), it might be too early to call the “T word” on next week’s meeting: U-6 is currently at 10.2%, significantly over 7.0% in February 2020. In the aftermath of 2008-09 crisis FED responded with accommodative monetary measures, and once they were no longer needed, the reversal was done in a glacial and gradual pace: first emergency facilities were cut off, then bond purchases were tapered (FED never sold any of these securities, but instead chose to let them mature in reduce the B/S in such a way) and finally interest rates went up. The difference between then and now lies in the fact that 2008-09 was followed by a period of deflation/disinflation and this time price rises threaten to get out of control. So far, FED was successful enough in mitigating risks of overheating economy, however ubiquitous and anecdotal price rises keep markets on the back foot since nobody really knows can inflation get out of control.

Here’s something worth thinking about: BIS economist Kristin Forbes made an eye-opening research into what drives inflation in globalized/free trade world and found out that there has been an apparent shift in importance away from factors such as domestic slack and domestic inflation expectations and more towards the global slack, global output gap and global inflation expectations. Mrs. Forbes did a principal component analysis and found out that in 1990-94 period the share of global component of CPI amounted to 27%; in 2015-17 the share rose to 57%. This effectively means that you can not make accurate forecasts on let’s say, US inflation, by looking just as US unemployment data (this is just what dusty, good old Philips curve does). Instead, US inflation is strongly driven for instance by global labour slack, which is still ample given that majority of EM countries haven’t been fully vaccinated and hence their economies are not ready to fully open. Yet.

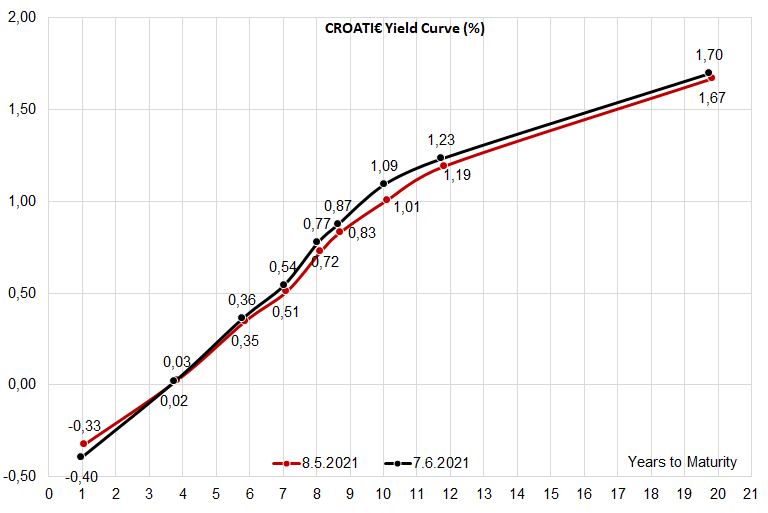

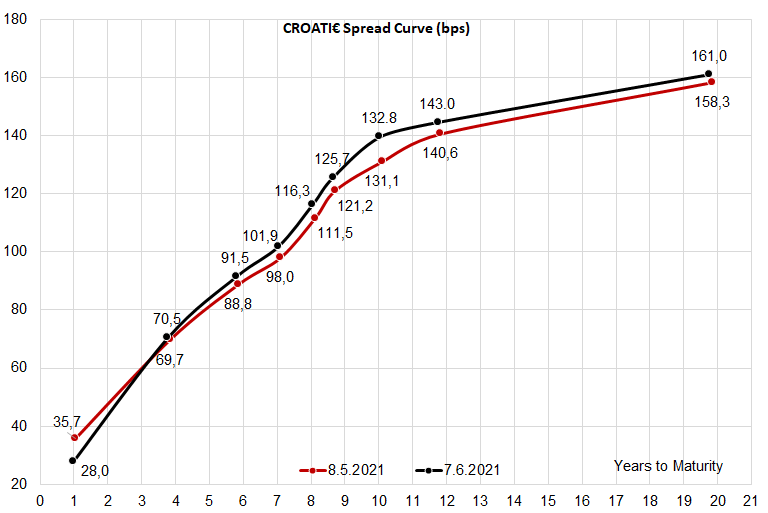

OK, so US labour market is recovering slow(er), anecdotal evidence of price growth is self-evident, however it’s not turning up in official figures (or it’s averaged out the same way used car prices are) and all of this might cause the FED to taper more slowly. What does all of that mean for Croatian bonds? If you glance at a selection of Croatian UCITS funds, they are still in red in YTD terms, but are regaining lost value looking on a shorter, one month horizon. CROATI yield curve has been frozen in time for the past month and it seems that prices you see on the screen are calculated by dealers using benchmark (mid swap or German curve) plus some fixed spread. This means that very little is really going on, although it’s worth mentioning that last week we were still seeing switches being offered by dealers with the intention of reducing duration (one idea was buy CROATI 1.125 03/04/2033, sell CROATI 1.5 06/17/2031, 5mm EUR lot). This means that market is still playing defense, cutting duration where it can and buying the paper only when it musts. Croatian investors are nevertheless focused on approaching refinancing of 6bn HRK worth CROATE 2.75 07/08/2021, which is maturing in one month’s time. Given the 66bn HRK excess liquidity, the interest is expected to be huge, however it hinges on the maturity and there haven’t been any indications on that point yet.

Source: Bloomberg