The week of November 4 was marked by the resolution of the US election, in which the upper hand was once again secured by Donald Trump. He is now poised to be the second person after Grover Cleveland to serve as the US president in non-consecutive terms. Impact on the fixed-income market was relatively muted by less uncertainty going forward stemming from the fact that it is his second term and that prediction markets were giving him slightly higher odds of winning in the days preceding the election. On the same day when the confirmation from the US was received, the German coalition broke down following the withdrawal of the Liberals after Chancellor Scholz sacked Finance Minister Lindner, who is also chairing the liberal FDP. The following day, we heard from the FOMC and the BoE, who held their respective meetings and press conferences. Stay with us to find out how these events shaped the week and what the implications are going forward.

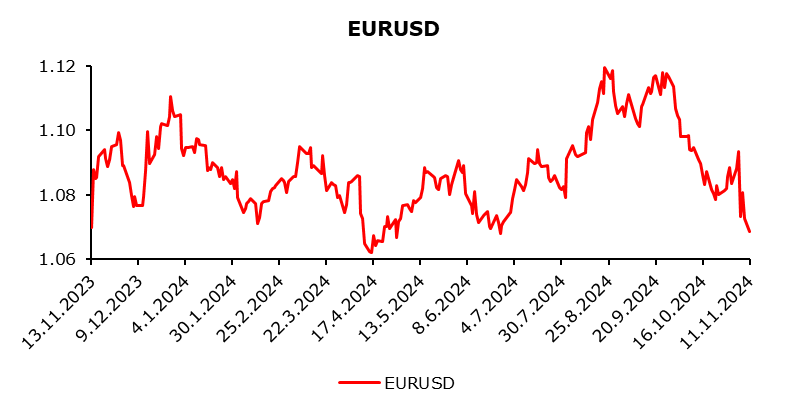

The first of the events that shaped the week, and the most significant one, was the US election on November 5. Around 3 am in Central, it became apparent that the president-elect would be Donald Trump. German Bund went 100 pips down in price mainly due to low liquidity and small trading volumes and then reversed losses during the day. Fixed income markets in the US had a modest reaction because it can be fairly accurately assessed how Mr Trump’s talk will translate into actual policies and how quickly that will happen. Equity and FX markets weren’t left unaffected, and EURUSD has weakened notably because of prospective tariff implementations and is now trading below 1,07. Equity markets in the US have skyrocketed past the previous all-time high and are only going up, while European ones are currently riding up a rollercoaster ride.

What was supposed to be a calm evening in Europe after the results of the US elections were known ended as the final day of the German governing coalition, which broke down after Liberals withdrew their support. Social Democrats and Greens will continue governing without a parliamentary majority for the time being, but snap elections are to be called at the beginning of next year, likely to take place in March or April.

On Thursday, November 7, the Bank of England’s Monetary Policy Committee decided to cut the Bank Rate by 25bps. It raised its growth and inflation forecasts for 2025 on the back of the new Budget delivered by the Chancellor of the Exchequer, Rachel Reeves. As a result, they now see a gradual approach to policy easing as appropriate, and risks are skewed towards a slower cutting process with fewer cuts. In the evening, the FOMC delivered a 25bps cut as well but provided limited forward guidance at the following presser. The US curve flattened as the tone of the meeting leaned hawkish, and chair Powell acknowledged that recent data have diminished downturn risks for the economy that led them to front-load some portion of the easing process and are now in no hurry to dial back to neutral. Although Powell accentuated that the election outcome won’t impact near-term policy, it is widely anticipated that the prospective changes to fiscal policy following the red sweep will lead the Fed to become more hawkish because of a higher neutral rate. The market is seconding that thought, pricing three more cuts by the end of 2025. Reporters were interested in hearing Powell’s thoughts on criticism received from Donald Trump and whether he would resign if asked to. He was adamant and confirmed that he was to finish his term no matter what.

Politics have shaped the week behind us, impacting the market’s short-term movement with multiple implications for the future, which are to be unearthed as time passes. They are likely to remain central for the motion of many asset classes in the following months because of changes that will be brought about by the return of Donald Trump to power. It is still too foggy to discern what the aftermath will be, but we should get more clarity in the next couple of months.

Source: Bloomberg, InterCapital