The Croatian Ministry of Finance announced an international bond placement beginning in February (right after the FED/ECB decisions) and last week they delivered. A Valentine’s gift to asset managers? Well, the spread to Germany widened in the secondary market, with plenty of sellers coming out of the woods. Still, stars are aligned for the Croatian spread curve to tighten due to large maturities in March (~4bn EUR). Where is this cash heading? Find out in this brief research piece.

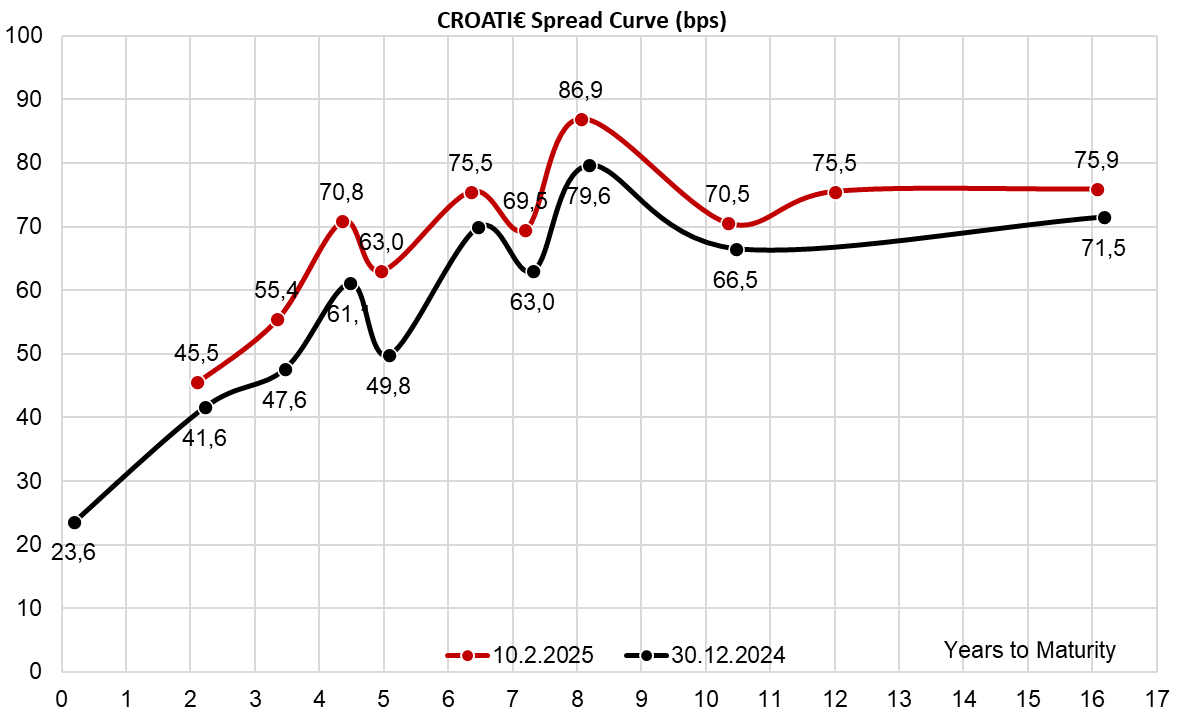

Last Tuesday, the Croatian Ministry of Finance decided to tap the financial markets and place a new 12-year paper (February 11th, 2037 maturity), 2bn EUR size. In the early morning IPTs were set at MS+120bps, which was considered quite generous by the financial markets, however as the orderbook increased these were cut all the way down to MS+90bps. In the morning fair value was estimated at MS+88bps, meaning that the afternoon pricing still gave some 2bps of NIP to the holders. Spead tightening ultimately caused the order book to decrease from 5.0bn EUR (2.5x bid-to-cover) to 4.4bn EUR (2.2x bid-to-cover). Still, it’s quite possible that the order book decrease came from price-sensitive investors aiming to load off the position in the secondary market because tight NIP spells little chance to generate income by offloading the position in grey.

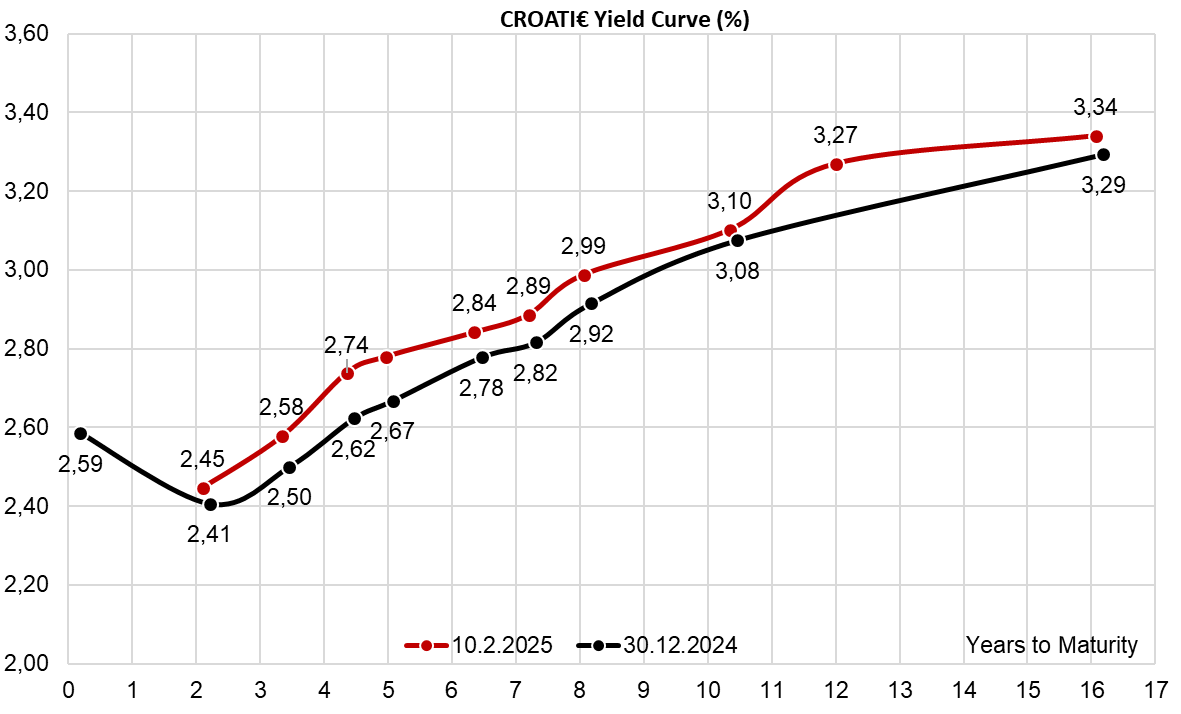

How did the paper fare on the secondary market so far? Our IB chat is still swamped with sellers with sizes up to 10mm EUR, but they don’t seem to be in a hurry since they are more or less unwilling to make any price concessions. The paper was priced at 99.746 rf (3.276% YTM, DBR 4 01/04/2037€+76.3bps), and by the end of Friday’s trading session it was at 99.77/99.88 (3.27% YTM/3.26% YTM, B+79bps/B+78bps). It’s obviously a buyers’ market out there, but notice that SPGB 0.85 07/30/2037€ (Spanish paper of the equivalent maturity, rated A-/A-/Aa1 similar to Croatia) trades at 3.25%/3.22% (B+77bps/B+74bps). By looking at the comparables, Croatian paper has room to tighten once price-sensitive investors offload excess position.

When might that happen? We have noticed something interesting in distribution by geography of accounts that bought CROATI 3.25 02/11/2037€ on the primary market. A quarter of allocations went to Croatian investors – that’s roughly 500mm EUR worth of bonds. We checked the sizes of CROATI 3 03/11/2025, CROATE 0.25 03/03/2025, and CROATE 3.65 03/08/2025 (the last one representing the inaugural retail bond placed just two years ago) and found out that just the pension funds alone have about 900mm EUR worth of maturities in March 2025. CROATE 3 03/11/2025 makes up roughly half of that size (445mm EUR); to make matters even more interesting, Croatian banks have 196mm EUR more on their balance sheets and word is on the Street that this particular duration wasn’t so beneficial for their LCR ratios, meaning that many of the skipped it. Looking at just the Eurobond redemptions in March, Croatian big money bought 500mm EUR of the new international placement, versus nearly 640mm EUR (~445 EUR+196mm EUR) of maturities just from the existing Eurobond alone on March 11th, with more to come in the following days. Still, there is no need to ring the “buy” alarm yet, because it’s quite likely we might have another dual tranche on the local market in the coming two weeks. One of these tranches will almost certainly be another retail bond.

So what happens in March? Does this >600mm EUR (we haven’t included UCITS funds, home offices, and voluntary pension funds) of outstanding cash come chasing the rest of the curve and tighten the spreads altogether? We opt for the scenario of the yield curve steepening on the 10Y-12Y part because domestic buyers might show a bid on the 5Y-10Y segment of the curve. Namely, we estimate that most of the bid would be focused on the 10-year point (CROATI 3.375 03/14/2034€ and CROATI 4 06/14/2035€). What’s quite curious about this placement is that Croatian pension funds shied away from duration – notice that 17% of the aggregate allocation went to PFs, resulting in 340mm EUR allocation in CROATI 3.25 02/11/2037€. Again, this comes against close to 445mm EUR of CROATI 3 03/11/2025€ maturity just weeks away; but our question that still needs to be answered is – if pension funds slept over the primary market because of 12Y duration, who can guarantee they would be buying on the secondary market after they receive cash from the old paper?

There are two reasons we believe they will ultimately present a bid in the future. First of all, they do keep a minimum 40% allocation to Croatian paper, meaning as the cash comes in they end up as a systematic buys of Croatian paper. Second, the steepness of the curve and scarcity on the 10Y point means that at some point even the Street dealers would become unwilling to give uncovered offers, knowing very well that there might not be another international placement all the way until March 2027 (next maturity). Shorting this paper means they might end up with a position that might last longer than some of their marriages.

Summa summarum, we still see favorable supply/demand dynamics on the CROATI curve and we are bracing ourselves for the pending local bond placement. Local bid on new CROATI€ showed us that there is certainly going to be one.

Source: Bloomberg, InterCapital