Yesterday was an exciting day because it does not happen very often that we have a major data print coming out as well as get the newest FOMC (Federal Open Market Committee) members’ freshest projections for the US GDP, inflation, and unemployment as part of the SEP (Summary of Economic Projections). What do we make of the newest developments in the US, and how do we think that affects the ECB’s monetary policy in light of the currently preached religion of data dependency? – Let’s dive in:

The day started with a somewhat softer reading of the US CPI with every number coming a tad below their respective expectations. Headline CPI is now at 3.3% YoY (0.0% MoM), and Core is at 3.4% (0.2% MoM). Without delving deep into the specifics of this print, the biggest contributors to falling inflation were vehicle insurance and airfares.

Before the press conference, we received the interest rate decision (hold) and the statement accompanied by the SEP. As Chair Powell informed us in an answer to one of the questions, members are allowed to update their projections and what they see as the most likely outcomes after receiving important data such as this one, although generally, they choose not to do so. Real GDP projections remained basically unchanged; those for the unemployment rate ticked up a bit for 2025 and 2026, while those for inflation using their preferred PCE measure went up 20bps for 2024 and 10bps for 2025, indicating that in their opinion, it is going to take a bit longer to completely tame the beast they’ve been in a clash with for more than 2 years which is when they started their hiking cycle. This change was also reflected in their assessment of appropriate monetary policy for the end of the year. The median number of cuts this year moved down from 3 to 1, although the mode (most frequent answer) moved from 3 to 2. If more of the participants updated their forecasts, taking the CPI print and its implications on the PCE Index into consideration, the median number of cuts would also probably be 2.

Moving onto the press conference where Chair Jerome Powell headlined the Committee’s view. He didn’t want to make the same mistake as the ECB a couple of meetings ago when they basically gave a guarantee to cut in June and entrapped themselves, although their opinion has most likely changed in the meantime, so he continued to preach their data dependency and how it is going to take a bit more of consecutive good prints to make the move, likewise to them getting a couple of consecutive bad prints, which led them to lose confidence that inflation will quickly move down to target. He also took stock of changes in the labour market, with unemployment ticking up to 4.0% and payroll numbers as strong as ever, assisted by strong numbers of average hourly earnings growth, noting that if they see abating pressure on the labour market, it might give them an incentive to cut.

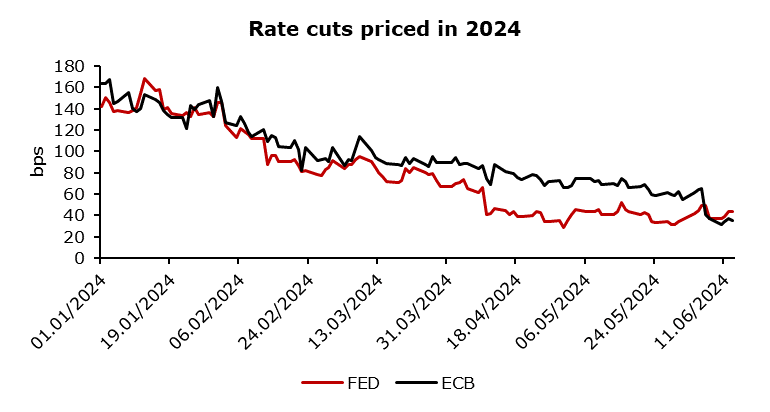

Lastly, let’s move on to the ECB and how this is going to affect their decision-making. After they volitionally moved away from the religion of data dependency and delivered their underwritten cut, they switched back to preaching data dependency with aplomb. The number of cuts priced in for this year is 1.75 for the Fed and 1.4 for the ECB (excluding the one they already made). In our opinion, it isn’t likely that the ECB will cut more than one time more than the Fed and is likely to adopt a waiting stance, taking note of developments in the US. The next couple of inflation prints (in the EA as well as in the US) are going to be crucial in determining the date of the next rate cut for the ECB. For now, it looks like it won’t happen before the summer ends.

Source: Bloomberg, InterCapital